There are a lot of personal things you might want to know about someone you date — relationship history, medical/psychological issues, allergies, political leanings, job prospects, any legal concerns just to name a few — but rarely do we look at a potential spouse and think, “I wonder if their credit score was wrecked by a $10,000 gallbladder surgery bill from when they were 21 and between jobs.” [More]

credit score

Poor Credit Reports Start Vicious Economic Cycle; Can It Be Stopped?

For some people, bad credit is a result of being irresponsible. For others, it’s a matter of bad luck and overwhelming circumstance. Alas, the credit reporting agencies don’t make such distinctions, meaning someone whose house went into foreclosure because he lost his job and also had to be hospitalized is treated the same as the person who stopped making mortgage payments because they didn’t feel like it. [More]

This Valentine’s Day, Tell Congress You’d Really Love Access To A Free, Reliable Credit Score

While the three major credit bureaus each allow you to access your credit report once a year at no charge through annualcreditreport.com, getting your actual credit score will likely cost you some money. [More]

5 Myths About Your Credit Score

How one’s credit score is computed is to most people a complete mystery, akin to figuring out a quarterback’s passer rating. Thus, there are numerous myths and half-truths that have attached themselves to credit scores, some of them having at least a partial basis in fact. [More]

How Long Should Paid-Off Medical Debt Be Part Of Your Credit Report?

Right now, any medical debt that gets sent to a collections agency can remain on your credit report for up to seven years, even after it’s been paid off. This ding on your credit score can be the difference between qualifying for a loan or being denied. That’s why the House Committee on Financial Services is looking at a bill that would erase some paid medical debts from folks’ credit reports. [More]

Is A Perfect Credit Score of 850 Even Possible?

A perfect credit score of 850 is technically possible, according to FICO spokesperson, Craig Watts but may not be possible for anyone. [More]

FTC Wants Your Input On How To Improve AnnualCreditReport.com

The problem with annualcreditreport.com—other than its name—is that getting your reports from the site is a little like dealing with GoDaddy: you have to deal with upsells and side-sells at every step. You can indeed get your free credit reports from the site, but you’ll also have to keep turning down other offers from the three participating bureaus. Hell, there are even ads (sorry, “sponsor” links) on the home page, the one place where you’d hope for the least consumer confusion.

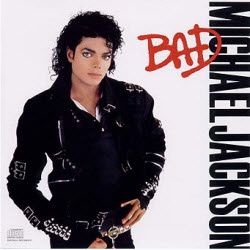

Michael Jackson Had Bad Credit

It was apparently the least of his problems, but the late King of Pop had less than stellar credit, says TMZ.

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

Laid Off? You May Be Asked To Pay Off That Corporate Credit Card Anyway

Rob lost his job, but kept the company credit card. Well, not so much the card, but the unpaid balance that went with it. As Rob’s employer stopped cutting him paychecks, it also stopped making payments on the account as well, and the creditor started hounding Rob, who wrote in to syndicated columnist Todd Ossenfort.

How Credit Bureaus Correct, Or Fail To Correct, Errors On Your Report

SmartMoney’s Anne Kadet looked into the process by which the three major credit bureaus—Experian, TransUnion, and Equifax—investigate and correct errors on credit reports. What she found was that the process is “almost entirely automated,” and that “many lenders respond by simply rereporting the erroneous data.” Here’s how it works, and your meager options when something goes wrong.

../..//2009/02/02/looking-for-a-quick-estimate/

Looking for a quick estimate of your credit score? CreditCards.com has a simple questionnaire that will give you an idea where you probably stand. [CreditCards.com]

Can Businesses Really Check My Credit Report Before Offering Me A Job?

Reader Brandon wants to know if those freecreditreport.com commercials are being misleading when they tell you that your credit report can affect where you get a job.