Within 24 hours of our reader emailing the addresses after the jup about a bill Guardian Life Insurance Company was supposed to pay but never did, a charge our reader had been fighting for 2 years and had been sent to collections for, Guardian sent a $850 check to the hospital…

insurance

Email Addresses For United Health Care Executives

Email addresses for reaching 5 executives at United Healthcare insurance company:

UnitedHealth Will Cover Teen's Bone Cancer Procedure

In the hours leading up to a planned protest outside PacifiCare offices, the health insurance reversed its decision and decided to provide coverage for 17-year-old Nick Columbo to undergo an additional cancer procedure recommended by his doctors, provided the family finds a doctor to perform it. VP of PR for United Health Care, Tyler Mason, told me the coverage for the CyberKnife procedure was initially denied after three review boards, one at Stanford, the USC Cancer Center, and UNH’s California regulator, recommended against it because the cancer was too large, too involved with nerve endings and wrapped in nerves, and because of the potential side effects. Mason said that this information was omitted from the California Nurse’s website because they wanted to use the Columbo case as a political tool. The side effects include Nick needing to use a bag for his bowel movements and the skin on his tailbone falling off. When I asked if the bone cancer, Ewing’s sarcoma, could kill Nick, yes or no, Mason said, “It’s a very challenging situation, I’m not a physician.”

Walmart Successfully Sues Brain-Damaged Worker For $469,216

A Walmart worker who was hit by a truck and left brain-dead-damaged has lost her final round of appeals and must repay the retailer $469,216. This is because she both had Walmart pay for her medical expenses and she successfully sued the trucking company for medical expenses. While, on the face of it, reptilian, standard employer-sponsored-insurance contracts have clauses prohibiting double-dipping, and, as we all learned from Seinfeld, double-dipping is gross for society. [St. Louis Post Dispatch] (Thanks to Michael!)

Teen Being Murdered By UnitedHealth Spreadsheet

Pacificare, owned by UnitedHeatlh, has decided to deny coverage for Nick Columbo, a 17-year-old dying from bone cancer. Nick has been unresponsive to chemo and his doctors recommend the “CyberKnife” treatment (read their letters here). Nick’s family is holding a protest outside the Pacificare today to try to get the insurance company to change its mind. UnitedHealth is ranked as the worst insurance company in the nation, is being investigated by the state of California, and has been fined over $3.5 million for negligent claims practices. Inside, a plea for help from Nick’s brother.

../../../..//2008/03/20/hospitals-are-reusing-medical-devices/

Hospitals are reusing medical devices labeled as “one-time use” to save money. [WSJ]

Insurance Company Won't Pay For Child's Leukemia Treatment

Primary Physician Care, a privately-owned insurance company based in Charlotte, North Carolina, has now twice refused to pay for a 3-year-old’s special leukemia treatment recommended by doctors at Duke University Hospital—even after the child’s mother called the insurance company and spoke…

"Expensive" Placebos Work Better Than "Cheap" Ones

A new study published in the American Medical Association has a new and astonishing demonstration of just how much your perception becomes your reality when it comes to prices. People in the study thought they were trying out a new kind of pain med. Instead, they got sugar pills. However, some were told their sugar pills cost $2.50, and the others were told the pills cost $0.10. People with the “pricey” sugar pill had their pain reduced much more than the “cheap” sugar pill. Does this mean that price alone pays for itself?

Patients Blind When Health Care Comparison Shopping

“The patient really has no way to act as an informed consumer,” Dr. Smith said. “You can’t call up a facility and say, ‘By the way, is my doctor any good?’ or, ‘Tell me who the best one is.’ “—A doctor responding to a study that found some doctors were 10 times better than other doctors at discovering precancerous lesions through colonoscopy. [NYT]

../../../..//2008/02/29/afraid-of-their-insurance-getting/

Afraid of their insurance getting jacked up or of employer discrimation, people who think they might be genetically predisposed to certain diseases are testing themselves with home DNA kits, hiding the results from their doctors, and harboring a potentially deadly secret. [NYT]

Watch Out For Medicare Scams

The March issue of Kiplinger’s features an article that will help you spot a medicare health scam before you (or your family) get taken for a ride. Watch out for sneaky insurance agents who ask for personal information or say they are from medicare and can reduce your premium:

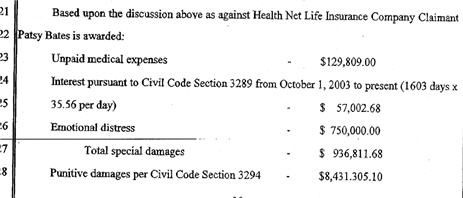

Cancer Patient Wins $9 Million From HealthNet In Arbitration Settlement

The award issued by an arbitration judge was the first of its kind and prompted Health Net to announce it was scrapping its cancellation practices that are under fire from state regulators, patients and the Los Angeles city attorney.

../../../..//2008/02/18/if-you-dont-have-private/

If you don’t have private insurance, you’re more likely to get a cancer diagnois after the disease is in its later stages, a new study shows. [NYT]

Get Countrywide To Remove Your PMI With An 80% LTV

Is Countrywide telling you your Loan-to-Value (LTV) ratio needs to have reached 75%, not 80%, in order to get the private mortgage insurance (PMI) removed? Throw the book at them: tell them they’re in violation of the Homeowners Protection Act of 1998. The law clearly states that PMI is to be removed after 80%:

Cancellation date.–The term “cancellation date” means…the date on which the principal balance of the mortgage…is first scheduled to reach 80 percent of the original value of the property securing the loan.

One reader (different from the guy we posted about before) says he was having trouble getting Countrywide to remove the PMI. They twice told him in writing that he needed a LTV of 75%. Then on the phone with them he mentioned the Homeowner’s Protection Act and then all of a sudden they were magically able to remove the PMI.

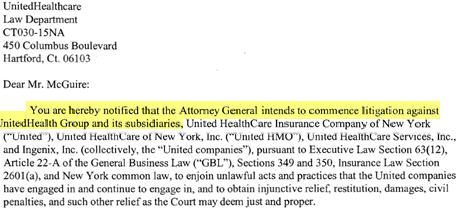

UnitedHealth Group Accused Of Fraud

New York Attorney General Andrew Cuomo is going after UnitedHealth Group, accusing them of “rigging data” and systematically “under-reimbursing” their members for out-of-network expenses.