What a difference a month makes: Just a few weeks ago, Cigna rejected Anthem as a suitor, citing things like the major data breach the company suffered earlier this year and turning down its $47 billion merger bid. It seems Anthem has been busy a-courtin’, as the company announced this morning that it’s reached a deal to buy Cigna for $54 billion, effectively creating an insurance giant. [More]

health insurance

Walmart Worker Suing Retailer Claiming Its Previous Benefits Policy Discriminated Against Same-Sex Couples

A Walmart employee who married her wife before the company changed its policy to extend health insurance benefits to same-sex couples is now suing the retail giant, claiming it violated gender discrimination laws. [More]

Percentage Of Adults Without Health Insurance Hits New Low

Two years ago, a Gallup survey estimated the percentage of adult Americans without health insurance at more than 17%. Even at the beginning of 2014, as the individual coverage mandate of the Affordable Care Act kicked, nearly 16% of Americans over the age of 18 were uninsured. The latest results from the polling organization currently put that rate at 11.4%, lower than any rate since Gallup began this survey in 2008. [More]

Cigna Rejects Anthem’s $47B Merger Bid, Says It’s “Deeply Disappointed” By Suitor’s Recent Actions

After Anthem Inc. unveiled its roughly $47 billion bid to merge with fellow health insurer Cigna Corp. over the weekend, the object of its affections swiftly put the kibosh on that proposal. In a letter to Anthem’s board, Cigna said it was “deeply disappointed” with its suitors recent actions, and that the offer wasn’t in the best interest of shareholders. [More]

HMO Must Pay $28M For Delaying MRI That Could Have Saved Cancer Patient’s Leg

Back in 2009, a then 17-year-old woman in California visited a Kaiser Permanente office because she was experiencing strange back pain. In the months that followed, she and her mother say they repeatedly requested an MRI but Kaiser doctors would only tell her to lose weight or get acupuncture treatments. All the while, a cancerous tumor was growing that would eventually result in the surgical removal of her right leg, and parts of her pelvis and spine. Believing Kaiser could have caught the cancer earlier if it hadn’t delayed the MRI, a jury has awarded the patient $28 million in damages. [More]

Healthcare.gov Open Enrollment Extended As Uninsured File Taxes

If you went without health insurance during 2014, you’re now facing a modest financial penalty of $95 or 1% of your income. Next year, that penalty will increase. All of this is news to some uninsured people. That’s why, as predicted, the federal government and some state exchanges are creating an extra open enrollment period to help these people out. [More]

Federal Government Could Extend Open Insurance Enrollment To April 15

2014 tax returns are the first ones that American taxpayers are filing since the health insurance subsidies, mandate, and penalties of the Affordable Care Act have come into effect. Included in our tax returns this year will be a penalty of 1% of income for people who don’t have health insurance that provides a minimum level of coverage. That penalty is taking some people by surprise. [More]

Patient Faces Bankruptcy After Ambulance Takes Her To Out-Of-Network Hospital

Most of us know that it could cost us everything we own if we go to a hospital that isn’t covered by our insurance plan. But what if you’re unconscious and have no say in the matter? That’s the case for a Wisconsin woman who owes $50,000 to a hospital that claims she should just pay up and be happy she’s still alive. [More]

Walmart Taking Away Insurance For 30,000 Workers

The nation’s largest retailer and private employer has announced that it will discontinue offering health insurance to many part-time employees who work fewer than 30 hours a week, along with increasing the premiums by up to 20% for many workers who continue to receive benefits. [More]

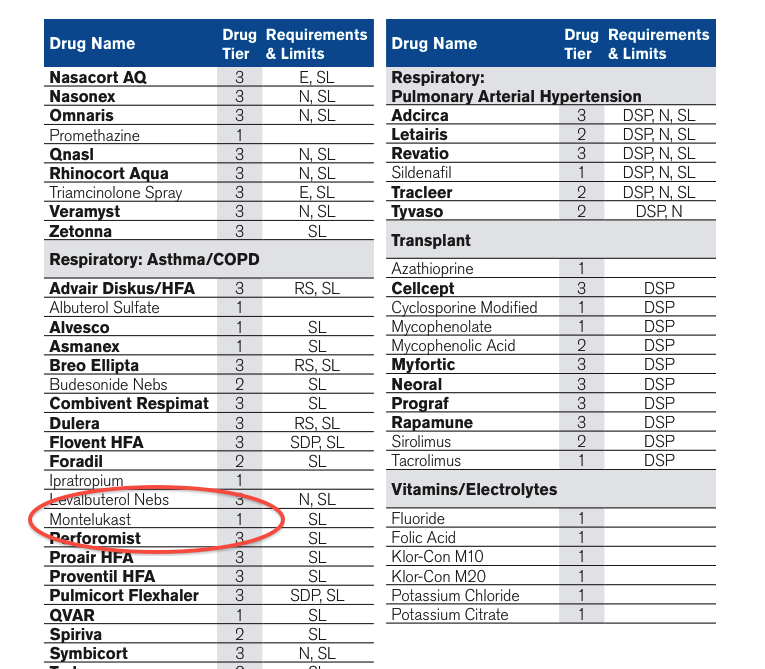

We Live In A World Where Your Insurer Doesn’t Care That It Charges Two Prices For One Drug

In one month, the price of your generic prescription doubles. The first person at your insurance company says “Oops, that’s a mistake,” but a second person tells you that the mistake was actually made when you were charged the original, lower price. Meanwhile, the insurance company’s website tells you that the lower price is the correct one — and none of these people actually seem to give a damn. [More]

34% Of Uninsured Choosing To Stay Without Health Coverage, 70% Don’t Know About Subsidies

We’d like to think that most of you know that March 31 is the deadline to obtain health insurance or face a penalty for lack of coverage, but if you’re one of the millions of uninsured Americans, it’s about a 50/50 chance that you’re actually aware of this deadline. And to about one-third of the country’s uninsured, the deadline doesn’t matter because they are choosing to go without coverage. [More]

Get Your Health Insurance Company’s Attention: Use Twitter

Over at ProPublica, they recently learned what we at Consumerist have known since 2008: when you’re having customer service trouble, sometimes the best way to use alternate means to get the attention of someone who can help you. Propublica discovered that some consumers are using Twitter to navigate the intensely personal and deeply confusing world of health insurance. [More]

Is Target Shaving Workers’ Hours So It Doesn’t Have To Insure Them?

Earlier this week, Target announced that it would no longer offer health insurance to part-time employees (those who work fewer than 32 hours per week), while at the same time claiming that it would not be trimming employees’ schedules so that they no longer qualify as full-time workers. However, some Target employees tell Consumerist that company execs aren’t telling the truth. [More]

Target Dropping Health Insurance For Part-Time Employees

Saying that part-time employees can now get health care coverage through recently launched online insurance exchanges, Target announced yesterday that, as of April 1, it will no longer offer insurance to its part-time staffers. [More]

Letter From Anthem BlueCross BlueShield Presumes I Don’t Understand Affordable Care Act

Kim received a solicitation in the mail from Anthem BlueCross BlueShield offering her the opportunity to apply for guaranteed health insurance coverage. This plan offers appealing benefits like no copay for routine screening tests or immunizations. Sounds great! Except it’s not. [More]

Is Staples Cutting Employee Hours Ahead of Affordable Healthcare Act?

Is it a case of following old rules, or a way to skirt paying part-time employees healthcare? That’s the question for Staples this week as a memo surfaced advising managers not to schedule part-time employees for more than 25 hours a week. Under the Affordable Healthcare Act, which takes effect next year, employees working more than 30 hours a week are considered full-time and eligible for affordable healthcare through their employer. [More]

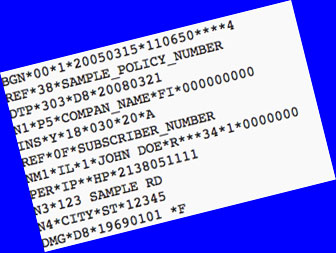

What Is An 834 Transaction, And Why Should I Care?

The good news is that Healthcare.gov, the health insurance marketplace for states that haven’t set up their own exchanges, is now up and functional. Well, the front end is working. Now that eligible people in need of insurance are able to log in and sign up, the next step is for the site to send their information over to the health insurance companies. That’s where things might go very wrong. [More]

Check Your Insurance Before Getting Flu Shot At Walgreens & Other Stores

Retail pharmacies are now responsible for around 1-in-5 flu shots given to Americans each year, and many of these stores advertise low-cost or no-cost shots for customers on certain health plans. But a survey of Walgreens locations in New York City and Los Angeles finds that nearly half of the flu shot recipients at these stores are getting bad information about whether their insurance policies cover the cost of the shot. [More]