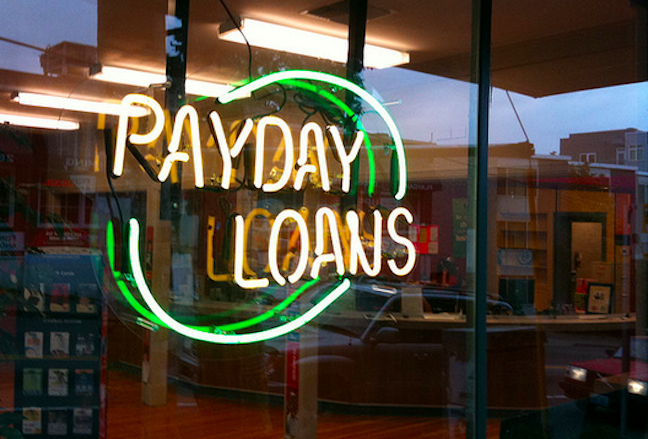

Last year, federal regulators released a report that found online payday lenders — despite their clean, professional websites — could be just as bad, if not worse, than their storefront counterparts. Today, the Consumer Financial Protection Bureau provided yet another example of how these companies can wreak havoc on consumers’ finances by skirting the law. [More]

collection

The IRS Is Now Using Private Debt Collectors; Here’s What You Need To Know

After years of warning taxpayers that the IRS will never cold call you to collect a tax debt, things are about to change as the IRS begins handing over some of its debt-collection work to private firms who probably will call you. [More]

7 Things We Learned About Federal Student Loans & The Companies That Profit From Them

Fifty years ago, Congress created the federal loan program as a way to help Americans realize their dreams of a better life through higher education. While millions of students have no doubt benefited from the program, millions of others have found themselves burdened by mountains of debts, fielding calls from debt collectors and loan servicers, and watching as their paychecks are whittled down by garnishments. Today, seven million former college students are in default with a record $115 billion in federal loans. While those figures may be oppressing borrowers, it’s providing a stream of income – and profit – for companies contracted by the government to collect payments from debtors. [More]

7 Things We Learned About How Debt Collection Lawsuits Affect Minority Neighborhoods

While some debt collectors have resorted to questionable and sometimes illegal practices, there are also legal routes to debt collection — like lawsuits and wage garnishment — that can nonetheless have a destructive effect, particularly in low-income, minority neighborhoods. [More]

Arbitration May Be Dead, But Courts Offer Imperfect Alternative

Last month, the Minnesota Attorney General brought an oppressive arbitration regime to its knees. Nation Arbitration Forum handled over 200,000 arbitrations per year. But many of those cases will end up in the 50 states’ district courts, where consumers may fare no better.

Marketers Announce They Will Bring More Transparency To Personal Data Collection By 2010

Several major advertising trade groups announced yesterday that starting in 2010, they will implement a new set of self-imposed guidelines on how they collect and use your personal info, in an attempt to prevent the government from handing down federal regulations.

NY Attorney General Shuts Down Abusive Debt Collection Operation, Puts Owner's Rap Career On Hold

The New York Attorney General shut down a network of debt collection agencies today that were run by convicted felon Tobias Boyland, who along with his colleagues impersonated police officers, threatened debtors with arrest, and told them they were being sued in civil court. Boyland is also an author and a musician, and he has an awesome website, bagsofmoney.us, which—warning—launches into a street-friendly rap song as soon as it loads.

Is Volkswagen Violating The Fair Debt Collection Practices Act?

Tim’s neighbor received a call from VW Credit asking her to walk across the street and leave a note on her neighbors’ front door and VW Bug asking them to call back their creditor. Calls like these are known as block parties, and they are a direct violation of the Fair Debt Collection Practices Act.

Should The Government Set Up A "Do-Not-Track" List?

One of the most popular sentiments expressed by readers on our blog is “be a smart consumer.” Now two privacy advocacy organizations are calling for the creation of a “do-not-track” list that would protect registered users from online data collection. They argue that a list is needed because too many consumers won’t or can’t understand the methods behind online tracking. To illustrate, one of the organizations “pointed to a 2005 University of Pennsylvania survey in which only 25 percent of respondents knew that a Web site having a privacy policy doesn’t guarantee that the site refrains from sharing customers’ information with companies.” But a do-not-track list is overkill, and a fearful reaction against emerging technologies.