We may be years removed from the robo-signing, foreclosure free-for-all that ensued following the collapse of the housing market, but mortgage servicers continue to screw things up. Today, federal and state regulators sued one of the nation’s largest home loan companies, alleging widespread errors that caused borrowers to lose money, and in some cases their homes. [More]

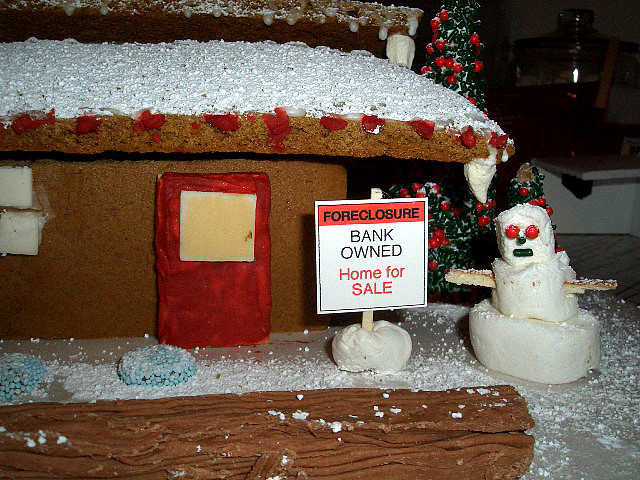

foreclosure

Federal, State Agencies Accuse Ocwen Of Mortgage Errors, Illegal Foreclosures

You Can Soon Buy Giant Picnic Basket Building In Foreclosure

Do you long to own a novelty office building in Ohio? Then your dream may soon become a reality, as the giant, basket-shaped former home of direct sales housewares company Longaberger is slated for foreclosure. [More]

CitiFinancial, CitiMortgage To Pay $28.8M Over Mortgage Servicing Issues

Millions of consumers lost their homes when the housing market bubble burst. But federal regulators say some of those people may have been able to stay in their homes had mortgage lenders fulfilled their requirements. To that end, the Consumer Financial Protection Bureau has ordered two Citigroup subsidiaries to pay $28.8 million to resolve allegations that some of its mortgage units harmed home borrowers. [More]

Mall Owners Let Properties Go Into Foreclosure, Walk Away

It’s not hard to believe that the owners of malls might be looking to get out of the mall business. Developing shopping centers may have looked like a solid investment for most of the last 60 years or so, but now owners are calculating that it’s better to let them go into foreclosure than to try keeping them open. [More]

Guidelines Intend To Protect Homeowners As Foreclosure Relief Programs Expire

Nearly a decade after the housing bubble burst and the government created programs to provide relief for homeowners facing foreclosure, the Consumer Financial Protection Bureau is working to ensure that consumers continue to receive needed assistance tailored to changing home retention needs. Today, the Bureau has released new a new outline to guide the creation of new solutions for foreclosure relief. [More]

Former Wells Fargo Employee Claims Bank Defrauded Government Of $1.4B In Foreclosure Funding

There has been no shortage of lawsuits filed against Wells Fargo in recent years, from accusations the bank pushed mortgages on borrowers who couldn’t repay them to claims the company pressed employees to engage in fraudulent conduct with regard to customer accounts. Now, a recently unsealed whistleblower lawsuit melds together those issues, claiming the bank encouraged employees to withhold information from customers that could potentially lead to foreclosure proceedings. [More]

HSBC Must Pay $470M For Alleged Abusive Loan Practices

Thousands of homeowners who lost their homes or had their loans modified will receive a portion of a $470 million federal-state settlement with mortgage lender and servicer HSBC to settle allegations the bank engaged in origination, servicing, and foreclosure abuses. [More]

West Virginia Woman Sues Wells Fargo Over Alleged Home Loan Modification Misrepresentations

When you’re going through the often-tedious process of refinancing your mortgage, getting some bad information can only serve to make things worse. That’s why a West Virginia woman is suing Wells Fargo, alleging that the bank told her to stop making loan payments then put her into collections and foreclosure.

[More]

Mortgage Relief Scammers Ordered To Pay $5.4M

Eight months after federal regulators took action to stop a mortgage relief company from making hollow promises to homeowners facing foreclosure, the ringleaders behind the operation have agreed to pay more than $5.4 million in penalties and never work in the mortgage relief or telemarketing business again. [More]

Mortgage Servicer To Pay Back $1.5M To Screwed-Over Homeowners

Residential Credit Solutions is a mortgage servicer specializing in delinquent loans and “credit-sensitive” (read: high-risk for default) residential mortgages. But after allegedly screwing over homeowners by, among other things, not honoring loan modifications on mortgages transferred from other servicers, RCS is on the hook to pay $1.5 million in restitution and a $100,000 penalty to federal regulators. [More]

Four Years After Reaching Deal With Regulators, Six Banks Still Haven’t Fixed Foreclosure Problems

Back in 2011, several of the nation’s largest banks entered into a settlement with federal regulators that required the institutions to correct widespread foreclosure abuses that helped to trigger the housing crisis. While the agreement was revised in 2013 to make things a bit easier for the offending banks, regulators today announced that six of the lenders – including JPMorgan Chase and Wells Fargo – still haven’t met requirements and face new restrictions on their mortgage operations. [More]

FTC Halts Mortgage Relief Operation Targeting Consumers In Foreclosure

Financially distressed consumers on the brink of foreclosure have enough to worry about without having to be on the lookout for shady mortgage relief companies making hollow promises to save their homes. Today, the Federal Trade Commission put an end to an operation that took advantage of homeowners’ vulnerabilities. [More]

Wells Fargo Breached 2010 Mortgage Settlement, Must Work To Provide Homeowner Assistance

Some homeowners who were wrongly denied mortgage assistance from Wells Fargo will soon receive the help they needed years ago after a federal judge ruled this week that the bank’s denial of modifications were in breach of a 2010 settlement involving adjustable-payment mortgages. [More]

Woman Wants To Back Out Of Buying House Saddled With $400K Debt, Blaming Winning Bid On Diet Pills

Feeling like maybe you shouldn’t have splurged on that shirt when you’ve already got a bunch like it already in your closet is one thing, but deciding you’d rather not own a home you purchased is an entirely other category of buyer’s remorse. A Florida woman is blaming her winning bid on a home that comes with a $400,000 debt on it on diet pills, saying they caused her to become confused. [More]

Citigroup Forgot To Compensate 23,000 Consumers For Abusive Foreclosure Practices, Sending Checks Now

Several years ago, Citigroup reached a deal with federal regulators that required the company to provide compensation for nearly 380,000 people affected by foreclosure abuse. Only the lender didn’t exactly follow through, failing to send checks to 23,000 consumers. [More]