Nearly four years ago, federal regulators shut down a debt relief company — Morgan Drexen — accused of deceiving customers with promises of reducing their debt and charging illegal upfront fees to do so. While that company eventually paid $170 million to resolve the allegations, the Consumer Financial Protection Bureau Monday sued a related company using the same playbook. [More]

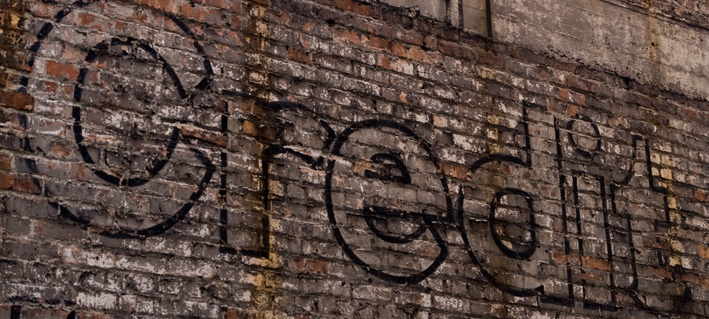

illegal fees

Credit Repair Service Accused Of Misleading Customers, Charging Illegal Fees

It can take years, decades even, to repair one’s credit. Unfortunately, there is no quick fix, despite promises of relief from companies offering their services for a price. Today, the Consumer Financial Protection Bureau sued one such company, Prime Marketing Holdings, for allegedly misleading consumers and charging illegal fees. [More]

Debt Relief Company Must Pay $170M For Illegally Charging Customers

Back in 2013, the Consumer Financial Protection Bureau sued Morgan Drexen, accusing the debt relief company of deceiving customers with promises of reducing their debt and charging illegal upfront fees to do so. Today, the Bureau announced a federal district court approved a final judgement requiring the company to pay $132.8 million in restitution and a $40 million civil penalty. [More]