Even in an age when everyone has Caller ID on their cellphones and landlines, when more than 200 million numbers are listed on the national Do Not Call Registry, our phones are still inundated with unwanted auto-dialed and prerecorded calls. And though state and federal regulators regularly shut down illegal telemarketing operations, it can seem like a game of Whac-A-Mole, with new robocallers popping up to replace the old ones. [More]

consumers union

Provision In Highway Funding Bill Would Require The IRS To Use Private Debt Collectors

While federal regulators continually work to crack down on private debt collectors that utilize unsavory, illegal tactics to make consumers pay up, government agencies often contract these entities to collect a variety of debts. That practice could continue if a provision in the Highway Trust Fund Bill receives approval. [More]

New Campus Banking Rules Hope To Protect Students From High Prepaid & Debit Card Fees

Back in May, the Department of Education proposed rules to govern college prepaid and debit cards in order to afford students proper protections from excess fees and other harmful practices. Fast forward five months, and those rules have are now finalized. [More]

Lawmakers Introduce Legislation To Curtail Surprise Medical Bills

There are good surprise and there are bad surprise. Falling into the latter category are unexpected medical bills, which affect nearly 30% of privately insured Americans. This week, lawmakers took steps to shield consumers from these often burdensome tabs. [More]

Consumer, Privacy Groups Urge Federal Regulators To Investigate T-Mobile/Experian Hack

A week after Experian revealed that hackers stole personal information for around 15 million consumers from a database of T-Mobile customers and applicants held by the credit reporting agency, a group of 25 consumer and privacy advocates are demanding that federal regulators open an investigation into the breach.

[More]

Countless Consumers Are Paying Off Someone Else’s Debt Because Of Default Judgments

Imagine receiving a phone call that 25% of your wages are going to be garnished because of a credit card account opened 14 years earlier that was never paid off. Making things worse, you know you didn’t have a credit card from the bank in question at that time, so it can’t possibly be your debt. This should be an easily remedied error, but not if a court has already granted a default judgment against you, making you responsible for paying back money that you didn’t owe and didn’t find out about until it was too late. [More]

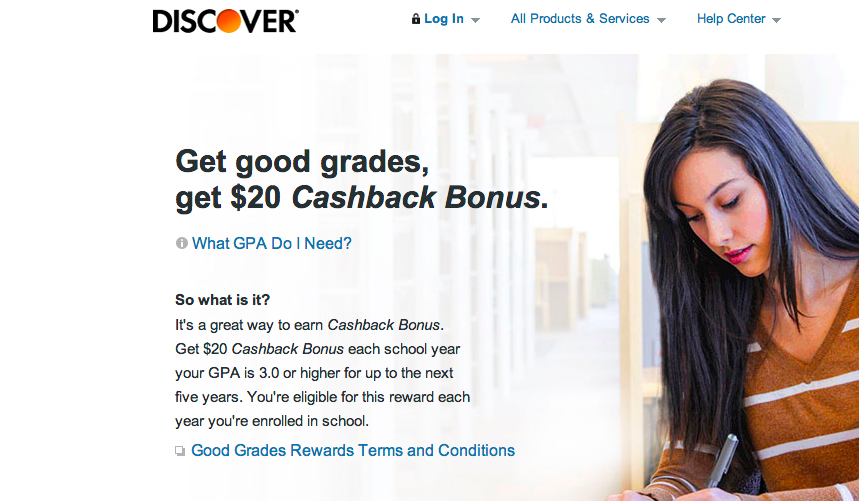

Discover Card Program Rewards Students Who Get Good Grades. Is That Legal?

Not so long ago, many college campuses regularly played host to credit card company shills, giving away T-shirts and pizzas to students in exchange for filling out account applications. Then the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 put an end to most of these practices, leading card issuers to devise new ways to market directly to the under-21 crowd. [More]

When Comparing Colleges, It Would Help To Know If A School Is Under Investigation

Many consumers thinking of pursuing a higher education weigh the pros and the cons of a specific college: tuition, convenience, available areas of study. Last month, the Department of Education announced it would make the college shopping experience a little easier for prospective students by creating a consumer-facing online college comparison system. While the tool will no doubt be helpful, consumer advocates warn that, as it stands, the system will be missing a vital information: whether or not schools are party to investigation, lawsuits or settlements over harmful and deceptive practices. [More]

SCOTUS Ruling Means Millions Of Americans No Longer At Risk To Lose Health Insurance Subsidies

The Affordable Care Act scored a major victory today as the Supreme Court upheld provisions allowing the government to provide tax subsidies for consumers who purchased insurance through the program, although their states don’t have an official insurance exchange of their own. [More]

Groups Call On Subway’s Sandwich Artists To Use Antibiotic-Free Meat In Their Masterpieces

With major fast food chains like McDonald’s, Chick fil-A, Chipotle, and Panera all now sourcing at least some meat that wasn’t raised using medically important antibiotics, a coalition of some 50 consumer and health advocacy groups are asking Subway, the fast food chain with the most stores in the U.S., to give drug-free meat a try. [More]

California Assembly Passes Measure To Ensure Consumers Don’t Face Costly Surprise Medical Bills

When you’re recovering from surgery, the last thing you want is to be blindsided by an unexpected bill for hundreds, if not thousands, of dollars because the hospital hired an out-of-network anesthesiologist or other specialist without telling you. Unfortunately, this type of surprise medical bill has become an unwelcome reality for nearly 30% of privately insured Americans. California lawmakers have just cleared a major hurdle in their goal of enacting a law that would protect consumers from unforeseen and often unavoidable medical charges. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

Nearly 70 Million Americans Had Their Personal Information Compromised In 2014

Given the sheer number of high-profile data breaches in recent years, and the varying levels of personal information stolen, it can be difficult to quantify how many American consumers were affected. A new survey tries to answer the questions of how many people have had their info stolen (a lot) and what consumers are doing to protect themselves (not much). [More]

Nearly 1-In-3 Privately Insured Americans Received A Surprise Medical Bill In Last Two Years

When you visit your doctor for a blood test, get an ultrasound, or have surgery at a medical facility that accepts your insurance, you likely expect that you’ll only be required to go out-of-pocket for the co-pays and deductibles detailed in your health plan. But the results of a new survey show that there’s a decent chance you’ll be hit with a surprise charge or two when those medical bills finally arrive. [More]

Nearly 35% Of Consumers Have Never Checked Their Credit Reports

While consumers are often urged to take advantage of the free once-a-year opportunity to request a credit report and make sure they aren’t riddled with errors, a new survey suggests many Americans simply aren’t heeding the suggestion. [More]

Consumer Groups Ask Congress To Ensure That For-Profit Schools Are Held Accountable

When the new gainful employment rules take effect later this year, for-profit educators would need to demonstrate that their programs are actually training graduates to earn a living. But a pending piece of legislation seeks to give these schools a free pass to billions of dollars in federal student aid.

AT&T, Verizon Responses To Campaign To End Robocalls Unsurprisingly Empty And Noncommittal

If there’s one thing consumers can agree on… well, it’s probably that they don’t like Comcast. But if there are two things that consumers can agree on, it’s that and also that robocalls suck. The tech to block robocalls is out there, but phone companies don’t use it. And their excuses for not doing so aren’t getting any better. [More]