A big part of one’s psychological development is building an individual identity that is distinct from one’s parents. So it’s a bit of a setback for Yuriy when Amex has him confused with his mother. He has an Amex card that’s attached to his social security number, but somehow his mother is the legal name on the account and the statements are addressed to her. Dealing with customer service has been fruitless. Is Amex trying to induce a Psycho-esque syndrome in Norman, er, I mean, Yuriy? [More]

credit cards

Got An HSBC Credit Card? It Will Soon Be A Capital One Card

Two months after upsetting ING Direct customers by agreeing to buy the online bank for $9 billion, the Capital One vikings/barbarians have announced a deal to purchase HSBC’s credit card division for $2.6 billion. [More]

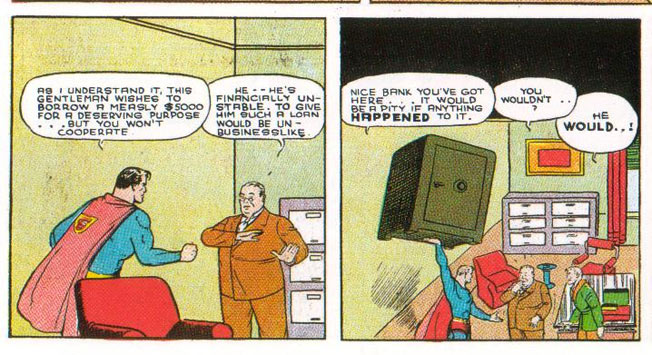

Stupid Things People Do With Credit Cards

Credit cards are rectangular Pandora’s boxes, unleashing the potential for torment in your financial life, as well as possible salvation. Undisciplined or desperate credit card users often get themselves into ludicrous jams. [More]

Get $15, $30, Or $60 In Chase Credit Card "Payment Protection" Class Action

You’re eligible to claim cash if you had a Chase credit card and got charged for a payment protection product between Sept 2, 2004 and Nov 11, 2010, thanks to a recent class action settlement. [More]

Bank Of America Opens, Closes Credit Card Customer Never Applied For

As a wee baby consumer, Kodi’s parents taught her that credit cards are terrible things that she should avoid. She did her best, avoiding credit cards, but wasn’t able to stay away completely. Not because of any failure of her willpower, but because somehow Bank of America applied for and obtained a credit card on her behalf without her asking for it–or even knowing about it. [More]

If The Debt Ceiling Isn't Raised, You'll Pay For It On Your Credit Card

The game of political brinkmanship over the debt ceiling isn’t just an abstract battle of wills. If it isn’t raised, you can expect that your credit card interest rate surely will be. [More]

Americans Actually Trying To Pay Down Credit Card Debt

From 2004 to 2008, while we all were busy flipping houses and blindly investing in luxury condo developments in Appalachia, credit card users were also spending $2.1 billion more in purchases than they were in bill payments. Since 2009, that tide has turned drastically. [More]

Would You Use Your Webcam To Pay By Credit Card?

We’re going to assume that most of you have made some sort of credit card purchase via an online vendor. We’re also going to assume that most of you did so by typing in your credit card number. But new technology is on the horizon that will let users pay by simply holding up your credit card to your webcam. [More]

CFPB Launches Credit Card Complaint Portal

Yesterday, the Consumer Financial Protection Bureau finally took down its “Coming Soon” sign and hoisted the “Open For Business” banner. And as part of its grand opening celebration, the CFPB kicked things off with the launch of its credit card complaint portal. [More]

American Express Amazes Family After Cardholder's Death Abroad

Let’s travel back in consumer history to 1989, a time before widespread Internet access, when she shopping and financial landscape was recognizable, but still different from what we deal with today. One thing that doesn’t change is that true “Above and Beyond” service leads to customer loyalty, and reader Margaret remains loyal to AmEx because of how they came through for her family in a time of crisis and grief. [More]

FDIC Scrutinizes Discover's "Payment Protection" Plan

The FDIC is looking into Discover over concerns that they deceptively marketed their “payment protection plan” for their credit card. Under the plan, if you were experiencing hardship you could put payments on hold for up to two years. Sounds great, but buried in the fine print was that you would end up paying a 10.5% monthly fee for the pleasure of doing so. [More]

6 Reasons To Live A Cash-Only Life

With every story we write about increased credit card fees, slashed rewards programs or hacked bank databases, a growing number of readers have expressed a growing interest in ditching their plastic and going cash-only. [More]

Beware These Credit CARD Act Loopholes

Protections offered by the Credit CARD Act of 2009, which demanded more transparency and established tighter rules for credit card companies, have left some loopholes that expose users to potential exploitation. Credit card-offering banks, which rarely miss an opportunities to use credit to manipulate customers, are taking advantage of the law’s shortcomings. [More]

Denied For A Credit Card Or Loan? Lenders Will Soon Have To Show You Your Credit Score & More

If you’ve ever been turned down for a credit card, auto or student loan — or maybe your application was accepted but you didn’t get the best interest rate — and wanted to see a copy of the actual credit score used in the lender’s decision-making process, you were probably out of luck. But starting July 21 lenders will be required to show you the score. [More]

Banks Use Your Shopping Info So They Can Send You Targeted Coupons That Make More Money For The Banks

The banks of America recently pitched enough of a hissy fit to effectively neuter swipe fee reform — after they raised rates, instituted fees and canceled rewards programs — claiming they’d be swiped into the poor house by the reduced fees. But not to worry, bankers are a clever folk and they always have a way to profit off your transactions. Like, for example, colleting information about your shopping habits. [More]

Capital One Sends You Over 20 Credit Card Offers In 3 Months

One after another, they keep popping up at his door. Brad didn’t ask for them and doesn’t know why they’re there. Over 20 have showed up in the past three months. Sometimes three of the little envelopes of annoyance appear a week. They’re credit card offers from Capital One, who seem keenly desperate to acquire Brad. Each of them gets sneakier and sneakier with fewer identifying marks on the outside until they almost look like regular mail from a real person. However, “What’s really been accomplished,” writes Brad, “is I now have a strong opinion about a brand that I never previously cared about either way.” [More]

Chase Drops Thousands Of Debt Collection Cases Against Borrowers

Chase is dropping thousands of pending debt collection cases against defaulted credit card borrowers, WSJ reports. Remember the big deal over robo-signing foreclosure cases a few months ago? The problem of bulk signing sloppy paperwork, and, in some case, filing fraudulent documents, could be even bigger when it comes to credit cards. It looks like JP Morgan Chase is trying to get its house in order before they’re forced to by government and legal forces. [More]

Which Credit Card Companies Do The Best At Keeping Your Data Safe?

According to the Identity Theft Resource Center, there have already been 216 credit card data breaches in 2011, including the Citi hack that resulted in $2.7 million of stolen funds. And while the number of breaches is down from 333 during the same period of time from last year, the security of our credit card information is still a big concern. [More]