A little while back, we asked Consumerist readers to send in their student loan-related questions to Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman. Today, we’re bringing you his answers in three parts, each dealing with a different aspect of the topic. Since it’s about time for next year’s freshman class to decide on schools and financial aid packages, we’re starting with answers for prospective students. [More]

financial aid

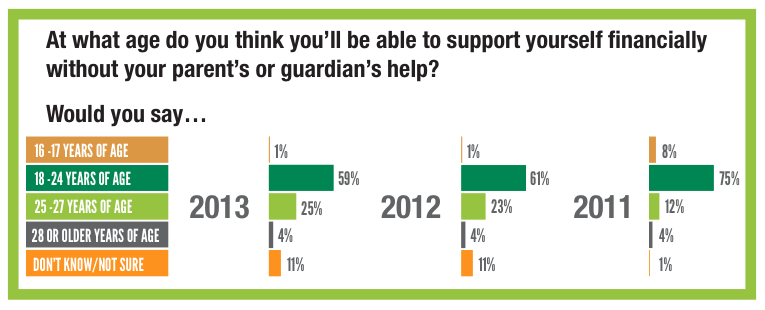

Number Of Teens Expecting To Depend On Parents Into Adulthood Has Doubled Since 2011

In what could be an indicator of either a massive drop in teens’ financial prospects or the fact that teens today are getting more realistic about their financial futures, a new survey shows that the percentage of teenagers who expect to remain dependent on mom and/or dad until at least age 27 has doubled in just the last two years. [More]

13 Attorneys General Voice Support For Federal Bill To Curb Advertising By For-Profit Schools

Earlier this week, Senators Kay Hagan (North Carolina) and Tom Harkin (Iowa) decided to take another go at introducing legislation that would seek to limit the amount of federal money for-profit schools could spend on advertising. At the same time, the Attorneys General from 13 states penned a letter to the chairs and ranking members of key Senate and House voicing their support for the bill. [More]

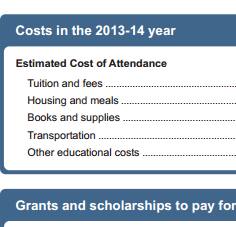

Students & Families Getting Screwed Because Schools Won’t Adopt Standard Financial Aid Letter

If you went to college, you’re probably familiar with the financial aid letters that detail — in not very much detail — the loans, grants and other assistance the school can offer. These letters vary from school to school, even though the Dept. of Education created a standard form, and it’s students and their families that pay the price. [More]

Lawmakers Suddenly Care About Those Fee-Laden College Cards That Are Now In The News

Earlier today, we told you about the U.S. Public Interest Research Group report on how the growing number of ethically questionable partnerships between U.S. colleges and financial institutions was resulting in millions of college students being pushed toward receiving their financial aid payments on cards costing hundreds of millions of dollars in fees to users each year. The study appears to have gotten the attention of some folks in Washington. [More]

Millions Of College Students Pushed Into Receiving Financial Aid On Fee-Laden Cards

The cost of a college education continues to rise at the same time as many schools seek to trim their budgets. This means that a growing number of colleges are turning to financial institutions to handle the distribution of student aid. And that means that students all around the country are receiving their financial aid on cards that end up making money for the bank. [More]

Thousands Of Students Taunted With Accidentally Doubled Financial Aid Deposits

Checking your bank account and finding thousands of dollars more than should be there is always a happy moment — well, at first, until you realize that the unexpected windfall is actually just one big mistake. That’s what happened to thousands of students at University of California, Los Angeles, last week. [More]

3 Things You Need To Know Before Filling Out A FAFSA

If you’re a college student who seeks financial aid, part of your annual ritual is filling out a

Free Application for Federal Student Aid (FAFSA), which lets you see what financial aid you qualify for. In its own way, the application is as important as any research paper or test you’ll complete at school. [More]

A College Financial Aid Primer

Students need to call upon several sources to cover the massive expenses college drops on them. Unless they’re independently wealthy or have a large college fund set up for them, they’ll scramble to come up with the funds to pay for tuition, fees, books and living expenses. [More]

Report: $37 Billion In Welfare Will Disappear By Year's End

Unless lawmakers somehow maintain the funding of welfare programs at current levels, the nation’s poor could suffer a devastating loss of income by the end of the year. According to an estimate by Moody’s Analytics, $37 billion in extended benefits are set to expire. [More]

Facebook App To Automatically Match College Students With Financial Aid

MTV and The College Board recently teamed up for something called the College Affordability Challenge, a contest to create digital tools that will help to make navigating the financial aid maze even slightly easier. Earlier this week, they announced the winner, a Facebook application that takes users’ info and matches them up with the most appropriate aid providers. [More]

Federal Student Aid To For-Profit Schools Has Tripled In Recent Years

Back in August, the Government Accountability Office released the findings of their hidden-camera investigation that caught employees at several for-profit colleges encouraging applicants to lie in order to get more federal financial aid. Today, the GAO released a report that sheds some light on just how much money these schools have been getting from the government. [More]

New Law: All Students To Borrow Directly From Federal Government

President Obama signed the last piece of the health care legislation today — but it wasn’t actually health care legislation — it was, instead, an overhaul of the federal student lending operation. All students getting federal student aid will now borrow directly from the federal government instead of sometimes having to go through a subsidized private lender. [More]

Students: Don't Forget To Fill Out Your FAFSA

The federal deadline for the Free Application for Federal Student Aid (FAFSA) is midnight Central Daylight time, June 30, 2010, but state deadlines are often different and earlier. [More]

Financial Aid-Hunting Students, Make Sure You Visit The Right FAFSA Site

Filling out the FAFSA every year is as much a part of college as binge drinking and the morning after pill. But Jackie points out how easy it is to miss out on this seminal, government-subsidized loan and grant hunting experience by accidentally clicking on FAFSA.com, run by a non-government entity that soaks you for $80 to use its financial aid-finding services. The site you’re looking for is FAFSA.gov, which is free. [More]

College Students: Before You Bog Yourself Down With Loans Fill Out A FAFSA To Snag Free Pell Grants

Exactly how much academic knowledge you glean from college is debatable, but the experience gives most people a thorough lesson of how to drown yourself in debt. But there is financial aid out there, some of it free, for those willing to look for it. This HowToDoThings post offers some helpful tips on how to sniff out federal Pell Grants by getting a Free Application for Federal Student Aid (FAFSA).

Financial Resolutions for 2009

It’s that time of year again. m The Earth has moved ’round the sun once again, and for a month everyone will screw up when writing the date. What are your 2009 Financial Resolutions?

Sallie Mae Will Make Fewer Student Loans In 2008

Student loan lender Sallie Mae said today it plans on making fewer loans in the future “in the wake of federal legislation last year to reduce subsidies for student lenders,” reports Reuters.