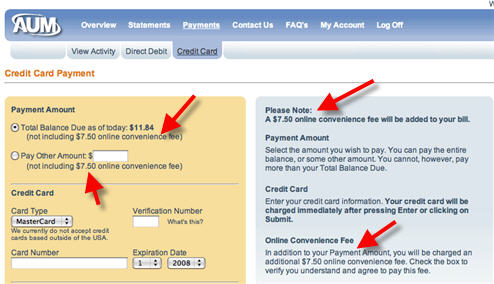

Emily noticed that the weird puppet crap she was thinking of buying on Ebay would make her PayPal account explode:

I know shipping products can be expensive, what with the rising fuel costs and all, but this shipping charge from the UK to Utah is ridiculous! Maybe the seller’s just padding the fee, I don’t know. 🙂