An anonymous AT&T employee who says to call him “Vernon” wrote in to tell us that starting next Tuesday, March 11th, some customers in the Southeast who call in to make a payment will be charged $5, with the fee going nationwide by May. He writes, “I feel this is taking advantage of our customers’ trust, because even when we put it on all of their bills, and let people know, there will be tons of reps that won’t let the customer know they’re being charged for taking their payment.”

fees

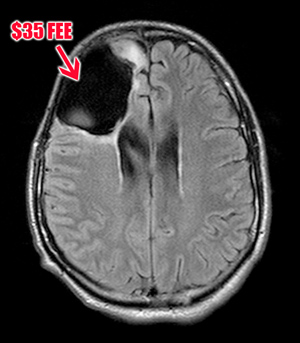

HSBC Refunds $35 Fee, Not To Correct Their Mistake, But Because You Have A Deadly Brain Tumor

I made an electronic payment online with my one of my bank’s check card. Turns out this was the wrong one, and I immediately canceled the payment (as there’s a very easy to find and large button allowing you to do this immediately as well), and resubmitted it through the correct bank. So, to sum up, the payment was made, about two weeks before it was due. I figured all was cool and I was being a good customer for paying more than the minimum balance, way ahead of the due date, online, so there wouldn’t be any “problems” with a check or the postal service. Then I look on my statement and I’ve been charged a $35 Returned Payment Fee.

Uhaul To Start Charging $1-$5 "Environmental Fee"

Uhaul is going to start charging customers a $1-$5 fee to defray the cost of throwing away the various nasty junks associated with its rental business, according to an anonymous store manager. It will be called an “Environmental Fee.” Ok, whatever, but we like the rebuttal supplied in the Q & A for Uhaul managers in case a customer complaints: “Do you want clean air and water thirty or fifty years from now? If so, pitch in.” Nice, avoid raising upfront prices and get customers to cover your operating expenses through the power of guilt. Full text of the announcement, inside…

Budget's Free Frequent Flyer Miles Promos Will Cost You

Michael writes, ” I was just reserving a budget rental car, and for some reason decided to actually read some of the fine print.” Buried in the text was something called an “FTP Surcharge,” which basically amounts to a participation fee for any frequent flyer promotion they offer their customers.

US Airways To Charge $25 For Checking 2 Bags

If you find yourself identifying with those dames in movies set in the 19th century who always travel with a stagecoach full of steamer trunks, you won’t like US Airways new policy. Starting May 5, US Airways will levy a $25 fee against passengers checking a second bag. United Airlines announced the same thing earlier this month, and is also starting the fee on May 5. We can expect to see more and more of these fees as airlines struggle to make money, making it even harder to comparison shop for tickets. As Upgrade: Travel Better notes, no airfare search engine is equipped to take add-on fees into account (hello, market opportunity somebody?). Inside, the email US Airways sent out to its passengers.

Government-Mandated Mutual Funds For Everyone! No Thanks.

There was a NYT op-ed last week, “Go On A Savings Spree,” suggesting that, as opposed to the tax-rebate stimulus, the best way to heal the economy is for the government to create universal mutual funds for every tax-payer. At one point, author Dalton Conley writes, “Some research suggests that asset-holders behave more responsibly and are more civic-minded than those without wealth. After all, they have a stake in the future of the economy and their community…Investing motivates people of all income levels to defer gratification and become knowledgeable about the economy and society.”

../../../..//2008/02/22/today-united-airlines-raised-most/

Today United Airlines raised most of its domestic fares by $10 roundtrip. Maybe now their flight attendants can start answering call buttons again. [Reuters]

$2,243 Burger King Bill Leaves Customer Overdrawn, Pissed Off

A $22.43 sack of burgers turned into a huge pain in the ass when Burger King accidentally debited $2,243 from Bryan Sampson’s bank account, leaving him overdrawn and unable to use his debit card lest the overdraft charges keep piling up. Burger King said the manager wasn’t available to correct the mistake because it was a holiday weekend… but the local media was happy to answer the phone.

Watch Out For These 14 Hidden Hotel Fees

Fodor’s posted another helpful list of hidden hotel fees to beware of the next time you travel. In most cases, these fees fall under the practice of “negative option billing,” meaning that there’s an assumption you’ve used the related service and therefore agree to the charge. If that’s not the case—or, in the case of gratuities, if you’ve already tipped—you should definitely ask the hotel to remove such fees from your bill.

ATM Fees Slink Upwards

Everyone with an ATM card is used to paying withdrawal fees when using another bank’s ATM and it’s no big deal, it’s only a buck or so, and the ATMs are so convenient. If that screen said, “This ATM will charge you $4.75 to withdraw money,” you might look around to make sure you hadn’t accidentally stepped into a casino or strip club. But since many banks charge you an extra per-transaction punishment fee for using another bank’s ATM, that’s exactly what’s happening. You just don’t notice because it gets lumped together into one ATM fee on your bank statement. Not only that, but these fees are slowly and steadily on the rise, as seen in this NYT graph. Average ATM surcharges by “other banks” have gone up from $.75 to $1.75 from 1999 to 2007. Average punishment fee for cheating with another bank’s ATM has gone from $2.00 to $3.00 in the same period. Obviously, one way to beat the fees is to only visit your bank’s ATMs. Another is to bank with a place like USAA, which refunds other bank’s ATM surcharges. Any other solutions out there for ending the fee spree?

Bank of America Angers More Customers With Unjustified Rate Hikes

More about Bank of America’s inexplicable rate hikes against good customers who never pay late: the Charlotte Observer talks to some recent recipients of BoA’s infamous rate-increase letters from the past few weeks. The first person they talk to is a 60-year-old woman who “had never been late on a credit card payment, just refinanced her home at a lower interest rate, and just been rewarded by her credit union with a lower rate on her credit card there.” Bank of America just raised her card from 13% to 24.99%.

Continental Raising Unaccompanied Minor Fee To $150

Broken homes, take note, starting February 17th, Continental is raising the unaccompanied minor fee to $150 round trip, or $75 each way, up from $50 one way. Tipster Barbara, who is sending two of her kids to visit family this weekend, writes that it’s, “almost cheaper for me to fly with them than to send them as unaccompanied minors!”

Why Is Bank Of America Raising Interest Rates On Its Good Customers?

BusinessWeek has just published an article about Bank of America’s recent surprise mailings in January to some of its customers, announcing “that it would more than double their rates to as high as 28%, without giving an explanation for the increase.” These customers have good credit scores and hadn’t made any late payments, and those who called Bank of America to ask why this was happening weren’t given clear reasons. Industry experts say Bank of America has reached a “new level” of “lack of transparency in raising rates,” beyond anything Citigroup and JP Morgan Chase currently practice, because BoA is apparently using some undisclosed internal metric to determine who gets the rate hike.

ISP's Sneaky Fees

“ISPs create tangled Web of sneaky fees: Companies use hidden charges to generate revenue in competitive industry” is an excerpt Bob Sullivan has published from his new book Gotcha Capitalism. For example, in 2006, the government dropped the federal Universal Service Fund (FUSF) fee on DSL, which meant providers could now charge less, right? Verizon turned around and quickly replaced the FUSF with a new “Supplier Surcharge” fee. Sneaky sneaky.

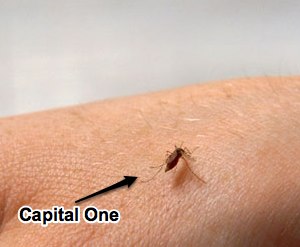

Capital One Won't Really Close Your Credit Card, Will Secretly Continue To Bill You

When Capital One “closes” your credit card account, they’ll continue to allow automatic withdrawals even though the account is closed. But they won’t send you a statement—you know, because it’s closed!—so that you’ll end up with late fees. Quenten experienced this first hand when he closed his account recently, and now Capital One has sent his account to collections over a $38.00 late fee for two 38-cent charges that he never knew about.

United Airlines To Charge $25 For Checking 2 Bags

Can’t fit it all in one suitcase? United is going to start charging passengers a fee for checking more than one piece of luggage, $25 per bag. Elite frequent flyers will skip the charge. The new policy begins May 5. It’s certainly one way to pass fuel costs on to passengers using more fuel, without raising up-front fare prices.