It took years to reach the $25 billion settlement between the nation’s largest lenders and 49 states, but affected homeowners were only given months to claim their piece of the pie. [More]

gmac

Deadline For Foreclosed-Upon Homeowners To File Claim In National Mortgage Settlement Is This Friday

Treasury Freezes Compensation For Top AIG, Ally, GM Executives

While a majority of the American corporations that received “exceptional” bailout assistance form the Troubled Asset Relief Program, there are still three businesses — AIG, Ally Financial (you may know it by its pre-bust name of GMAC), and General Motors — remaining. Today, Treasury Dept. announced that the Acting Special Master for TARP Executive Compensation has determined that the top executives at this trio of companies will not get a pay raise in 2012. [More]

$25 Billion Mortgage Settlement Is Just The First Step Toward Cleaning Up Mortgage Mess

There are a lot of good things about today’s $25 billion settlement between the five largest mortgage servicers, the Dept. of Justice and the attorneys general of 49 states. But in spite of the huge price tag on the deal — which could grow even larger if other lenders sign on — it’s only the beginning of cleaning up the aftermath of housing market collapse. [More]

DOJ, 49 States Reach $25 Billion Settlement With Five Largest Lenders Over Robosigning

More than a year after several of the nation’s largest mortgage lenders temporarily suspended foreclosures after it was revealed that they had been using untrained, unqualified “robosigners” to process foreclosure documents, the U.S. Justice Dept. and the attorneys general of 49 states have announced a $25 billion settlement that will result in mortgage reductions to some homeowners. [More]

Slew Of Foreclosed Homes To Hit The Market In Early 2012

Last year, several of the country’s largest mortgage servicers — Bank of America, GMAC/Ally, JPMorgan Chase, among others — were forced to hit the pause button on foreclosure procedures after it was revealed that many foreclosure documents were being rubber stamped by untrained, ill-informed “robo-signers.” This delay caused a bottleneck of foreclosure-worthy properties waiting to be reviewed. But now it looks like those homes are starting to trickle out into what could be a flood in early 2012. [More]

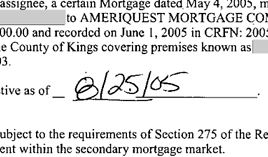

Paperwork Shows GMAC Created Fake Document To Foreclose On Property

Last summer, GMAC was looking to foreclose on a property here in Brooklyn. Only problem was, it didn’t have documentation proving that it actually owned the mortgage and the original lender, Ameriquest, couldn’t help because it had gone the way of the dodo a few years earlier. So what’s a mortgage servicer to do but fabricate the paperwork? [More]

Ally Bank Withdraws Maryland Robosigner Foreclosures

If you’re one of 250 Maryland homeowners with a foreclosure order signed by Ally Bank’s Jeffrey Stephan, you’ve just been granted a reprieve. The bank is withdrawing all Maryland foreclosures authorized by Stephan, who admitted that he casually signed off on thousands of foreclosures each month. But homeowners aren’t completely off the hook. Ally plans to restart the foreclosure process with new filings. [More]

GMAC Buys Your Mortgage, Tosses It In A Drawer

How are things in the mortgage industry today, in what is supposed to be the post-robosigner era? According to source on the ground, reader Chris, it’s not so great. Chris writes that when he and his wife refinanced their house, they knew that GMAC would most likely buy their loan from the mortgage originator. What they couldn’t have predicted was that GMAC would wait around for more than a month before they got around to actually acquiring the mortgage, then call Chris and tell him that he was delinquent on the mortgage that he had already paid. [More]

GMAC Resumes Foreclosures; White House Warns Banks To Not Be Stupid

One month ago, GMAC/Ally was the first major mortgage lender to freeze foreclosures and foreclosure sales in about half the U.S.. But the day after Bank of America announced it was thawing its foreclosure freeze, GMAC followed suit. Meanwhile, the White House has warned all lenders that it will go after banks who are found to employ any of the tactics that got them into this mess in the first place. [More]

Banks Hired "Burger King Kids" To Process Mortgages

JPMorgan & Chase had a cute name, the “Burger King Kids,” for the workers with little no experience or qualifications it hired to process the reams of mortgages it plowed through at the height of the housing bubble. These walk-in hires “barely knew what a mortgage was,” writes the NYT. The newbies Citigroup and GMAC/Ally Bank outsourced the work to sometimes tossed paperwork into the garbage can. [More]

Texas AG Calls For Statewide Foreclosure Freeze

Hot on the heels of foreclosure and eviction freezes by GMAC/Ally, JPMorgan Chase and Bank of America, the Attorney General for the state of Texas has become the latest AG to request that loan servicing companies put a temporary halt to foreclosures. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

GMAC Bungled Foreclosure Affidavits In 23 States

GMAC Mortgage is taking the eye-opening step of stopping evictions in 23 states because the affidavits used to support the kickouts contained information the employees didn’t themselves personally know to be true, and they were sometimes signed without a notary present, according to a company statement. [More]

GMAC Halts Evictions In 23 States

GMAC has told brokers and agents to immediately stop evicting homeowners in 23 states. In a memo, the Ally Financial Inc. subsidiary cited “corrective action in connection with some foreclosures” that may need to be taken. Smells like some people got foreclosed on that shouldn’t have, though we’ve been hearing scattered reports about that for a while without the banks doing much, so why drastic action now? Have they uncovered something massive? [More]

Pay Czar Cuts Exec Pay 15% At AIG, GM And Others

Kenneth Feinberg, better known as the Obama administration’s pay czar, announced yesterday that he’d cut salaries on top executives at 5 companies that are still using bailout cash. [More]

Ally Launches Free Online Checking

Online bank Ally has launched a new free online checking account that looks pretty decent. Free ATM access, free online bill pay, free checks, with no monthly minimum balance or maintenance fees. And get this, insufficient fund fees are only $9. That’s not per item, that’s just $9 for every day you are overdrawn. [More]

Renter Forced To Move Out Of Foreclosed House, Can't Get Security Deposit Back

Silpa had the bad fortune of renting a house from a deadbeat owner who let the property go into foreclosure. Now that $2,200 security deposit could be lost forever amid the turmoil. Silpa’s story:

Ally Bank Delivers Lower CD Rates Than Promised; Also No Pony

A few weeks ago, we posted about the rebranding of and promising new start for Ally Bank, formerly GMAC. But one new customer isn’t very enthusiastic about their services.