Medical bills account for nearly half of all collections notices on consumers’ credit reports, affecting more than 43 million Americans. Meanwhile, it’s been shown that medical billing is fraught with errors and many consumers sent to collections for these debts are penalized too harshly. A new federal requirement hopes to reduce this overly negative impact of medical debt on credit reports. [More]

credit reports

Why Does Negative Info Linger On Your Credit Report For Up To 7 Years?

Credit-related mistakes can follow you link a stink you can’t wash off. Have an account go into collections, miss payments on your student loans, credit cards, mortgage, car loan, and that info can linger on your credit report for up to seven years, even if it’s just a fluke. This is particularly a problem with medical debt, where even someone with otherwise pristine credit is unable to pay a huge hospital bill. So why is seven years? [More]

Man Named God Suing Equifax For Refusing To Believe He (And His Financial History) Exists

As if it’s not hard enough to go through life explaining why you share a name with a divine entity, a man called God is now suing credit-reporting agency Equifax claiming it refused to accept his name as a legitimate moniker. Basically, he’s trying to prove he exists. And along with that, of course, his credit history is also a real thing. [More]

New Legislation Aims To Ensure Accurate Credit Reports, Provide Free Credit Scores

Even a small inaccuracy on a consumer’s credit report can have long-lasting negative affects. From the most simple computer error to mixing up individual’s data, credit reporting agencies have been known to be hard to work with when trying to fix incorrect data. But that could all change under legislation introduced today that aims to ensure issues like these don’t happen. [More]

No Surprise Here: Credit Reports Created With Your Online Information Are Mostly Inaccurate

More than 64 million Americans are cut off from access to traditional banking because they lack credit history. To better serve these unbanked consumers financial institutions are relying on the promises of big data brokers to accurately determine the creditworthiness of consumers. But is the new method a reliable way to provide affordable access to credit? Not really, a new report by the National Consumer Law Center points out. [More]

Dear Equifax And Heartland Bank, I Am Not Dead

A 46-year-old woman near St. Louis would like to to refinance her mortgage and maybe get some new credit cards. She can’t, though. As far as her bank and the credit bureau Equifax are concerned, she’s dead. [More]

How To Not Suck… At Disputing Credit Report Errors

Like it or hate it, your credit report and credit score have lots of power. These may determine whether or not you’re approved for a mortgage, car loan, or other borrowing, and will determine the interest rates on your credit cards. This information is often even used when you’re evaluated for an apartment, insurance or a job, or try to get a bank account. That’s why it’s incredibly important to check your credit report for errors, as mistakes on your report can haunt every part of your financial life for years. [More]

Credit Report Wrongly Says Man Is Convicted Felon, Forces Him To Prove Innocence

How do you prove you didn’t commit a crime if your accuser won’t tell you which crime you’ve been accused of committing? That’s the problem facing a New Jersey who has spent months trying to convince a shady credit reporting company that he is not the criminal that is showing up in their records. [More]

Companies That Furnish Info For Credit Reports Are Obligated To Investigate Disputes

More than 1-in-4 credit reports contain some sort of error, according to a recent Federal Trade Commission report, but one can’t lay all the blame at the feet of the three major credit bureaus — Experian, TransUnion, Equifax — as the companies that supply this information are not always fulfilling their legal obligation to investigate disputes by consumers. [More]

Jury Awards Woman $18.6 Million In Battle With Equifax Over Credit Report Errors

There’s major consumer victory news from Oregon: a woman who discovered huge errors in her Equifax credit report and couldn’t get them fixed was awarded a total of $18.6 million in damages. She contacted Equifax eight times about the errors between 2009 and 2011, but they remained on her report. [More]

Young Adults Not Eager To Take On Piles Of Credit Card Debt For Some Reason

Everyone has that one relative who was an adult during the Great Depression and hid boxes of cash all over the house because they didn’t trust banks. Someday, your own descendants might share tales of weird old Aunt Mykayla, who entered the workforce during the Great Recession and refused to get credit cards or even buy a car. [More]

Legislation Would Give Consumers 120 Days To Resolve Medical Debts Before Dinging Credit Reports

Consider the following: 1-in-10 insurance claims are processed incorrectly; debt collectors are using account information that may be incomplete, inaccurate and out-of-date; once reported to a credit bureau, medical debt — whether real or erroneous — can do severe damage to your credit score. Perhaps it couldn’t hurt to give consumers a chance to challenge or resolve medical debts before collectors report them to the credit bureaus? [More]

How Bad Credit Keeps People Unemployable, And Why It Shouldn’t

Here’s the thing with credit histories: it’s easy to fall behind on your bills when you don’t have a job. The reduced income (or total lack of income) really works against you. While half of all companies report that they check the credit reports of at least some prospective employees, there isn’t really any solid evidence that correlates bad credit with being a bad employee. [More]

Green Billing At Macy’s Is Costing Me Lots Of Green

Robert and his wife aren’t poor: they’re currently in the process of buying a vacation home. His wife opened up a Macy’s credit card in order to get an additional discount, because yay for discounts! Robert set up “green” or paperless billing after gaining online access to the account, but it turned out to be more like billess billing: they never saw any bills. Should they have noticed that no bills were coming and checked their spam folders? Maybe. But no bills came. [More]

Consumerist Readers Make The Case For Wiping Paid Medical Debt From Credit Reports

It’s a nightmarish scenario — you pay your credit card bills, car payments and loans all time, but when your credit report arrives… WHAM. Medical debt rears its ugly head and mucks up your life in a real way — even if you pay it. After hearing from one Consumerist reader who was shocked to discover a major dent in his credit score because of one $72 hospital bill, we asked for more stories from our readers to highlight what a very real problem this is. [More]

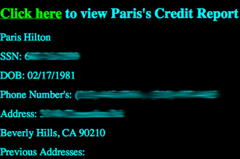

It’s Scary How Easy It Was To Perform The Celebrity Credit Report “Hacks”

Yesterday someone released the private information of more than a dozen celebrities online, posting their phone numbers, mortgages, and Social Security numbers. Although the word “hack” has been used, it’s a surprisingly very easy process to go from a city’s mortgage registry to a plethora of other personal information. We’ll let Buzzfeed explain. [Buzzfeed] [More]