Wiping away private student loans is a difficult, almost impossible task, for borrowers. But some debtors are finding their tabs zeroed out as the result of a long-running legal battle between former students and a group of student loan creditors attempting to collect on defaulted loans. In the end, the courts could forgive up to $5 billion in private education loans if the creditor continues to fail in providing critical paperwork. [More]

debts

States Look To Outlaw ‘Lunch Shaming’ Of Kids Whose Parents Can’t Pay Cafeteria Bill

Schools across the country deploy a variety of humiliation tactics on students whose parents haven’t been able to pay their school lunch bills, whether it’s publicly throwing away perfectly good trays of food or marking students’ hands. Some states and schools say these practices go too far and are adopting laws and policies that don’t punish schoolchildren for their parents’ debts. [More]

Debt Collector Accused Of Taking Money From People Who Didn’t Owe Anything

As part of its ongoing efforts to crack down on unscrupulous debt collectors, the Federal Trade Commission has accused a North Carolina company of running a “phantom” debt collection scheme that went after people for money that they did not actually owe. [More]

Some Schools Shame Students When Their Parents Can’t Pay For Lunch

Shaming a debtor may be an effective — and potentially illegal or unethical — way of getting them to pay up, but should children who have no control over their family finances be publicly shamed if it gets their parents to pay their outstanding school lunch bills? [More]

Education Secretary DeVos Withdraws Protections For Student Loan Borrowers

Relatively new federal guidelines intended to to make the student loan repayment process more accurate and transparent have all been rescinded today by Secretary of Education Betsy DeVos — a move that consumer advocates says removes accountability for debt collectors and loan servicers. [More]

Authorities Shut Down 5 Shady Debt Collectors, Secure $6.5M In Relief

The Federal Trade Commission teamed up with two states to put an end to five unscrupulous debt collection operations that illegally deceived millions of Americans. The actions, made under the “Operation Collection Protection” initiative between federal, state and local law enforcement authorities, represent $6.5 million in relief for millions of consumers. [More]

Man Charged With Operating Debt Collection Scheme That Targeted, Defrauded Spanish-Speaking Consumers

Deceiving consumers is a trademark for most unscrupulous operations attempting to collect debts that aren’t actually owed. Shady collectors have been known to lie about debts, misrepresent themselves as officers of the law, threaten lawsuits and, in the case of one operator, threaten Spanish-speaking residents with deportation. [More]

Local Official Thinks It’s Uncool To Pay $25 Parking Ticket In Pennies, But Affirms Man’s Right To Do So

A Pennsylvania man who was rebuffed when he tried to pay a $25 parking ticket he owed to his borough entirely in pennies should’ve been able to use those coins, a local official said, but really, it was kind of rude for him to do so. [More]

Senators Introduce Legislation To Make Private Student Loans Dischargeable In Bankruptcy

Since 2005, student borrowers have been unable to discharge their private student loans through the process of bankruptcy. But that could soon change after a group of 12 senators introduced a bill aimed at addressing the current student debt crisis by restoring the bankruptcy code to hold private student loans in the same regard as other private unsecured debts. [More]

Is It Time For Regulators To Stab Zombie Debt Through The Brain?

What a lot of people don’t know — and what debt collectors rarely mention — is that most unpaid debt has an expiration date after which you can’t be sued for repayment. And even fewer consumers are aware that this dead debt can be sparked back to life by making a payment after it’s already passed on to the debt afterlife. A new report calls on federal regulators to make sure that debt doesn’t rise from the dead in zombie form. [More]

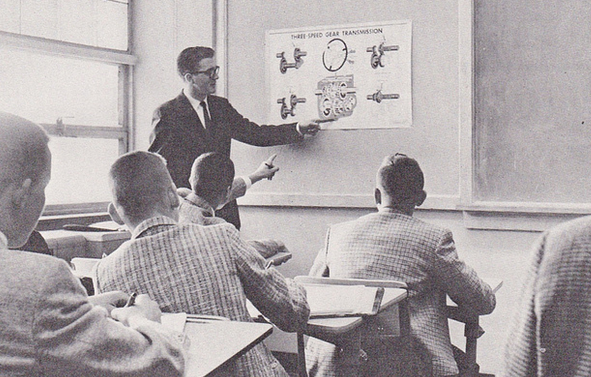

In Vermont, Debt Collectors Can’t Seize Your Goats Or Bees, But Your Car May Be Up For Grabs

Every state has some level of protection for debtors so that they are able to continue living and working while repaying their debts. But the level of protection covers the spectrum from protecting reasonably priced homes, vehicles, and necessary goods, to protections so minimal that the debtors will likely remain in the red, unable to ever climb out of debt. [More]

4 Magical Words Debt Collectors Use To Open Your Pockets

Debt collection is all about mind games. NotSoDeepSouth blogged about the four magical words that he used to use as a debt collector that acted like a crowbar on people’s wallets, getting formerly relcacitrant people to empty out their pockets. [More]

What's My State's Statute Of Limitations On Debts?

One of the first thing you’ll want to check when you get a debt collection notice is the expiration date. No, it won’t be written on the top like a milk carton. But you can check to see when the debt is from. If it’s longer than your state’s statue of limitations on debt collections, they’re unlikely to successfully sue you. Those dates vary by state, so here’s a handy list that gets routinely updated. [More]

Debt Collection Firm Accused Of Setting Up Phony Courtroom

Call it “theater of the real.” A debt collection firm is accused of setting up a fake courtroom, complete with a raised “bench” and judge in black and other decorations and furniture, to trick and holding bogus hearings to extract payment from debtors. [More]

Govt. Notices Rise Of "Debtor's Prisons," Doesn't Like Them

An increasing tool of choice for collection agencies is getting folks thrown in jail for missing “financial assessment hearings,” even when the folks had good reason – like moving and never getting the letter – or the validity of the debt is in dispute. In addition, collectors are requesting forfeited bail to pay off judgement, turning our local jails into de facto debtor’s prisons, and the police into deputized debt collection agents. Now regulators and officials are taking notice, and taking action to curb some of the worst abuses. [More]

PayPal Says Man Owes Nearly $300 For Dispute That He Won

Kentaro already went through a dispute resolution with PayPal for an HTC Droid Eris he sold on eBay. He says the reason for the dispute no longer exists, and anyway, he won and that was supposed to be the end of it. But now he owes $287, according to PayPal. [More]

Verizon Bill Collector Threatens To Blow Up Man's House

A man in New Mexico is suing Verizon Wireless over a series of harassing phone calls made by Verizon bill collectors last year. The man, Al Burrows, says the calls were concerning a relative’s unpaid cellphone bill. When he hung up on one of them, the disconnected Verizon rep called back, said she knew where Burrows lived, and added, “I am gonna blow your mother fucking house up.” [More]