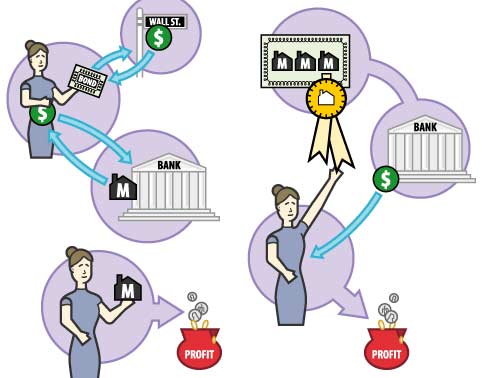

A federal jury has found Bank of America (and a current JPMorgan executive) liable for a Countrywide Financial program that knowingly sold piles of cruddy home loans to Fannie Mae and Freddie Mac, meaning the bank could face nearly $850 million more in penalties added to the $40 billion-plus court tab it has tallied since acquiring the cratering mortgage-lender in 2008. [More]

fannie mae

Wells Fargo Settles With Freddie Mac For $869 Million

Because a few days can’t go by without one of the few remaining big banks agreeing to pay out hundreds of millions of dollars (without ever admitting any wrongdoing), Wells Fargo has agreed to settle with Freddie Mac for $869 million over — you guessed it — toxic mortgages from the Bubble Era. [More]

Bank Of America On Trial Over Countrywide’s “Hustle”

There are children in elementary school who were not yet born in 2007, when Countrywide Financial allegedly launched a program dubbed the “Hustle,” which removed virtually all the roadblocks in the mortgage approval process so the lender could write as many loans as possible and quickly sell them off to Fannie Mae and Freddie Mac for billions of dollars. Many of those mortgages proved toxic, and six years later, Bank of America has to answer in court for the bad behavior of the mortgage company it must now regret acquiring. [More]

U.S. Lawsuit Against Bank Of America Given Go-Ahead For Trial

It’s been nearly a year since the U.S. government sued Bank of America over Countrywide’s sale of billions of dollars worth of toxic loans to Fannie Mae and Freddie Mac. Predictably, BofA has attempted to have the case dismissed, but a federal judge has given the green light for the suit to finally head to trial next month. [More]

Clearer Mortgage Rules, No-Fee Refinances Key To President’s Plan For Middle-Class Housing Market

On Tuesday, President Obama will visit Arizona, one of the states that took the biggest butt-whooping from the housing boot, and one of five states (along with Nevada, Florida, Michigan, and Georgia) that still account for a full 1/3 of the negative equity in the U.S. In a speech in Phoenix, the President will outline what his administration believes are steps that will help give more middle-class Americans a chance at securing a foothold in the housing market. [More]

Citi To Pay Nearly $1 Billion To Fannie Mae For Toxic Mortgages

Ever since taxpayers bailed out Fannie Mae, the mortgage-backer has been trying to get some of the nation’s largest lenders to buy back the toxic loans that had been sold to the company before the housing bubble went POP. Today, Citi announced that it has agreed to pay $968 million to Fannie Mae to put an end to its part in the matter. [More]

Losing Your House To Foreclosure Doesn’t Necessarily Mean You No Longer Owe Money To The Bank

There’s a commonly held notion that losing one’s home to foreclosure is the final act in a sad drama, that the homeowner has hit bottom and has nowhere to go but up. But thousands of foreclosed-upon homeowners are finding out, years after turning their keys over to the bank, that they may still be on the hook — sometimes for hundreds of thousands of dollars. [More]

Fannie Mae Fires Head Of Office At Center Of Kickback Scandal

A few weeks back, we told you about the Fannie Mae office in Irvine, CA, where some employees have been accused of taking kickbacks from real estate brokers in exchange for priority access to the bailed-out mortgage-backer’s lists of repossessed properties. Now comes news that the head of that office has been given the boot “for performance issues.” [More]

Fannie Mae Staffer Accused Of Taking Kickbacks Says He’s Not The Only One

Since 2009, bailed-out mortgage-backer Fannie Mae has sold nearly three quarters of a million repossessed properties. And considering that there are plenty of investors and speculators looking to snap up bottom-dollar homes with the hopes of eventually reselling at a profit, someone with inside information could be tempted to put a premium on that data, even if doing so is against the law. [More]

States Say Federal Housing Finance Agency Is “Direct Impediment To Economic Recovery”

Since 2008, mortgage giants Fannie Mae and Freddie Mac have been under the conservatorship of the Federal Housing Finance Agency, which has previously balked at the notion of reducing the principal on borrowers’ loans in order to keep people from defaulting and losing their homes to foreclosure. And so today, the Attorneys General for nine states have written to President Obama and leaders in the U.S. Senate calling for removal of acting FHFA head Edward DeMarco. [More]

Fannie & Freddie To Let Some Underwater Homeowners Walk Away From Their Mortgages

Since bailed-out mortgage servicers began dealing with the toxic loans made during the housing bubble, the focus has been on people who couldn’t pay their mortgages. Now Fannie Mae and Freddie Mac have an out for people who have continued to pay while their houses have lost value. [More]

Bank Of America To Pay $11.6 Billion In Latest Countrywide Settlement

Like someone who thought they were buying a nice little fixer-upper at a bargain only to find that every ounce of the property is covered in lead paint and asbestos, Bank of America’s 2008 purchase of Countrywide Financial continues to eat away at the company’s coffers. [More]

Fannie Mae & Freddie Mac Kick Off The Holidays With Yearly Moratorium On Foreclosures

For three years in a row, we’ve been able to take note of a particularly heartwarming act by two of the country’s largest mortgage giants, Fannie Mae and Freddie Mac. Just as the two companies did in 2011 and 2010, they announced today that they’ll suspend all bank repossessions of homes starting Dec. 19 and Dec. 17, respectively, running through January 2, 2013. That simple act could help homeowners ensure they can stay home for the holidays. [More]

Exec Who Looked Other Way As Countrywide Sold Off Bad Mortgages Is Now Running Chase’s Foreclosure Review Dept.

The federal government recently filed a lawsuit over a Countrywide scheme dubbed “The Hustle” that removed impediments to a mortgage approval so the company could sell as many mortgages as possible to Fannie Mae and Freddie Mac. Now comes news that a Countrywide exec who ignored warnings about the Hustle is currently running Chase’s foreclosure review initiative. [More]

Homeowners Impacted By Hurricane Sandy Could Get Some Mortgage Relief Soon

While one major problem facing many homeowners is dealing with insurance claims in the aftermath of Superstorm/Hurricane Sandy, there’s another long-term issue causing trouble for people whose homes have been damaged by the natural disaster — simply paying the mortgage. Relief is in sight for some borrowers as government agencies and other major lenders begin implementing programs to offer breaks on mortgage payments, among other forms of assistance. [More]