A subject that many Americans don’t even know about — until it’s too late for them to do anything — is now shaping up to be a battleground between lawmakers in both the House and Senate, where two very different sets of legislation will go head to head to determine whether or not companies can strip their customers of their constitutional right to file a lawsuit in court — and their First Amendment right to speak freely. [More]

forced arbitration

Wells Fargo Tries, Fails To Explain Why Customers Shouldn’t Be Allowed To Sue Over Fake Accounts

Wells Fargo has admitted that thousands of its employees opened fake, unauthorized accounts in customers’ names, but the bank is doing everything it can to prevent these wronged customers from having their day in court. We asked Wells Fargo to explain why it believes hundreds of thousands of Americans shouldn’t be allowed to exercise their constitutional right to sue. The bank’s response made little sense (unless you’re a Wells Fargo executive). [More]

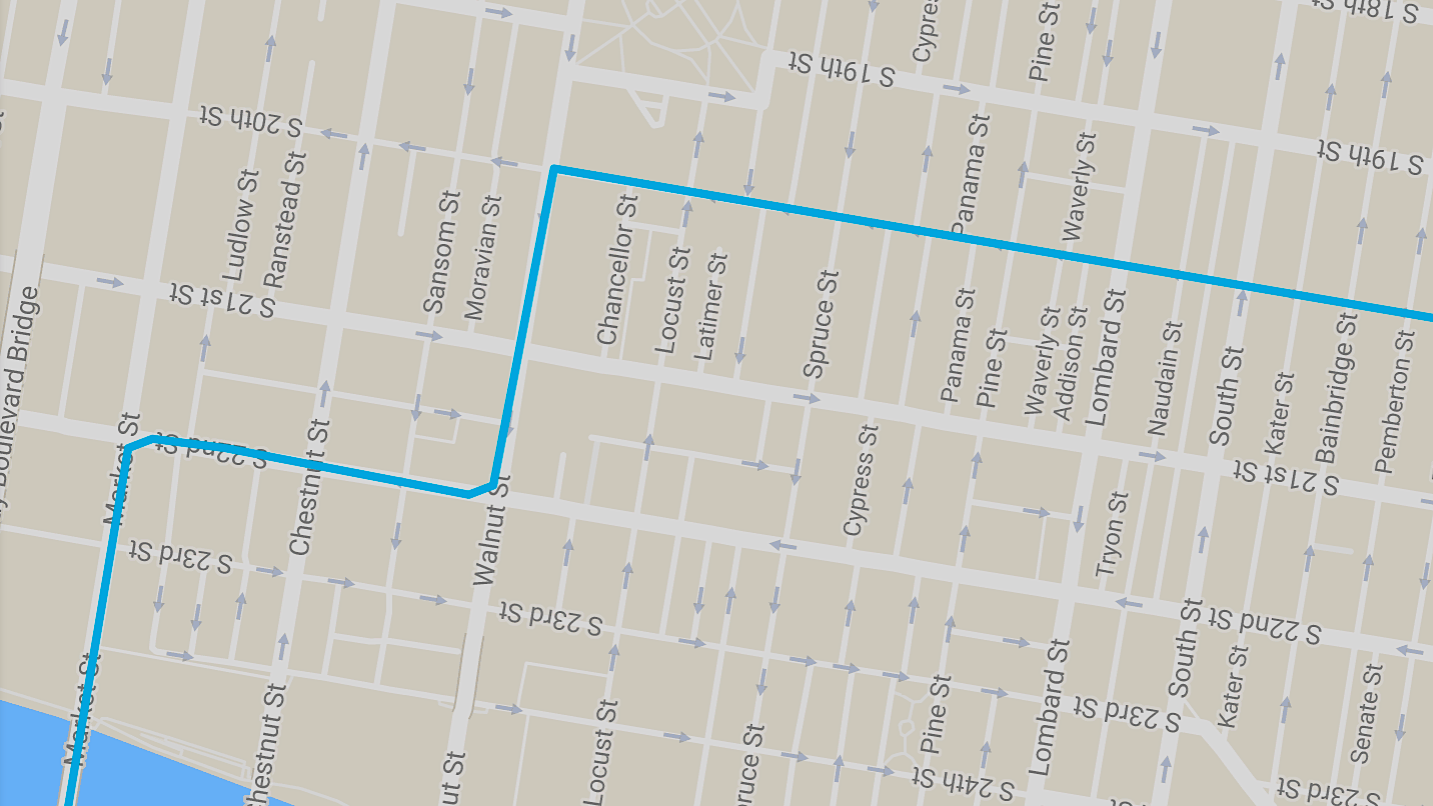

Uber Driver Claims Company Keeps More Money Than It’s Supposed To

When you hail an Uber car, the driver of that vehicle is supposed to get a set percentage of the total fare you pay. However, one driver claims that Uber is breaking its agreement with drivers by basing their cut on an amount that is lower than what the passenger is charged. [More]

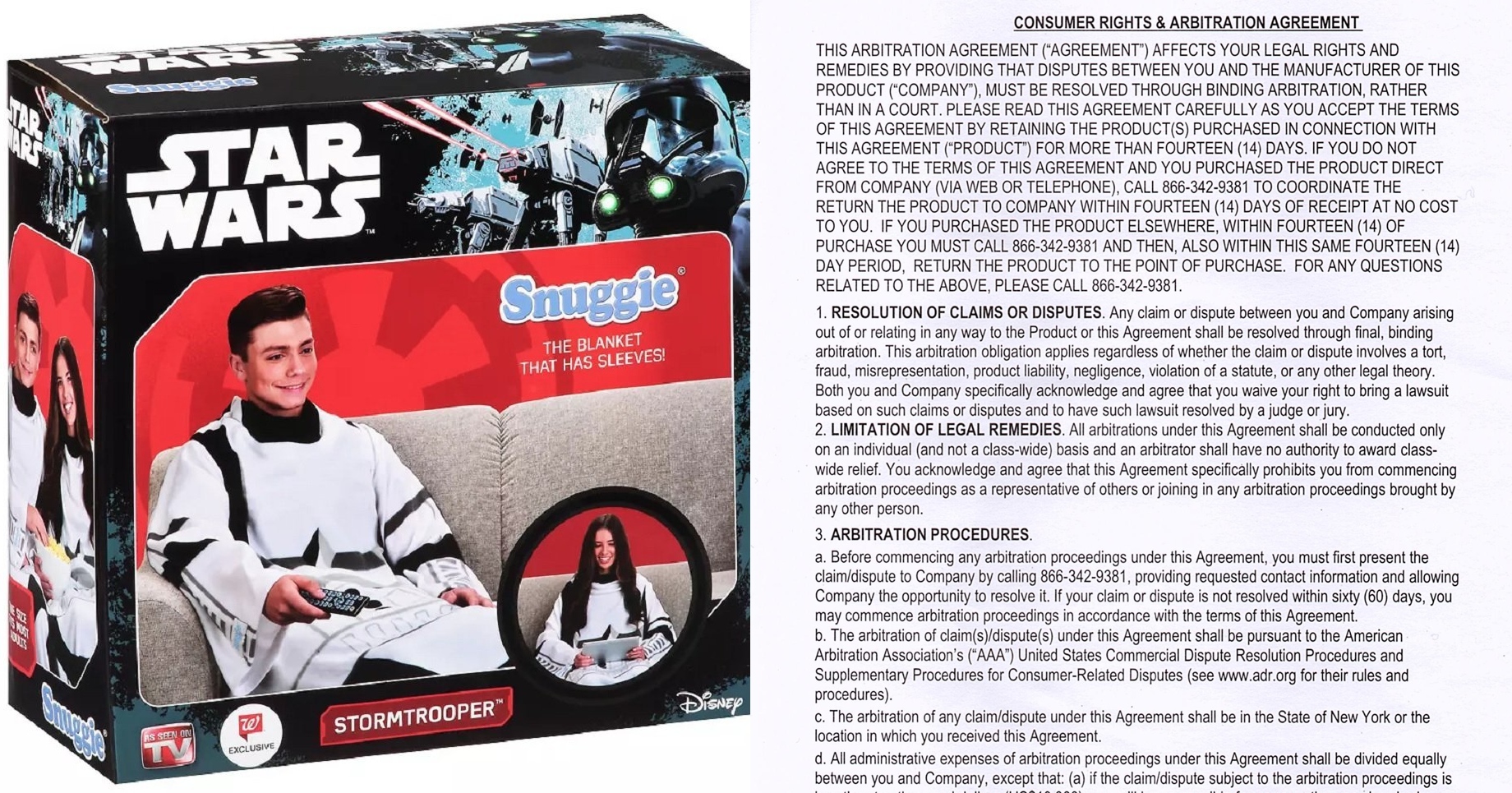

Appeals Court Says Samsung Can’t Use In-Box Warranty Booklet To Strip Customers Of Legal Rights

Last week, we used the example of a Stormtrooper Snuggie to show how easy it is for companies to take away customers’ constitutional rights with just a slip of paper placed inside the box. Now a federal appeals court has ruled that Samsung can’t use an in-the-box warranty booklet to derail a class-action lawsuit. [More]

Your New Stormtrooper Snuggie Comes With A Surprise: It Strips You Of Your Right To File A Lawsuit

Until the other day, Consumerist reader Jeff had completely forgotten about that cute Stormtrooper Snuggie someone gave him for Christmas. When he finally opened the box, there was the Star Wars-themed sleeved blanket, and a slip of paper giving him the bad news: He had, without doing a thing, given up his right to sue the Snuggie’s manufacturer. [More]

Wells Fargo Customers: Bank’s Contract Can’t Be Used To Allow Illegal Activity

Even though Wells Fargo has admitted that bank employees opened millions of fraudulent, unauthorized accounts in customers’ names, the bank has avoided or delayed class-action lawsuits over this fake account fiasco by citing terms in customer contracts that prevent account-holders from bringing lawsuits against Wells. However, one group of customers is arguing that the bank can’t use these contracts to shield itself from being held liable for illegal activity. [More]

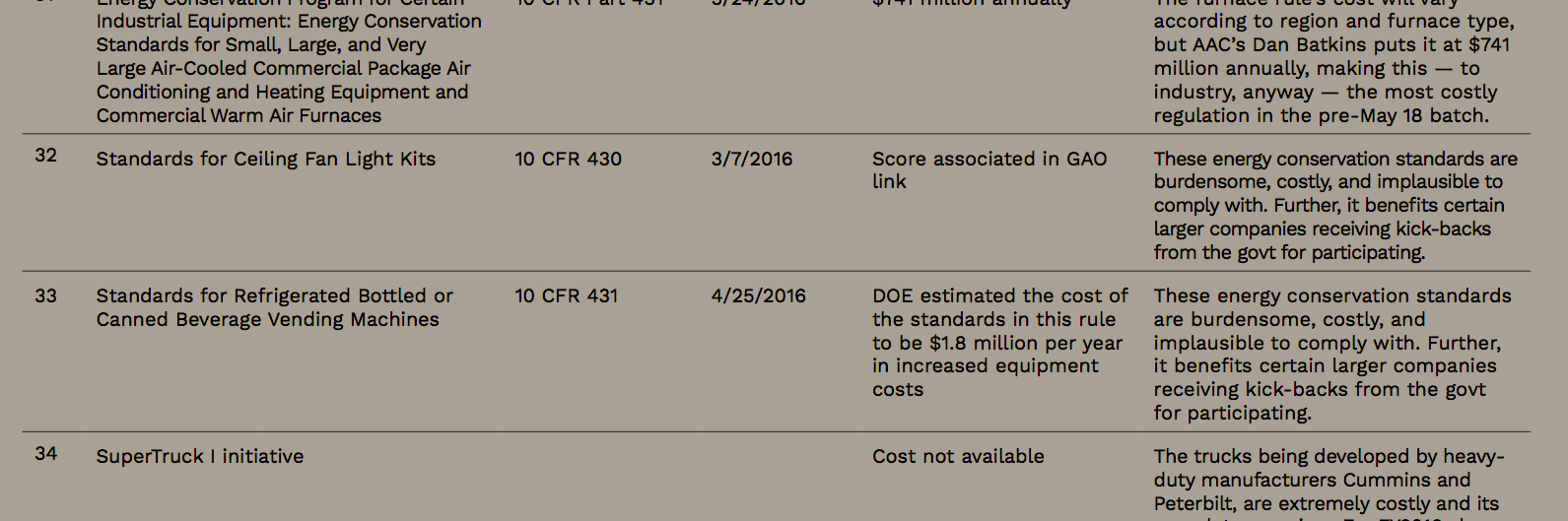

House ‘Freedom Caucus’ Asks Trump To Undo 232 Rules On Net Neutrality, Tobacco, Nursing Homes & Ceiling Fans

What’s on your wish list this holiday season? For the few dozen members of the House of Representatives Freedom Caucus, the hope to see President-elect Donald Trump undo or revise more than 200 federal rules involving everything from tobacco to food labels to ceiling fans to your constitutional right to bring a lawsuit against your credit card company. [More]

Wells Fargo Fake Account Lawsuit On Hold While Bank Tries To Force Case Out Of Court

As we mentioned last week, Wells Fargo — the bank where employees opened millions of unauthorized accounts in customers’ names — has been trying to wriggle out of class action lawsuits involving the fake account fiasco by forcing each individual customer into private arbitration. This afternoon, the judge in one lawsuit put the case on hold until he decides whether or not Wells gets to play this “get out of jail free” card. [More]

Wells Fargo Already Playing Its ‘Get Out Of Jail Free’ Card To Avoid Lawsuits Over Fake Accounts

Wells Fargo is facing multiple lawsuits from customers and employees over the long-running fake account fiasco that saw more than two million bogus, unauthorized accounts being opened in customers’ names. Even though lawmakers and consumer advocates have repeatedly asked the bank to not sidestep its liability by using an often-ignored clause in its customer agreement, lawyers for Wells Fargo have already begun to play that “get out of jail free” card. [More]

Proposed “Justice For Victims Of Fraud Act” Would Take Away Wells Fargo’s Get Out Of Jail Free Card

Wells Fargo has admitted that millions of its customers were victimized by bank employees who opened unauthorized accounts in these customers’ names, but those fake account fiasco victims can’t file lawsuits against the bank because of clauses buried in their account contracts. A newly introduced piece of legislation would prevent Wells Fargo from using that clause to minimize its responsibility under the law. [More]

Future Looks Dim For Consumer Financial Protection Bureau Under Trump Presidency

On the campaign trail, President-elect Donald Trump made his disdain for the 2010 Dodd-Frank financial reforms clear, leaving many to wonder what a Trump White House would mean for the Consumer Financial Protection Bureau — the financial services regulator created by the 2010 legislation. Now that pieces are beginning to fall into place for the Trump transition plan, the outlook for the CFPB does not appear very bright. [More]

Court: Nursing Homes Can Continue Stripping New Residents Of Their Right To Day In Court

In September, the federal Centers for Medicare & Medicaid Services (CMS) issued a new rule that would prevent most nursing homes and other long-term care facilities from using forced arbitration to strip new residents of their right to file lawsuits against these companies. The industry soon fired back by doing the very thing it doesn’t want its customers to do: filing a lawsuit. This morning, the judge in the case granted the industry’s request for a preliminary injunction preventing the new rule from being enforced. [More]

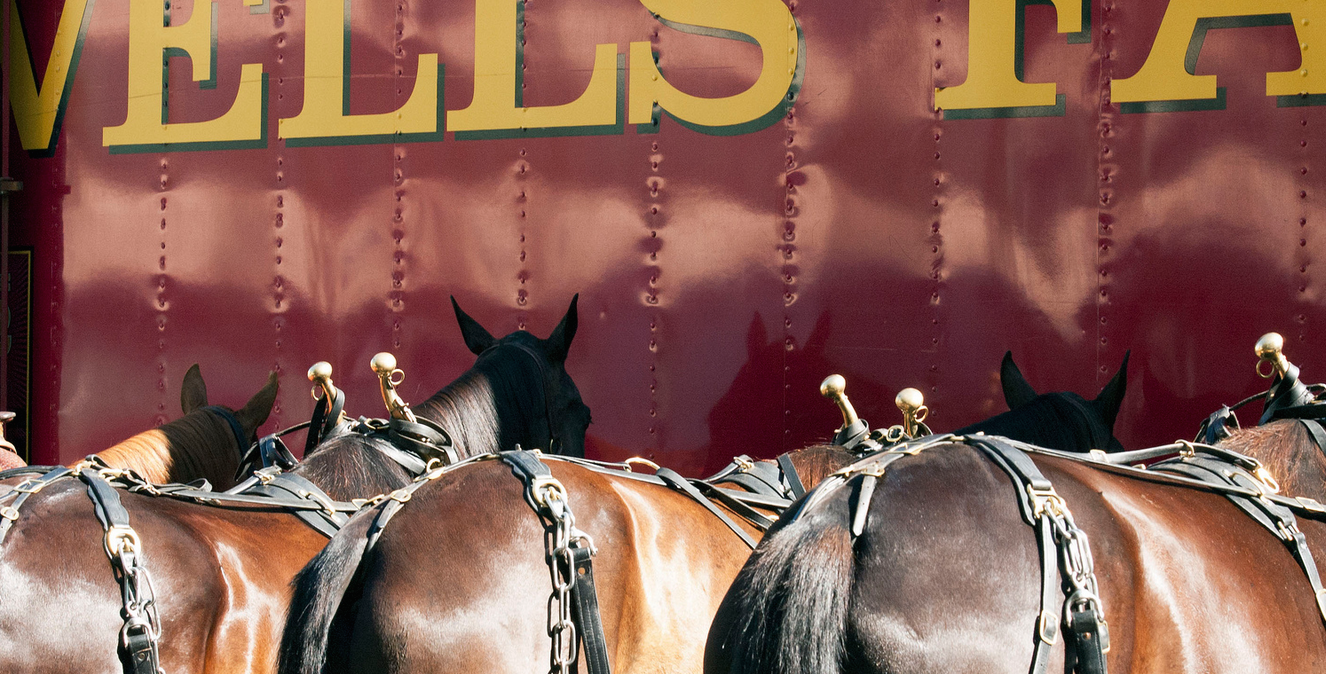

Judge: Airbnb Can Force Users’ Racial Discrimination Claims Out Of Courtroom

A large — and growing — number of companies use arbitration clauses in their overlong, legalese-stuffed customer agreements to prevent customers from bringing lawsuits and joining together in class actions, but can that arbitration agreement be used to avoid legal liability for possible violations of federal civil rights law? According to one federal judge, yes. [More]

New Rules Aim To Make It Easier For Students To Seek Financial, Legal Relief From Failed Colleges

In the last few years, multiple for-profit college chains have closed with little or no warning given to their students, while others remain on the brink of closure. And many of the for-profit schools that remain bar wronged students from ever suing the college in a court of law. Today, the Department of Education finalized the massive overhaul of its “Borrower Defense” rules in an effort to make it easier for students to hold colleges financially and legally responsible for their actions. [More]

FCC To Propose Rules That Could Restore Consumers’ Right To Sue Phone, Broadband Providers

While the big headline of this morning’s monthly FCC meeting was the release of the Commission’s final rules on broadband privacy, the agency’s leadership also let it be known that it’s planning to take on one of the industry’s most controversial issues: The right of consumers to have their day in court. [More]

Nursing Home Industry Files Lawsuit To Keep Preventing Patients From Filing Lawsuits

Last month, the federal government issued new rules for nursing homes, barring most long-term care facilities from using forced arbitration agreements to stop new residents from filing lawsuits against the homes. Now nursing home operators and industry trade groups are challenging that rule by doing the one thing they want to prevent their patients from doing: going to court. [More]

New Rule Will Stop Many Nursing Homes From Stripping Residents Of Their Right To Sue

As we’ve written about previously, some nursing homes and other long-term care facilities use forced arbitration contracts to prevent their residents bringing a legal action against the home in a court of law. Today, the Department of Health and Human Services issued a new rule that will prohibit long-term care facilities that accept Medicare or Medicaid from forcing residents into arbitration. [More]

Senators To Wells Fargo CEO: Don’t Strip Wronged Customers Of Their Day In Court

Now that Wells Fargo is in the hot seat for allegedly pushing its employees to meet sales goals and quotas by opening millions of bogus accounts in customers’ names, will the bank use the anti-consumer terms of its customer contracts to get out of the inevitable class action lawsuits? A coalition of U.S. senators have written the bank’s CEO asking him to please not strip customers’ of their day in court. [More]