The retail industry has already politely asked Congress to please not roll back financial reforms involving debit card transactions, but as lawmakers on Capitol Hill inch closer to undoing these protections, retailers are once again voicing their concerns that undoing the 2010 law will lead to higher prices and hurt small businesses. [More]

durbin amendment

Court Strikes Down Fed’s Debit Card Swipe-Fee Rules

One of the more contentious aspects of the recent financial reforms was a directive from Congress for the Federal Reserve to set a cap for swipe fees — the amount charged to retailers for each debit card transaction — in order to bring the fees in line with what it actually costs to process the transactions. This morning, a U.S. District Court judge ruled that the Fed disregarded the intention of the reforms by setting that cap much higher than it should have been. [More]

The New Sneaky Fees Banks Are Adding

Just because the monthly debit card fee battle has been won doesn’t mean banks are gonna stop trying to squeeze more profit off basic checking accounts. Here’s a bunch of the recent fees banks have invented: [More]

Why You Should Thank BofA For The $5 Debit Card Fee

Bank of America’s new $5 monthly fee for having a debit card is getting painted as a public enemy, but columnist Michael Hiltzik for the Los Angeles Times says we should be giving it a great big hug. [More]

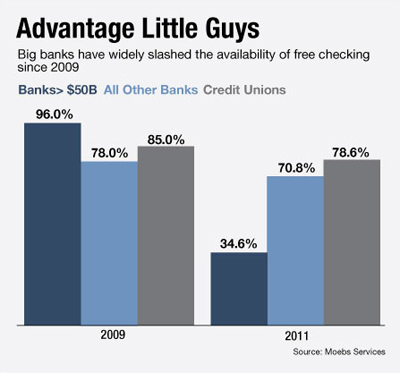

Chart: This Is How Dead Free Checking Is At Big Banks

This chart from American Banker shows just how many nails are in the coffin of free checking at big banks in a post-Durbin amendment world. That is a whopping drop from 96% of large banks offering free checking in 2009 to only 34.6% in 2011. What’s also amazing is just how resilient free checking is at the credit unions and smaller banks, which continue to use it as a marketing tactic to attract customers. [More]

Senate Votes To Continue With Debit Card Swipe Fee Slash

The Senate narrowly voted earlier today to defeat a measure to delay new rules that significantly decrease swipe fees, the amount of money banks charge retailers every time a debit card is used. [More]

Senator Durbin To Chase CEO: You're Already Gouging The Consumer, So Stop Complaining

The main reason that JPMorgan Chase and other big banks have given for things like $5 ATM fees and prohibitive caps on debit card purchases is a soon-to-be-enacted bit of legislation known as the Durbin Amendment, which limits the amount of money banks can make off of interchange fees, the amount they charge retailers for each debit card transaction. Chase CEO Jamie Dimon has called the laws “price fixing at its worst” and “downright idiotic.” Now Dick Durbin, the Illinois senator whose name graces the legislation, has come out swinging at Dimon, telling the bank exec to quit whining and enjoy being profitable. [More]

Free Checking Lives On At Smaller And Online Banks

Now that free checking is dead at each of the four major retail banks, is there any where you can go to just have a simple checking account without paying a bunch of fees? Yup, look at your smaller local bank or credit union, or think about an online checking account, reports American Banker. Unlike the big banks that have such dominant market presence that they don’t need to compete on price, just who has more ATMs, the scrappier outfits are going to to use free checking as a competitive advantage and a way to get people in the door so they can try to upsell them to other banking products and services. [More]