As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

credit crunch

American Express Judges You Based On Who Holds Your Mortgage, Where You Shop

Has your credit limit been inexplicably lowered lately? Well, it might not be anything personal. The problem might be with your mortgage lender. Or where you’ve been shopping. Or where you live. American Express, long rumored to judge customers based on this criteria, has admitted that it evaluates who you do business with and where you live when determining how much credit to give you, says MSNBC.

Lehman Brothers CEO Got Punched In The Face

Dick “It Wasn’t My Fault” Fuld, the CEO of bankrupt investment bank Lehman Brothers, (seen here being heckled after testifying on Capitol Hill) was apparently punched in the face while working out in Lehman gym on the Sunday following the bankruptcy, according to CNBC’s Vicki Ward.

What Is Commercial Paper And Why Is The Federal Reserve Suddenly Buying It?

The Federal Reserve today announced the creation of something called the Commercial Paper Funding Facility (CPFF), that will buy commercial paper directly from issuers. So, you’re asking yourself, what is commercial paper? Why do I care that the Federal Reserve is buying it?

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

American Express Randomly Cut My Credit Limit From $25,000 to $1,800

Reader Pierre is a small business owner who has an American Express Business Account that used to have a $25,000 limit, but has now been cut to $1,800. He says his company’s bill is usually around $12,000 a month, and it is always paid in full — on time. While Pierre is clearly upset with American Express, the Wall Street Journal says that all banks are cutting access to credit.

What To Do In These Uncertain Financial Times

The housing crisis. The stock market plunge. The banking industry in shambles. What’s a person to do in the midst of all this financial turmoil? We thought we’d offer our suggestions for making it through the rough waters many of us are facing:

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

../../../..//2008/09/10/now-that-the-magic-accounting/

Now that the magic accounting party is over, Fannie Mae and Freddie Mac are to be removed from the S&P 500 starting Wednesday. The minimum market cap a company needs to be allowed in the index is 5 billion. Freddie’s market cap is $614 million and Fannie’s $1.04 billion. [AP]

../../../..//2008/08/27/fdic-chairs-assessment-of-the/

FDIC chair’s assessment of the banking situation: worse and getting worser. [NYT]

FBI Saw Mortgage Crisis Coming, Didn't Stop It

The LA Times says that FBI agents told reporters that low interest rates and “soaring home values, [were] starting to attract shady operators and billions in losses were possible.” According to the report, Chris Swecker, the FBI official in charge of criminal investigations, told reporters that the FBI thought it was going to prevent a crisis similar to the S&L debacle.

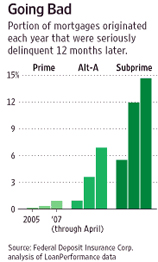

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

Homeowners In Denial: Everyone's House Is Worth Less Except Yours

According to a new survey from Zillow.com, Americans are totally out of touch with reality when it comes to their homes. 62% of homeowners surveyed said they thought their homes had appreciated in value over the past year. In fact, only 19% of homes in the US increased in value, and 77% actually decreased in value. (5% stayed the same.)

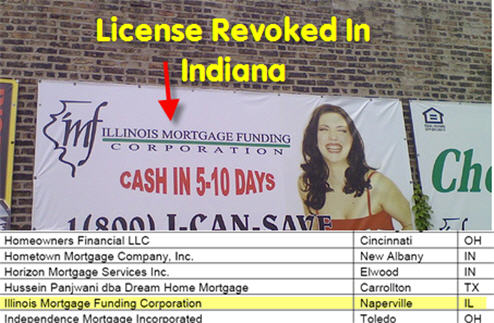

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?

U.S. Foreclosures Double: 1 in Every 171 Households Affected

Hmm, wasn’t this housing bubble crap supposed to be slowing down? Guess not. The foreclosure numbers for last quarter are twice as bad as last year according to the new numbers from RealtyTrac (a firm that tracks foreclosure filings.) 1 in every 171 households nationwide was foreclosed on, received a default notice or was warned of a pending auction in the second quarter of 2008. Bloomberg says this is an increase of 14% from last quarter and an increase of 121% from this time last year.

Credit Crunch CEO Bloodletting Claimes Latest Victim: Wachovia's Ken Thompson

Just when you thought it was safe to go back in the water… Wachovia CEO Ken Thompson has been gobbled up in a subprime shark attack after 32 years with the company.

Subprime Meltdown Driven By Nouveau Riche Countries With Too Much Money And Nowhere To Put It

The fuel and engine for the sub-prime mortgage meltdown and the credit crunch was Allen Greenspan and the doubling of the global monetary supply, according to the This American Life episode “The Giant Pool of Money” I just got around to listening to. Basically, a bunch of poor countries got rich all of a sudden selling TVs and the like, and in 6 years, doubled the worldwide supply of money. The giant pool of money was hungry for places to invest itself.