Netlfix announced yesterday that they’ll be eliminating the ability to set up separate queues or “profiles” within one account. Some customers, like reader Stephen are hopping mad about it.

features

Sneak Peek Of BillShrink.com's New Credit Card Comparison Tool

Billshrink.com is going to bring a never-before-seen level of transparency to consumers looking for the best credit card offer. Think of it as a turbocharged dashboard for navigating the credit card market. The site launched earlier this year as wireless plan comparison service, but with personal debt at record highs and personal savings rates at record lows, the credit card vector is potentially even more important and useful tool. I sat down with CEO Peter Pham yesterday as he showed me the actual website in action.

How Robots Are Killing Customer Service

Here is the live audio and powerpoint from a recent presentation I gave called, “The 5 Things Your Customers Aren’t Telling You.” This is number 3, “Stop Hiding Behind Walls Of Robots.” It’s all about how companies think they’re saving money by replacing humans with machines but sometimes machines can’t do jobs as well as humans, especially when it comes to customer service. I brought the point to life with a funny little story about eBay and their wonderfully inept automated email response system. I hope you enjoy the video, including the intro and outro ditties I worked up on my girlfriend’s old Yamaha synth. [More]

10 Ways To Save Real Money

The champagne is dry and crusty, and all the hundred-dollar bills used to light cigars have crumbled into ash. It’s time to tighten our belts and get real about spending less and saving more. Here’s 10 ways to save some serious cash…

Blame The Subprime Meltdown On The Repeal Of Glass-Steagall

A lot of blame has sloshed around for the sub-prime meltdown, from greedy borrowers to greedy mortgage brokers to Alan Greenspan, but if you want the real culprit, it was the repeal of the Glass-Stegall Act. On November 12, 1999, the champagne must have been shooting from the walls at Citigroup, which had worked behind the scenes for over 30 years to get the act overturned. After recovering from their hangover, they and their banking buddies went on a sub-prime lending orgy. But what was Glass-Steagall and how did it use to protect us?

Citicard Exec On Ending Universal Default: "It's Like Telling People You Stopped Beating Your Wife."

I was talking to a high-up marketing type person from Citicards recently and she wanted to know what Consumerist readers were complaining about with regards to the little plastic devil she pushes. She told me how Citicards had recently stopped doing Universal Default, which is where if you’re late on your payments with one creditor, other creditors get to treat you like you defaulted with them and spike your APR. She said she was personally appalled after finding out that her company had the policy in the first place, but then struggled with how to tell customers about it, because, she said, “It’s like telling people you stopped beating your wife.”

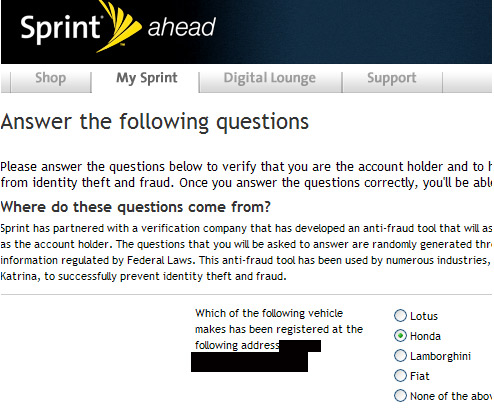

Flawed Security Lets Sprint Accounts Get Easily Hijacked

We found you can hijack a Sprint user’s account as long as you know their cellphone number, just a smidge about them, and have half a brain. Once inside, you have total access to their account. You could change their billing address, order a whole bunch of cellphones sent to a drop location, and leave the victim paying the bill. There’s also the stalker’s wet dream: add GPS tracking to their cellphone and secretly watch their every movement from any computer. Reader Jim told Sprint about this 2 months ago but they ignored him, so I tested it out and am publishing the results in the hope of getting Sprint to fix this exploit. I’ll show you we cracked into a Sprint account and just how much damage I could have done, inside…

How To Research An Unknown Online Retailer

So you just spotted that gizmo you’ve been lusting for at unbeatable price, but the only problem is it’s for sale at an online retailer you’ve never heard of. How do you know if they’re trustworthy?

5 Steps To Being A Savvy Shopper

Today’s consumer world has become increasingly fragmented and difficult to navigate, so we here at The Conglomerist put together a helpful guide on how to be a savvy shopper. It’s a five-step process consisting of Research, Shopping, Paying, Customer Service, and Disposal. After the jump, let’s get started with learning about how to use our dollars more wisely…

Treasury Secretary Calls For Supercharged Fed, Streamlined Regulatory System

Treasury Secretary Henry Paulson wants to consolidate the nation’s financial regulators into a tripartite gang that can save the economy from distress and doom. The plan to give the Federal Reserve broad new regulatory powers and streamline the regulatory community has been in the works since last March, before the start of the subprime meltdown. Paulson is worried that the U.S. markets are no longer competitive with maturing world markets, some of which aren’t hampered by nuisances like regulation. After the jump we’ll explain the consumer impact of the plan and introduce you to your three new regulators.

Inside The Consumer Reports Testing Facility

Ever wonder how Consumer Reports figures out which products to recommend? For one, it takes mad science, like this echo-free room that sits on a different foundation from the rest of the building. I was up at the Consumer Reports HQ yesterday for a planning meeting related to a blogger’s conference they’re planning for June, and they were nice enough to give me a quick tour of their testing facilities. I snapped some 33 pictures with my cellphone camera. Check them out in the interactive photo essay gallery, inside…

Interview With Ron Burley, Customer Service Avenger

“There’s only one leverage any consumer has with a company. And that’s financial.” So says Ron Burley, author of UNSCREWED: The Consumer’s Guide To Getting What You Paid For. I got to interview Ron Burley to plumb his brain about his customer satisfaction hacks, and the current state of affairs of customer service. His techniques are bold and make no apologies. We’re not talking letters, and forms, and complaint departments. These are real methods for real people that work real fast. He also goes into the mindset that you need to develop if you’re going to get results. Bookmark this post, it’s an epic barnburner. Transcript, inside…

Complaint Remover Gets Rid Of "Negative Links," Including LOLCats

Complaint Remover is a special service that says it gets rid of “defamatory” and “negative links” on the internet for you:

The immediate goal of our service is to stop defamation by positioning links on the Search Engines and by appeals to law to remove negative information. We send cease and desist letters and if necessary, file legal actions against the perpetrators and Internet service providers contributing to the unjust defamation of our members.

Their site has an online chat function with a customer service rep and we decided to ask if they could help us take a crap all over free speech, and how much that would cost…

Monster Cables, Monster Ripoff: 80% Markups

Ever wonder why gadget store employees push Monster cables like they’re crack? Bitchin’ markups, just like you suspected (or knew) all along. That’s what we found when a Radio Shack employee sent us his store’s entire inventory list, which included the wholesale and retail price of every item in stock.

How Your 401(k) Is Ripping You Off

Another chapter in Bob Sullivan’s excellent book Gotcha Capitalism explores how Wall Street quietly devours your retirement plan through an array of hidden fees. Bob quotes a Wall Street money manager as saying, “If we had to disclose fees, half the people in this room wouldn’t have jobs.” [More]

2007 Federal Tax Law Changes

Every year, as way to make itself feel important and useful, the federal government makes modifications to the tax code. Here’s a detailed breakdown of all the changes for 2007 and how they affect your wallet, from AMT exemption amounts, to deductions for business-related mileage.

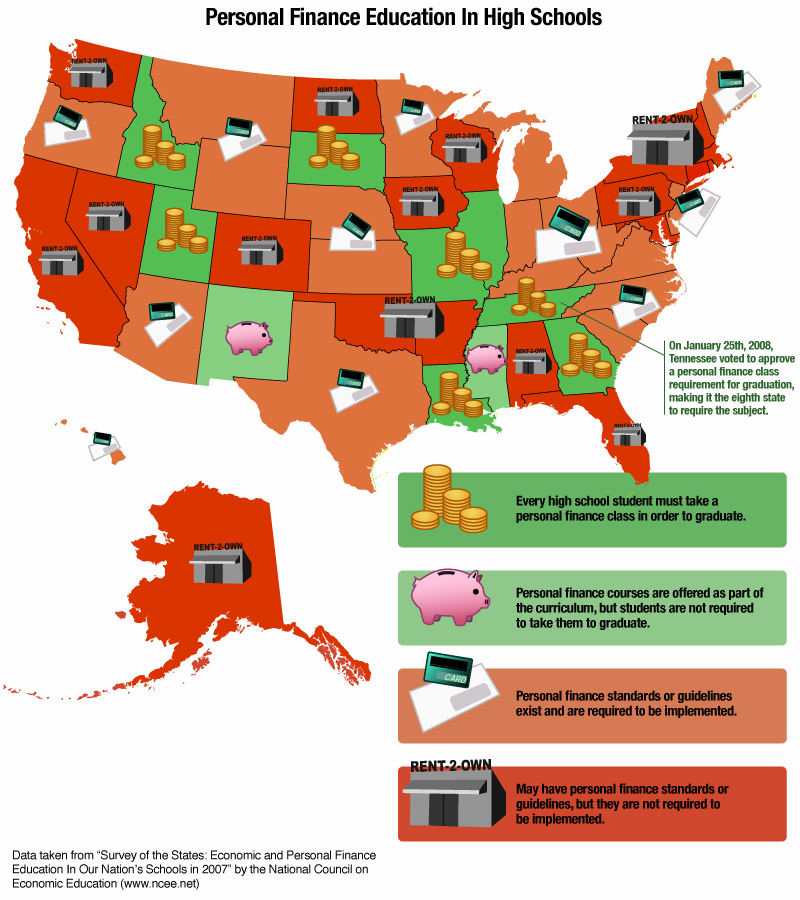

Report Card On Personal Finance Education Nationwide

Less than a week ago, Tennessee voted to require a personal finance class of all graduating high school students, starting with this year’s seventh graders. Unfortunately, less than 20% of states have similar requirements. We’ve made a fancy-schmancy graphic to show which states are teaching tomorrow’s citizens how to manage money, and which states are likely to be great places to set up payday loan shops. Inside, see the chart nice and big.