The federal government and 11 states have joined together to accuse 30 purported debt relief operations of using deception and false promises to swindle more than $95 million from student loan borrowers. [More]

debt relief

Sketchy Debt Relief Company Accused Of Impersonating Federal Agency

In a sweet case of karma, a debt relief operation that claimed to wipe away consumers’ debt through an affiliation with the Consumer Financial Protection Bureau has been sued by none other than that exact same agency. [More]

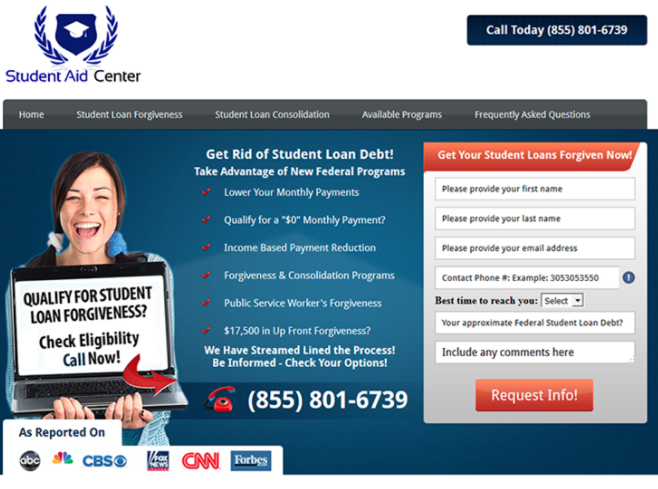

Feds Shut Down Alleged Scam Promising Student Loan Relief & Forgiveness

A federal court has shut down a Florida-based operation that charged customers $1,200 up front and $50/month with allegedly false promises of getting their student loan payments reduced or forgiven, sometimes in the impossible timeframe of only three years. [More]

Feds Shut Down Multimillion-Dollar Debt Relief Scam

A phony debt relief operation that bilked tens of millions of dollars from individuals — including the disabled and elderly — based on the promise it could lower their debt burden is out of business after a federal court temporarily halted the scheme. [More]

Feds Shut Down Student Loan Debt Relief Operation That Collected $3.6M In Illegal Fees

Federal law bars debt relief services from receiving upfront fees before they’ve even renegotiated a single debt for a customer. But one student loan debt relief operation allegedly took in nearly $3.6 million in illegal fees, only to enroll borrowers in programs that are already available for free.

[More]

Debt Relief Company Must Pay $170M For Illegally Charging Customers

Back in 2013, the Consumer Financial Protection Bureau sued Morgan Drexen, accusing the debt relief company of deceiving customers with promises of reducing their debt and charging illegal upfront fees to do so. Today, the Bureau announced a federal district court approved a final judgement requiring the company to pay $132.8 million in restitution and a $40 million civil penalty. [More]

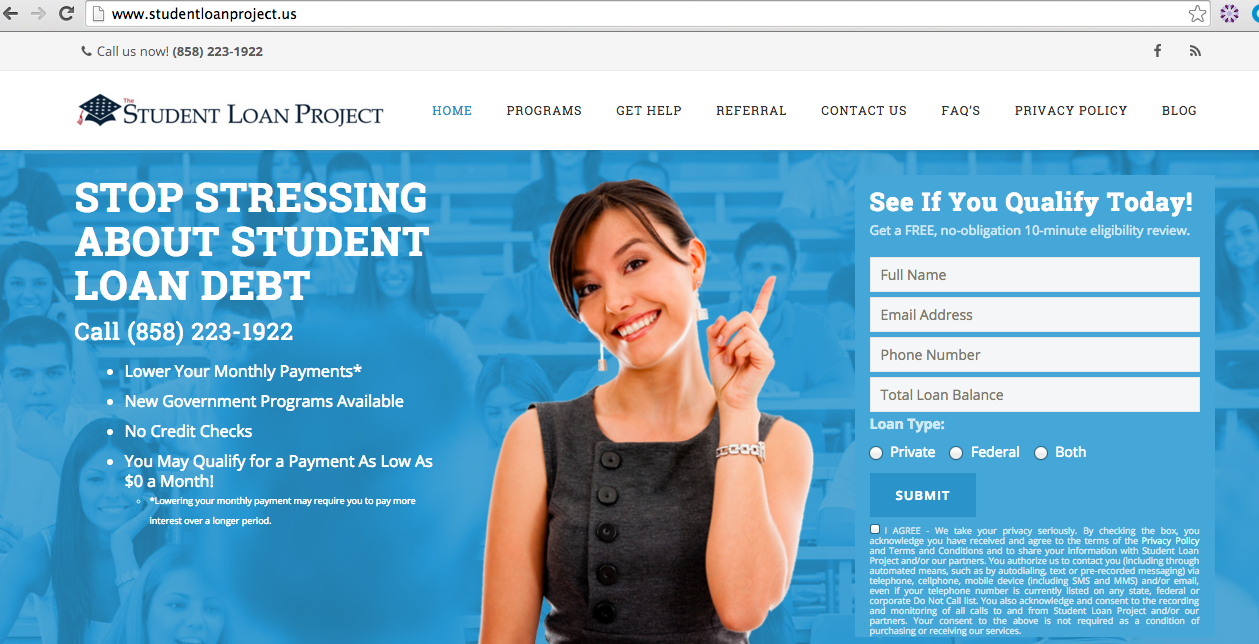

Feds Shut Down Illegal Student Loan Debt Relief Operation

Last December, the Consumer Financial Protection Bureau filed a lawsuit against Student Loan Processing.US, a debt relief operation, that allegedly reaped millions of dollars from thousands of consumer by promising to provide repayment benefits that come free of charge with federal student loans. Today, the agency took steps to put an end to the organization once and for all. [More]

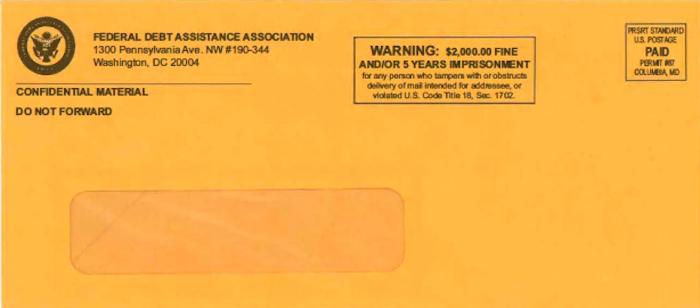

Feds Order Debt Relief Schemes To Cease Misleading Use Of Government Logos

Even though it’s incredibly easy to slap a government agency’s logo on your website, that doesn’t make it okay. Just ask the two debt relief companies that have been ordered to stop using Department of Education logos to mislead student loan borrowers. [More]

Feds Forgive $103M In Debt For Nearly 7,000 Former Corinthian College Students

Nearly 7,000 additional former students of defunct for-profit chain Corinthian College will have their loan debt erased by the federal government. While the $103 million tab sounds like a lot, it’s only a fraction of the billions of dollars that Wyotech, Heald College and Everest University charged in tuition. [More]

CFPB Sues Debt Relief Firm, Alleging It Bilked Customers For $67M

Being in debt can be paralyzing, leaving some people with the feeling like they’ll never climb their way out of the hole. So when a company promises it can help ease that burden, it might some like a good idea to spend even more money in the hope that you’ll ultimately be pointed in the right financial direction. Federal regulators say one debt relief operation took in $67 million from customers in need of help, but most of that money just went to the firm’s fees while the customers’ debts continued to pile up. [More]

Regulators Shut Down Debt Relief Operation That Took Millions From Consumers

The Florida Attorney General’s Office and the Federal Trade Commission make a pretty effective pair when it comes to putting an end to companies and operations taking advantage of consumers. Just a day after the regulator and state’s attorney general teamed up to sue a company behind medical alert robocalls, the two entities announced they shut down a debt relief scheme that took million from consumers with credit card debt. [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

FTC Files Lawsuit To Shut Down Deceptive Payday Loan Debt Relief Operation

It’s probably safe to assume that consumers stuck in the payday loan debt-trap have enough financial issues without being deceived by a company promising to make their debts disappear. There may be one less unsavory debt relief company around after the Federal Trade Commission sued to stop an operation that targeted millions of consumers. [More]

CFPB Takes Action Against Two Alleged Student Debt Relief Scams

Student loan borrowers have enough to worry about, so they shouldn’t have to deal with being hounded by so-called debt relief companies promising to provide consumers with repayment benefits that actually come free of charge with federal loans. Today, the Consumer Financial Protection Bureau took action to put a stop to two such relief scams that reaped millions of dollars from thousands of consumers. [More]