First of all, let’s get this straight — fee-happy carrier Spirit Airlines isn’t going to be charging every passenger $100 for a carry-on bag, although that would honestly not surprise us. But if you’re a passenger meeting certain conditions, you could end up paying a maximum of $100 just to bring that roller bag aboard if you’re not careful how you go about it. [More]

fees

HSBC Confuses, Angers Online Customers With Vague New Fees

UPDATE: A rep for HSBC has finally responded to our request for clarification on the fees. [More]

Not Even Verizon Knows Exactly Why It Charges $5/Month To Keep Your Number Unpublished

Most telecom companies have pat, scripted explanations for each of their many, many monthly fees and surcharges, but when one man tried to find out why Verizon charges a $5 fee to keep his number unpublished, he got two very distinct reasons — or rather, one reason and one description of the service. [More]

FDIC: There Is No Such Thing As An “FDIC Fee” To Bank Customers

Odds are that your bank is insured by the Federal Deposit Insurance Corporation, and that your bank pays a premium to the FDIC for said insurance. And while those banks may choose to pass that cost on to customers, they can’t go calling it something like an “FDIC fee.” [More]

Do We Still Need Fee-Disclosure Placards On ATMs?

Back in 1999, the Electronic Fund Transfer Act began requiring that ATMs provide two separate disclosures of associated fees — one on the ATM screen before the transaction is confirmed and a second placard placed in a conspicuous location on the ATM itself. Yesterday, the House of Representatives passed an amendment to the EFTA that would eliminate the placard requirement. [More]

Which Airlines Pile On The Most Fees? Compare And Learn

Our friends over at NerdWallet are always coming up with useful, easy-to-use tools that sift and collate financial information that is normally scattered in a lot of different places. Most of these tools involve credit cards and banking, but they’ve recently opened a travel section. A handy new tool on the site lets you calculate the fees that different airlines charge for the same options, such as checked baggage, rebooking, or unaccompanied minor tickets. This makes it easier to compare airfares that might seem cheap before you start piling on fees. [More]

Can I Survive The Wells Fargo Takeover Of Wachovia With My Account Terms Intact?

Keith has had the same bank account for eight years, but during that time “his” bank has been four different banks thanks to mergers. Ameribank became First Union, which became Wachovia, which in turn was gobbled by Wells Fargo. That’s just how the history of American banking has worked: what’s the big deal? For the first time in all of these mergers, additional fees will be imposed on Keith’s account. He wants to keep things the way they’ve been for the last eight years, and Wells Fargo wants to move on. Well, it wants to move on to taking more money out of Keith’s wallet. [More]

4-Minute Phone Call Saves ADT Customer $100 Per Year

Aishel is an ADT home security system customer. When he received a letter in the mail that the company was increasing his monthly bill slightly, he decided that this change made him feel quite insecure in the wallet. He called up ADT to see whether they could waive the increase for him. Of course they could: and how would he like a $6 decrease in his monthly bill while he was at it? [More]

Spirit Adds $2 "Dept. Of Transportation Unintended Consequences Fee"

Fresh off fighting laws that require truth in advertising, Spirit Airlines, which hilariously dubbed itself the “most consumer-friendly airline,” is now taking a stand against another government regulation — one that requires airlines to allow passengers to change flights within 24 hours of booking without paying a penalty — by adding two dollars to everyone’s ticket. [More]

ATM Company Testing Out Displaying Ads Instead Of Charging Fees

ATM fees are the bane of anyone who hates flushing $2 or $3 down the drain just to gain access to their own money. Going off the idea that any money-loving American would rather see an ad displayed during their transaction than pay an obligatory fee, one ATM company is conducting an interesting experiment. [More]

The New Sneaky Fees Banks Are Adding

Just because the monthly debit card fee battle has been won doesn’t mean banks are gonna stop trying to squeeze more profit off basic checking accounts. Here’s a bunch of the recent fees banks have invented: [More]

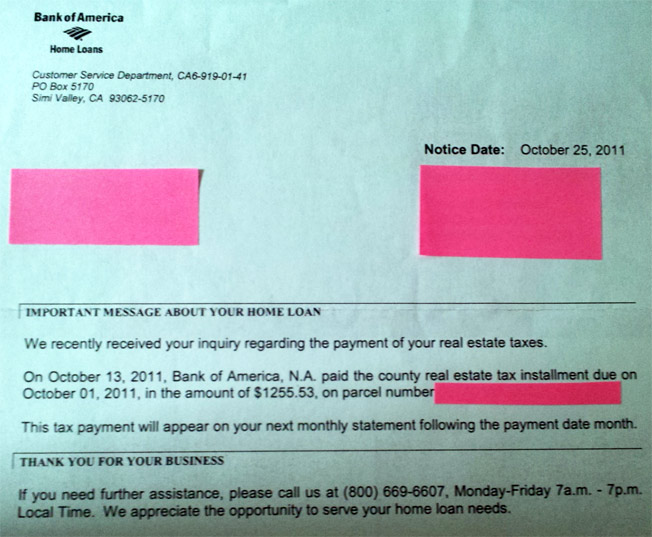

BofA Says "Sorry" For Paying Your Real Estate Taxes Late

Banks are happy to jump all over you and ratchet up the fees when you’re late. But when they’re late, not so much. [More]

Apparently, Any Transaction Can Be 'Foreign'

The Internet brings a global marketplace to us as we sit on the couch eating Pop-Tarts while wearing pajama pants. But a world of options brings a world of fees, thanks to our banks. Beth would expect her credit card issuer, Citibank, to assess foreign transaction fees if she were using her card abroad. Not if she were buying a domain name through Yahoo. [More]

BofA Reaps Fees From Unemployment Benefits Loaded On Debit Cards

While Bank of America’s now-abandoned plan to charge debit card users $5 a month has received a halogen spotlight recently, far less attention has been paid to how it collects fees off the unemployed. In some states, unemployment benefits are issued via Bank of America debit cards. States save money by not using paper checks, but the unemployed lose out from all the fees hiding in the cards. [More]

BofA Charges Man $39.23 On A $0 Balance

Bank of America charged Roger $39.23 in interest on his credit card, even though he had a zero balance. How could that be? [More]

BofA Ending $5 Debit Card Fee

Bank of America is calling off its plan to charge debit-card users $5 a month, the WSJ reports. [More]

Chase Drops Plan For $3 Debit Card Fee

Chase joins U.S. Bancorp, Citigroup, PNC, KeyCorp and other large banks that have recently moved away from the plan to charge consumers a monthly fee when they use their debit cards to make purchases, reports the Wall Street Journal. The bank recently tested the fee in both Washington and Georgia. [More]