../../../..//2008/03/25/maybe-im-skimming-the-wrong/

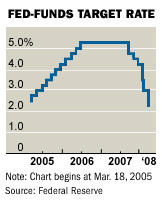

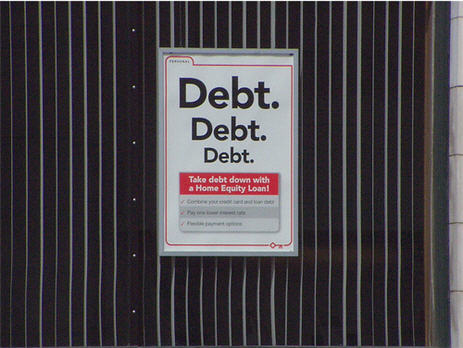

Maybe I’m skimming the wrong articles and half-listening to the wrong news reports, but in all this belly-aching about declining consumer spending one thing seems to be missing. Now, correct me if I’m wrong, I don’t seem to see any mention of the fact that consumers have been overspending for so long and it might actually be economically healthier in the long-run for there to be a cutback. IANAE (I Am Not An Economist) but it seems to me that if you just keep building magic castles on magic castles, eventually there will have to be an implosion. The earlier it happens, the less catastrophic the end result.