Nearly four years after tax refund anticipation loans were all but removed from tax preparation offices, similar costly financial products continue to be offered to many low-income consumers in need of a cash infusion before their tax refund actually hits the bank. This appears to be the case for a loan company accused of providing thousands of refund anticipation-like loans with hidden fees to people living in and around the Navajo Nation. [More]

deceptive marketing

Lawsuit Claims Lender Targeting Navajo Nation Deceived Customers On True Cost Of Tax Refund Anticipation-Like Loans

Feds Sue Four Online Payday Lenders For Collecting On Void Debts

Last year, federal regulators released a report that found online payday lenders — despite their clean, professional websites — could be just as bad, if not worse, than their storefront counterparts. Today, the Consumer Financial Protection Bureau provided yet another example of how these companies can wreak havoc on consumers’ finances by skirting the law. [More]

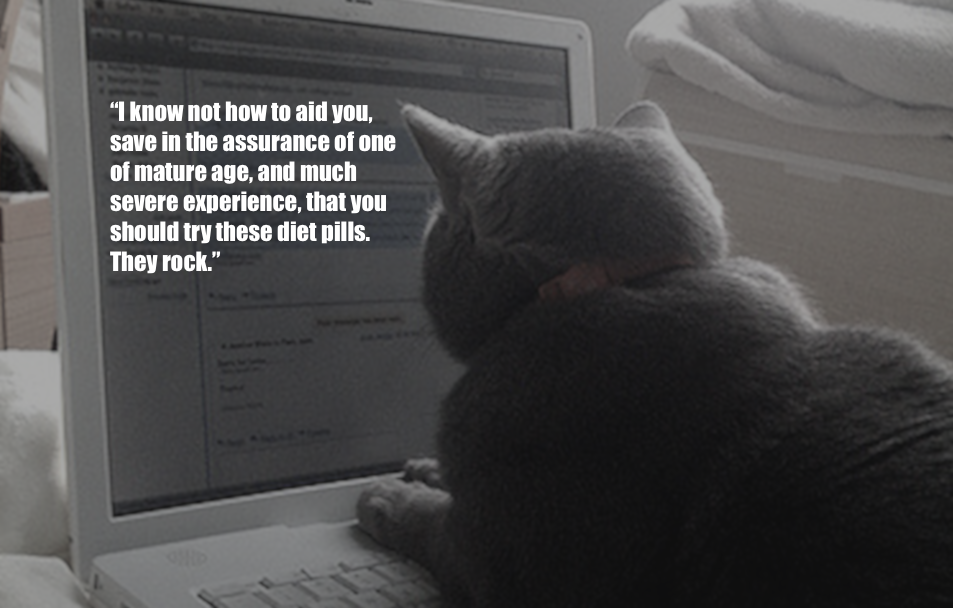

Spammers Must Pay $500K After Using Hacked Emails To Push Diet Pills

Last summer, federal regulators charged the operators of an alleged spam scam of hijacking hacked email accounts to spread the word about a slew of unproven weight-loss products. Now, the three affiliate marketers have agreed to pay $500,000 to put the case behind them. [More]

Feds, New York Accuse Maker Of Prevagen Dietary Supplement Of False Advertising

Prevagen is a dietary supplement that claims to help improve memory in 90 days, but both federal and state regulators are accusing the company behind Prevagen of making false and unsubstantiated claims. [More]

Are Nestlé’s Raisinet Boxes “Recklessly” Under-Filled?

By now most Consumerist readers are familiar with the Grocery Shrink Ray, where the amount of a product in a package shrinks over time to keep the price of the product consistent without decreasing profits. Sure, that’s annoying and perhaps a bit misleading, but the Shrink Ray’s sneakier twin — slack-fill — is even worse, and now it’s the reason for a class-action seeking lawsuit against Nestlé, accusing the candy company of “recklessly” underfilling its Raisinets boxes. [More]

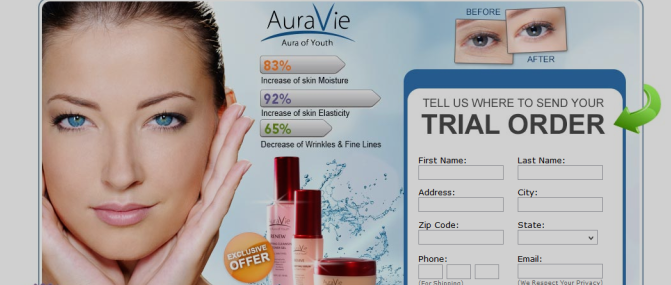

Skincare Marketers Barred Over Deceptive Marketing and Billing Practices

A year after federal regulators received a court order temporarily shutting down a group of marketers allegedly using deceptive online “risk-free trials” to entice customers into buying skincare products, the agency officially received orders barring the companies and their operators from using the deceptive tactics to promote their products. [More]

Spammers Used Hacked Email Accounts To Push Bogus Weight-Loss Products

Word-of-mouth is a great way to promote a weight-loss product, as you’re more likely to trust a passed-along recommendation from a friend than some ad you see on the internet. That’s why the operators of an alleged spam scam hijacked hacked email accounts to spread the word about a slew of unproven weight-loss products.

[More]

You Can’t Claim Your Glue Is “Made In USA” If It’s Made From Imported Chemicals

While there’s no official pre-approval process for products labeled “Made In U.S.A,” there are federal standards for what that phrase means, and a company can get into trouble for slapping “Made In U.S.A.” on imported products — like the glue company accused of misleading consumers about where its sticky stuff comes from.

[More]

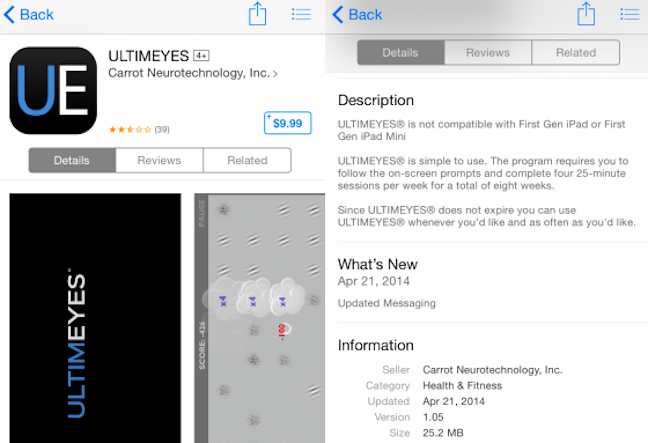

Feds Say Vision-Improvement App Not Backed By Science

They say that staring at a computer for hours at a time can ruin you vision, so it might be hard to swallow claims that a mobile app can improve your vision… especially when science doesn’t back it up. [More]

Regulators Halt Alleged Energy Drink Pyramid Scheme That Targeted College Students, Other Young Adults

Federal regulators continued their crackdown on supposedly deceptive dietary supplement companies this week by temporarily shutting down an Arizona-based company that allegedly ran a pyramid scheme promising college students they would rake in the big bucks by selling energy drinks. [More]

Regulators Sue Pension Advance Companies Over Deceptive Marketing Of Loans

Five months after the Consumer Financial Protection Bureau warned that pension advance loans could be the new payday loan – leaving consumers who are already struggling to make ends meet in dire financial situations – the agency announced it had teamed up with the state of New York to shut down two companies that allegedly deceived retirees about the risks and costs associated with the loan products. [More]

Citibank Must Pay $700M Over Illegal Marketing, Collection Practices

The Consumer Financial Protection Bureau ordered Citibank and one of its subsidiaries to pay $700 million in relief to more than 8.8 million consumers for engaging in a string of illegal credit card practices, including deceptively marketing and billing for debt protection and credit monitoring services, and misrepresenting fees related to debt collection actions. [More]

FTC Says Some Of Those “Risk-Free Trials” For Skincare Products Are Bogus, Shuts ‘Em Down

Sometimes it’s hard to ignore the lure of a “risk-free trial” when it comes with a product that promises to leave your skin youthful, radiant and as soft as a baby’s bottom. But as the Federal Trade Commission once again reminds us, those deals often come with strings attached and hollow promises. [More]

FTC Files Lawsuit To Shut Down Deceptive Payday Loan Debt Relief Operation

It’s probably safe to assume that consumers stuck in the payday loan debt-trap have enough financial issues without being deceived by a company promising to make their debts disappear. There may be one less unsavory debt relief company around after the Federal Trade Commission sued to stop an operation that targeted millions of consumers. [More]

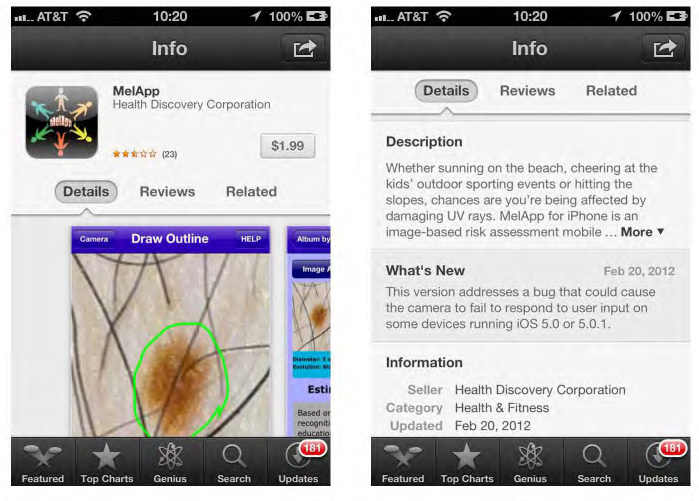

Feds Warn: These Melanoma Detection Apps Aren’t Supported By Scientific Evidence

Early detection of cancer can help save lives and make treatment easier, so the idea of mobile app that can spot possible skin might seem like a godsend… if there were any science to back it up. [More]

Marketers Of Green Coffee Bean Weight-Loss Products Must Refund $9M

By now we should all be fairly familiar with the saga of Dr. Oz, the supposed “miracle” weight-loss benefits of green coffee bean extract, and the Federal Trade Commission’s mission to put a stop to the craze by shutting down marketers and online sellers that created fake news sites, fake reporters and relied on bogus studies to sell the product. The Commission’s work continued Monday when one such company agreed to pay $9 million in consumer redress to settle charges of deceptively marketing the products. [More]