Did you participate in an office gambling pool or place a few bets with your friends? Well, bad news, big winner: those bets were illegal and your winnings are taxable.

deductions

5 Last-Minute Ways To Reduce Your 2008 Taxes

USAA Mag has 5 good ideas for getting in good shape for tax season before the closing bell rings on 2008:

TurboTax Doesn't See Anything Unusual About Your $1,635,335 In Moving Expenses

Reader Elijah is glad he gave his taxes a manual check before sending them off. Despite accidentally inflating his cross-country moving expenses from $1,635 to $1,635,335, TurboTax’s audit check said Elijah’s return was “green” — meaning that he was at low risk for an audit. Now, Elijah’s wondering: If $2,000 error on his tax return wouldn’t put him at risk of an audit, what would?

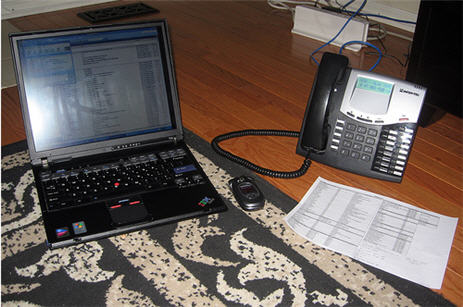

Tax Tip: Home Offices Are Worth The Deductions If You Qualify

The first question that must be asked about any home office in order for it’s expenses to be deductible is, is the workspace used exclusively and regularly for business? The answer to both of these questions must be yes before any deduction can be taken. If the workspace is used for both business and personal use, then it is not deductible. Furthermore, the space must be used on a regular basis for business purposes; a space that is used only a few times a year will not be considered a home office by the IRS, even if the space is not used for anything else. These criteria will effectively disqualify many filers who try to claim this deduction but are unable to substantiate regular and exclusive home office use. It should be noted that it is not necessary to partition off the workspace in order to deduct it (although this may be helpful in the event you are audited.) A simple desk in the corner of a room can qualify as a workspace, provided you count only a reasonable amount of space around the desk when computing square footage.

Make Sure Your Refinance Loan Isn't A "Tax Trap"

“If you fail to follow some little-known rules for calculating your home mortgage deduction, you may be writing off too much interest. Instead of saving on taxes, you could wind up owing them,” says Business Week in next week’s “Personal Finance” column.

Donate Your Frequent Flier Miles To Charity

Why bother with frequent flier miles when you can donate them to charity? The donations are tax-deductible, making them an attractive alternative to the Sisyphean challenge of ferreting out an eligible seat.

Many non-profit organizations have frequent flier mileage donation packages, and several major air carriers have developed charitable programs using earned miles. Some are exclusive partnerships geared to one or two specific charities, while others have multiple organizations with quarterly or monthly rotations, allowing all the participating charities equal time to receive miles.

Peter Greenberg lists several charities that accept miles as donations, from the Make-A-Wish Foundation, to Save The Dogs, an Italian non-profit committed to rescuing stray dogs in Romania. — CAREY GREENBERG-BERGER

"Girls Gone Wild" Tax Indictment Teaches Us Not To Deduct Funny-Looking Numbers

Joe Francis, the quivering chumbucket behind the “Girls Gone Wild” franchise, got indicted Wednesday for tax evasion, as noted by commenter LAGirl. His story holds a lesson for all taxpayers: when claiming deductions, don’t use funny-looking numbers.

Taxes: Deductions For Non-Itemizers

Even if you’re just going to claim the standard deduction, Don’t Mess With Taxes says there’s above-the-line “deductions” you can take.

Tax Deductions You Might Not Know About

Check out the Kiplinger’s guide to what items you can deduct from your tax return.

The 13 Most Overlooked Tax Deductions

Thirteen often overlooked deductions that can blunt the dent to your wallet come April 15th.

Taxes: Breaking Changes To How You Claim College Deductions

December tax law changes mean 1040 filers claiming college deductions will have to take special steps.

Tax Tip: The 50 Most Overlooked Deductions

AllFinancialMatters has a list of the 50 most overlooked deductions from The Ernst & Young Tax Guide 2007. Highlights of particular interest:

Two Free Tax Tools: DeductionPro and OrganizIT

Thanks to H&R Block, today is National Tax Advice day, and they’re offering two free tax prep tools.

Should You Itemize Your Deductions?

Married Filing Separately $5,150

There are a few exceptions, conditions, etc that the Tax Man explains in his post, so check it out. Also, keep in mind that itemizing is fun. Yes, really. —MEGHANN MARCO

New Things To Know For Taxes This Year

Ladies and Gentlemen, Dependants and Deductions, it’s officially tax season! Yay! So, what’s new?

Best Charities for your Tax Deductions

It’s tax season, a time for reflection, pauses, teeth-grinding and good times with our good pals, as Jenny writes: