Even Uncle Sam needs to make his payments on time or risk taking a hit on his credit rating. Moody’s is reviewing the U.S. government’s Aaa government bond rating, and could downgrade it if government gridlock fails to raise the federal debt ceiling. The government has reached its $14.2 trillion debt limit and lacks congressional authority to borrow more to pay its bills, according to the Treasury Secretary, starting Aug. 2. [More]

credit rating

Moody's Could Downgrade U.S. Government Bond Rating If It Misses Debt Payments

Ways You Can Screw Up Without Messing Up Your Credit Score

Your credit can determine interest rates for loans, as well as whether or not you’ll qualify for credit in the first place. Employers also ask you to let them run credit checks on you to see if you’re reliable. So it’s in your best interests to avoid making mistakes that will ruin your credit rating. [More]

Wall Street Hoped They'd Be "Wealthy And Retired" Before The House of Cards Fell

If you’re wondering why all these supposedly smart people bought bullsh*t securities made up of pools of overpriced mortgages given to broke people with crap credit — it’s time for you to meet the rating agencies. Rating agencies are the folks who decide the “quality” of investments. They’re the ones who decided that these securities deserved a AAA (read: awesome) rating. Did they know that they were passing junk off as gold? Um, yeah, according to reports from Bloomberg and the New York Times. It looks like they sorta did.

5 No BS Ways To Get A Credit Score For Free

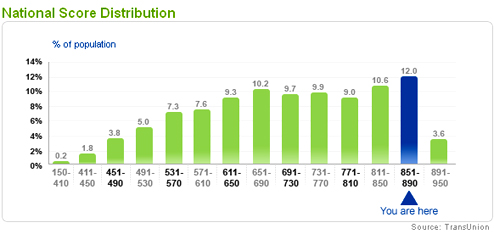

Here are 5 ways to get your credit score for free. Note, all of them are the credit scores developed by the credit bureaus themselves, Experian, TransUnion, and Equifax, and are not your actual FICO scores. Only the FICO score is used by lenders to determine your credit worthiness. However, you can at least use these credit bureau scores to get a general sense of how good your credit is. [More]

How To Improve Your Credit Score With Department Store Credit Cards

A worker in the credit industry, Derek, gave us some tips to help young Paul boost his access to credit so he can live his American Dream.

20 And No One Will Give Me Credit, What's Up?

Paul is chasing the American Dream, looking to buy land and build a house on it in the next few years. He works hard, pays his bills on time, and has a good credit rating, but no one will actually give him any credit.