We’ve heard plenty of horror stories about people’s coverage being denied for situations where they’re darn sure that they were covered, and now, an insurance industry insider has come forward with some tips on how best to make an appeal.

insurance

Doctors Are Learning That "I'm Sorry" May Prevent Lawsuits

In recent years, doctors have discovered that a simple apology can have a great effect in preventing malpractice lawsuits. According to the New York Times, Dr. Das Gupta, the chairman of surgical oncology at the University of Illinois Medical Center, mistakenly removed the wrong rib from one of his patients. Instead of using the classic “deny and defend” strategy, he promptly acknowledged his error and apologized to the patient. While the patient did accept a settlement from the hospital, she decided not to sue. Details, inside…

Mazda To Destroy $100 Million Worth Of Brand New Cars

Two years ago the freighter Cougar Ace nearly sank, spending weeks bobbing at an impossible-looking angle in the North Atlantic. The cargo was eventually saved (you can read about the salvage effort here), but what does one do with cars that have spent weeks at sea? Can you be sure that they weren’t damaged?

Geico Insurance Quote Increases Over $1,000 After Bait And Switch

After the contract was signed, mistakes made by a…

../../../..//2008/04/25/the-state-of-florida-is/

The state of Florida is offering single-family homeowners in the state free wind inspections that can then be used to get insurance discounts. [My Safe Florida Home]

UnitedHealth Unapproves Surgery From 2 Years Ago, Wants $7700 Back

United Health Care, not content with merely denying life saving cancer procedures or refusing to pay for basic (covered!) checkups, took things to a new level by retroactively un-approving procedures they paid for in 2005. They sent reader Suzanne a letter and a bill for $7700, claiming the pay-out was an “administrative error”, and she needed to pay up. Check out the details, inside.

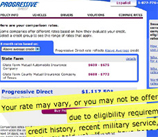

Progressive Responds To Question About Using Recent Military Service To Determine Rates And Eligibility

The Progressive auto insurance company saw our post “Why Is Progressive Using “Recent Military Service” To Determine Rates And Eligibility?” and responded to let us know that it’s just to make sure that service members aren’t penalized for having a lapse in their coverage due to the fact that they’ve been deployed overseas. They’ve apologized for the confusing wording on the website and have pledged to rewrite it for clarity. Full official statement, inside…

Caliber Collision Center Damages Car Brought In For Repair

Sean’s car had a blowout over the Easter weekend, and he had it towed to Caliber Collision Center for repair.

How To Wean People Off Doctors

It’s Friday and since no one gives a damn about our groundbreaking Verizon expose, here’s a 1999 Daily Show video where a fake HMO spokesperson played by Paul Mercurio presents his case for “How To Wean People Off Doctors”. To wit: “Giving birth eats up a lot of time, something today’s busy working women don’t have much of. That’s where our next project comes in. Drive-through maternity clinics. Or, as we like to call them, Stop & Pops.” Wasn’t Walmart thinking about installing those this year? Full video inside.

Oxford Tweaks Rules So It Can Double Your Monthly CoPay

Kristine writes:

Oxford healthcare recently updated its policy to read that no dosages of prescriptions exceeding 31 days would be processed. In the case of a patient receiving injectable solution, this may mean that their reconstitution device will give them 18 days of dosing, meaning that they will have to pay two copayments per month in order to receive ample supply of their medication…

Dateline Investigates Shady Annuity Salesmen Targeting Seniors

Dateline did a hidden camera investigation into the world of shady annuity salesmen targeting seniors and playing on their emotions to lock their life savings away in funds they may never live to receive the benefit from, or pay stiff penalties, not disclosed in the sales pitch, for early withdrawal. In this clip, Dateline producers attended “Annuity University,” a two-day session run by Tyrone Clark to teach them how to sell to elders. He settled with the state of Massachusetts after he published a sales pamphlet that told salespeople to treat seniors “like they were selling to a twelve year old” and to hit their “fear, anger, and greed buttons” to make the sale. He also sells questionable self-promotional tools and services. In one of them, a fake radio guy will call up the salesperson and interview them like they’re a financial expert on the radio. The session is recorded and the salesman gets CDs to pass out, so they can pass themselves off as legitimate financial advisers. Video, inside…

It's Been 4 Months, GEICO, Where's My Money?

Jonathan writes:On January 1st, a friend of mine went to visit another friend in CT (I am from NJ), and unfortunately hit black ice, and proceeded into a guardrail.

UPS Breaks, Steals Computer

Nick paid the UPS store in Woburn, Massachusetts $600 to ship his computer with insurance to and from England. UPS smashed the computer somewhere along the way and insisted that Nick would need to wait 4-6 weeks for a decision on his claim. After a month, Nick called the UPS store and was told that they needed additional documentation. Another month later, Nick decided to get a new computer and asked for the damaged computer back so he could use it for parts, only to find out that the UPS store had inexplicably shipped it to headquarters, which then delivered it to a stranger in New York named Ken.

../../../..//2008/04/07/a-florida-appeals-court-ruled/

A Florida appeals court ruled that state insurance regulators could ban Allstate from writing new insurance policies until the company complies with a subpoena. Regulators believe the insurer is gouging consumers in hurricane-prone areas with exorbitant rates. [AP]

Suburban Chicago Hospital Will Close After Being Crushed By Too Many Uninsured Patients

In a stunning development underscoring the plight of non-profit hospitals struggling with the increase in uninsured patients, the Catholic ownership of St. Francis Hospital & Health Center on Wednesday said it will shutter the hospital because nobody would buy it.

Walmart Drops Lawsuit Against Brain Damaged Worker

The world’s largest retailer said Tuesday in a letter to the family of Deborah Shank it will not seek to collect money the Shanks won in an injury lawsuit against a trucking company for the accident.