I’m sick of paying ATM fees so I just finished switching to my USAA debit card for my cash money needs. They refund up to $15 of ATM fees per month and don’t charge you any fees for using other people’s ATMs. I’m still keeping my WaMu account but I took my WaMu debit card out of my wallet and just funded my USAA account with some money. Not that I have a problem but I think this will also help reduce petty cash spending. Plus, by using cash more often that means I’m getting more change, and all my coin change goes into my piggy bank (60% full at the moment, looking forward to the day I take it to the Commerce Bank “Penny Arcade” coin-counting machine). With the specter of a recession giving us all wet willies, are you making any changes to your personal finance system?

debit cards

Bank Of America Stranded Me In Japan Without Cash On My Honeymoon

Before leaving for his honeymoon, Derek called Bank of America to make sure he could rely on his debit card while he was in Japan. Bank of America assured him that he would have no problem accessing money. Yet on the third day of his honeymoon, neither he nor his wife could draw cash from their cards, stranding them with only $15 in cash.

Bank Of America Won't Let You Access Your Money

Silly Bill. He thought Bank of America would let him spend $5,800 on a home theater system just because he had over $10,000 in the bank. He tried to charge the system to his Bank of America Visa Platinum Check Card but was declined. Confused, Bill called Bank of America customer support for an explanation and had the sort of conversation that makes you want to drive a fork through your ear.

Is HSBC Straining Under An "Unprecedented" Wave Of Fraud Activity?

If you’re an HSBC customer, check your account, as there may be a wave of fraudulent activity hitting your bank. Two days ago we wrote about the guy in the U.S. who discovered his account had been drained by someone in Bulgaria. Later that day we received an email from Emily in NYC who was having similar problems, only her fraud-buddy was in California and Canada making withdrawals on her account.

Emily’s fiancé wrote back to us today with an update, and according to Emily, the HBSC Fraud Investigator who spoke to her “said that their fraud department was so overwhelmed, it was ‘still in the developing stage of how we’re going to handle’ it. I asked if she knew how many customers were affected and she stated ‘We don’t even know.'”

Dear Sur La Table: It Has Been 42 Days Since You Stole $100 From My Bank Account

Rachel used a $100 gift card to pay for her Christmas gifts, but Sur La Table decided to take the funds directly from her debit card. Sur La Table apologized for the error, but instead of overnighting Rachel a refund check as promised, they inexplicably charged her an additional $31.89. Now Rachel is angry and wants an explanation.

../../../..//2008/02/01/heres-a-horrible-idea-a/

Here’s a horrible idea: a 401(k) program with a debit card. That’s right, you can go to the ATM and make withdrawals from your 401(k) retirement savings plan. [TheStreet]

Walmart's Debit Card Has Lots Of Hidden Fees

Great idea, tap into the “unbanked,” and then rip them off. Here’s an even better idea for potential Walmart Debit Card users: cash! No fees!

"Major Retailer's" Data Breach Results In Wave Of Credit Card Fraud?

Anecdotal evidence suggests that a recently reported data breach by an undisclosed “major retailer” has resulted in a jump in consumers having their debit cards forcibly reissued, or calls from their bank to verify their recent purchase history. The problems seem to have started just around Christmas time and have continued into mid-January.

Thief Buys $812.28 In Shoes Using Personal Finance Columnist's Stolen Identity

A Washington Post personal finance columnist got her identity stolen and someone tried to use it to buy $812.18 worth of running shoes. Somehow, the thief had gotten access to the Nancy Trejos personal information and stolen her Bank of America debit card number. The crook placed an order online with the store and arranged for an in-store pickup. The clerk grew suspicious when the woman couldn’t produce the card used to place the order.

../../../..//2007/11/16/always-scrutinize-your-bills-us/

Always scrutinize your bills: US Bank charges customer 25 cents every time she buys stuff with a debit card and punches in her PIN. The fee applies to US Bank customers in Colorado, Indiana, Kentucky, and Ohio. [Red Tape Chronicles]

Credit vs Debit

What’s better, debit or credit? Red Tape Chronicles examines the pros and cons. For our money, debit cards are better for controlling spending, but credit cards protect the buyer better, much better, and so we use debit cards to withdraw cash from ATMs and credit cards for transactions.

Check Credit Card Statements For "STC SAWA RECHARGE RIYADH SA"

Check your credit card and debit card statement for unauthorized charges from STC SAWA RECHARGE RIYADH SA. The Saudi Arabian phone card company is fraudulently passing charges to consumer’s cards, usually for sums of $80. If you find one of these unwanted charges, contact your card company to dispute the charges. This may not be enough, as consumers report being the charges hitting their cards multiple times, even after reporting them. In these cases, it may be better to cancel the account.

iCache Is The Credit Card To Control All Credit Cards

Like using different credit cards for different rewards programs but get tired of the bulk? Enter the $99 iCache, an electronic device as thin as a Razr cell phone, that carries all of your credit cards in the writer portion, and then temporarily writes the credit card info onto a card. The card is good for one swipe and then the card goes blank again and ready to be rewritten. The unit is protected by a fingerprint scanner.

Apple Debits Money From The Wrong Account, Now You Can't Pay Your Mortgage

Julie would really like to pay her mortgage, but she can’t. Why not? Because when she tried to help her son buy a MacBook, Apple decided to debit $1517.27 from her account without permission. When she called to tell them they’d pulled the money from the wrong card, causing her account to over draft, they apologized and told her they’d fix it. Instead, they debited another $186 from Julie’s account, and another $1517.27 from her son’s account.

House Subcommittee Taking A Look At Unfair Overdraft Fees

US PIRG blog tells us, “Chairwoman Carolyn Maloney (D-NY) of the House Subcommittee on Financial Institutions and Consumer Credit is holding a hearing today on unfair bank overdraft fees and their impact on consumers, especially in regard to debit card transactions.” Chairwoman Maloney has introduced a bill that addresses overly-punitive fees that are often assessed when a consumer buys a small amount on a debit card. As US PIRG points out, “It’s much easier to overdraw your (debit) account. A debit card gives you a latte if you have no money. A latte costs $5 but the bank gets a $30 overdraft.”

How Frank Abagnale Protects Himself From Identity Theft

How does Frank Abagnale, an infamous check forger in the 60’s, protect himself from modern day identity thieves?

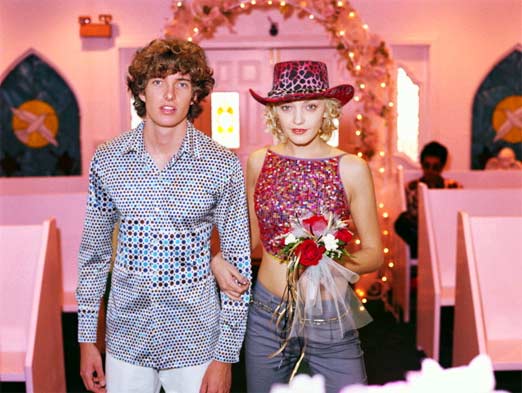

Eloping Nearly Ruined By Bank Blocking The Entire "State" Of Las Vegas

I know a lot of your readers believe that local, mom and pop operations are the way to go — that big corporate companies are universally evil and local is almost always filled with nice, smiling workers who are far superior to their sell-out counter-parts. I’m here today to show you that, at least in banking, size doesn’t matter.