This year, there have been a record number of retail bankruptcies, but there’s also been a change in the industry. While some of the largest recent retail bankruptcies were preludes to liquidation, lenders and landlords are now working to keep as many stores open as possible after bankruptcy. [More]

debt

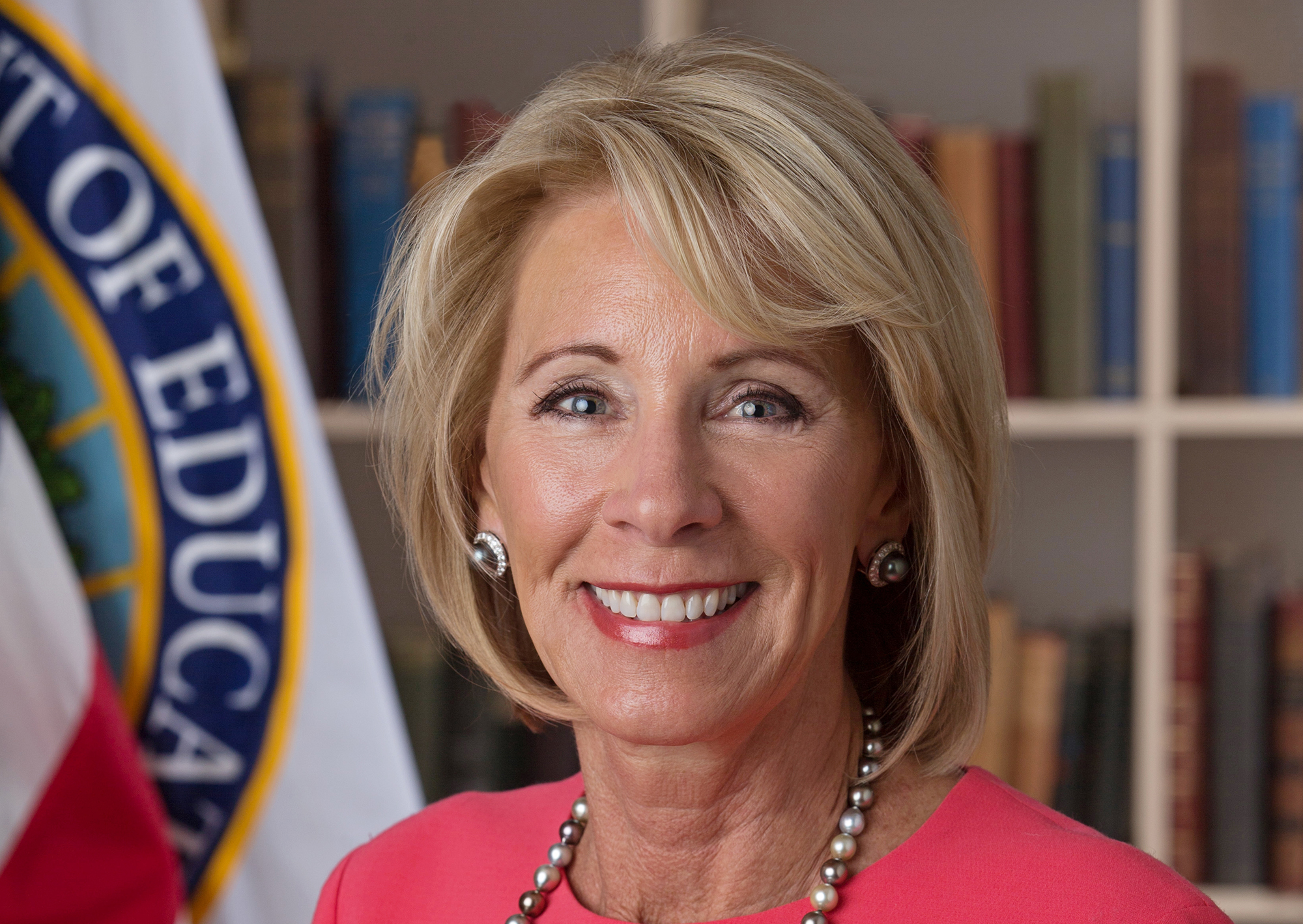

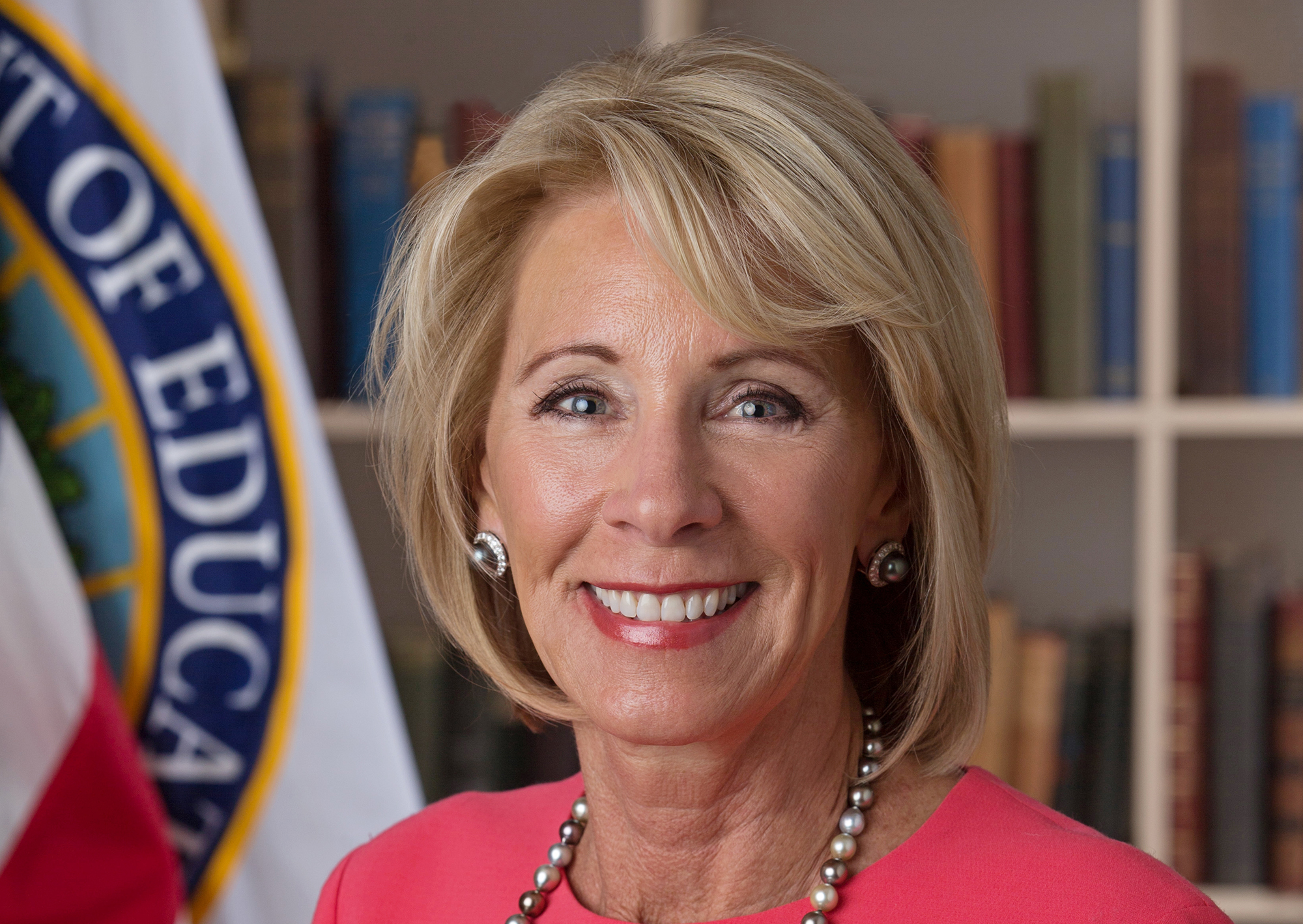

Betsy DeVos Refuses To Work With Consumer Protection Agency On Student Loans

The Department of Education will no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. That’s according to Education Secretary Betsy DeVos, who recently notified the CFPB that her department is ending years of formal cooperation combating student loan fraud. [More]

4 Things LuLaRoe Sellers Say About The Stress & Cost Of Their Job

LuLaRoe, best known as the company behind the lycra leggings that at least six of your high school friends are trying to sell through Facebook, markets itself to freelance “consultants” as a possible pathway to financial independence and stability. But once again, LuLaRoe sellers are coming out of the woodwork to allege that this job is putting stress on their well-being, financially and physically. [More]

Huge Collection Fees Making It More Difficult For Cash-Strapped Students To Afford College

Each year, millions of college students rack up student loans that won’t come due until they leave school. But even with financial aid, some students have trouble keeping up with the soaring costs of tuition, and once that debt ends up in the hands of a collection agency, the amount can mushroom out of control while the student is still in school. [More]

Is A Content Bubble Responsible For Netflix’s $20B In Debt?

You’ve got to spend money to make money. That appears to be the mantra over at Netflix, where the DVD-by-mail service turned mega-streaming outlet has racked up nearly $20 billion in debt expanding its platform to new areas, producing original content, and buying the rights to show other company’s movies and TV shows. [More]

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]

Trump Administration Looking To End Student Loan Forgiveness Program

This October will mark the first time that student loan borrowers who have worked for 10 years with the government or a qualifying non-profit will be eligible to have their debts wiped clean. It may also be the last time, as the Trump administration is reportedly targeting this and other Department of Education repayment programs for elimination.

[More]

The System To Collect Defaulted Student Loans Is No Longer Functioning

Consumers who expected their student loan payments to be deducted from their bank accounts this month have reportedly found the funds untouched, and their calls to the companies unanswered thanks to a Department of Education’s order prohibiting the debt collection companies from working on default accounts in response to two lawsuits against the agency.

Some Schools Shame Students When Their Parents Can’t Pay For Lunch

Shaming a debtor may be an effective — and potentially illegal or unethical — way of getting them to pay up, but should children who have no control over their family finances be publicly shamed if it gets their parents to pay their outstanding school lunch bills? [More]

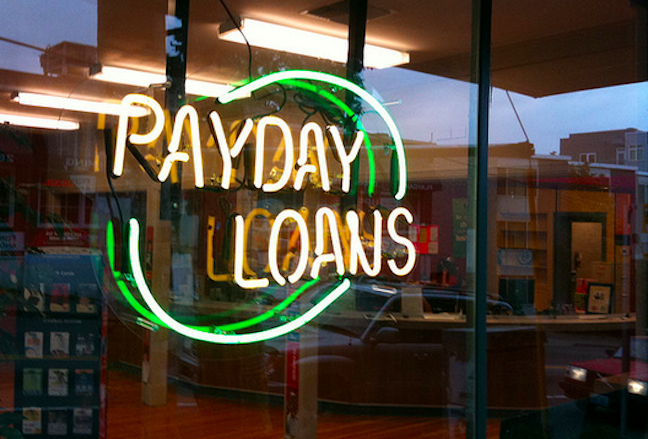

Feds Sue Four Online Payday Lenders For Collecting On Void Debts

Last year, federal regulators released a report that found online payday lenders — despite their clean, professional websites — could be just as bad, if not worse, than their storefront counterparts. Today, the Consumer Financial Protection Bureau provided yet another example of how these companies can wreak havoc on consumers’ finances by skirting the law. [More]

45% Of Americans Carry At Least $25,000 In Debt

If you owe creditors less than $5,000 (not including a mortgage) you’re in a rather small group of Americans with minimal debt. According to a new survey, nearly half the country owes at least $25,000 — and spends as much as half of their monthly income paying down their debt. [More]

Feds Sue Debt Collector That Allegedly Misrepresented Attorney Involvement

Under the Fair Debt Collection Practices Act, it is illegal for debt collection firms to use false, deceptive, or misleading representations to collect a debt. One Ohio company apparently didn’t follow this rule when sending consumers letters that claimed attorneys were involved in the collection of their debts, and now it’s facing a lawsuit from federal regulators. [More]

Data Shows Too Many Americans Being Pestered About Medical Debt They Don’t Owe

What’s worse than being overwhelmed by medical debt after a hospital stay or doctor’s visit? Being told you owe money for healthcare procedures and services you never received. Yet, a new analysis of federal data shows that too many Americans are being pestered to pay off medical debt that they don’t actually owe. [More]

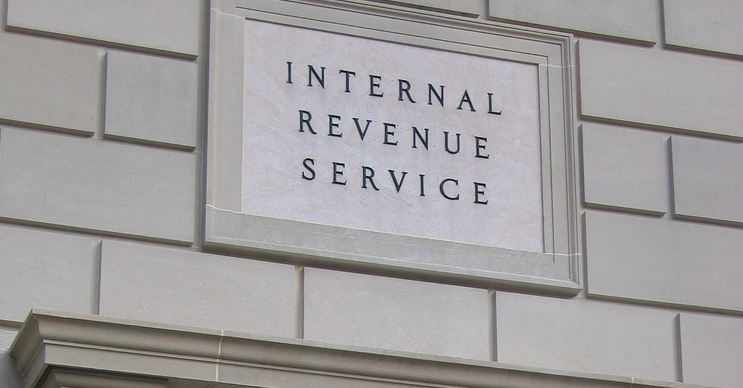

IRS Will Begin Working With Private Debt Collectors This Month

The Internal Revenue Service has released additional details about its new program that turns certain delinquent accounts over to private debt collectors, giving us some idea of when these collection calls will begin, and how many accounts will be affected.

[More]

The IRS Is Now Using Private Debt Collectors; Here’s What You Need To Know

After years of warning taxpayers that the IRS will never cold call you to collect a tax debt, things are about to change as the IRS begins handing over some of its debt-collection work to private firms who probably will call you. [More]

When Education Dept. Said Your Student Loan Would Be Forgiven, It May Not Have Meant It

One way to erase federal student loan debt is to work for the government or at a non-profit for 10 years. However, thousands of people who received notices from the Department of Education that their federal student loans were going to be forgiven through this program may still be on the hook for this debt, as the Department now says these notices are not binding. [More]