JD writes:

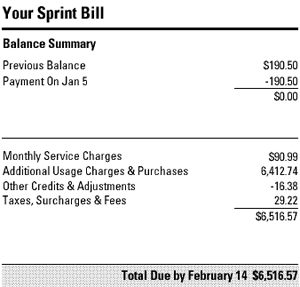

My device was stolen in Mexico. I reported it. The Sprint rep. suspended the WRONG line. My bill comes a few weeks ago: $6,000+. My Sprint bill was $6,000 this month and two calls to Fraud Prevention/2 tickets/and my bill is almost due (with no response or adjustment, was was promised within 2 business days, twice). I don’t know what to do at this point…

It appears your claim has gotten lost somewhere within the deep dark bowels of Sprint’s billing system. The best thing we can suggest at this point is to call the Sprint Executive Customer Service line at 703-433-4401 and get your claim expedited. Oh, and happy Valentine’s Day.