Late last year, Dennis got a new phone number. That shouldn’t be anything to complain about, and indeed he has no complaints about his mobile carrier or about his new phone. The problem is that Chase Bank keeps calling him about his account balance, which he would appreciate if he actually had an account with Chase or a low account balance. He does not. [More]

chase bank

Why Does Chase Keep E-Mailing Me About My Closed Non-Zombie Account?

Elizabeth wishes that Chase would stop sending her emails. They’re not spam, exactly: she used to be a customer. But she’s getting e-mails as if she still had accounts there, and she closed hers more than a year ago. She was afraid that it has gone zombie: that is, that it’s been mysteriously re-opened without her permission to make unwanted payments and devour her credit score. [More]

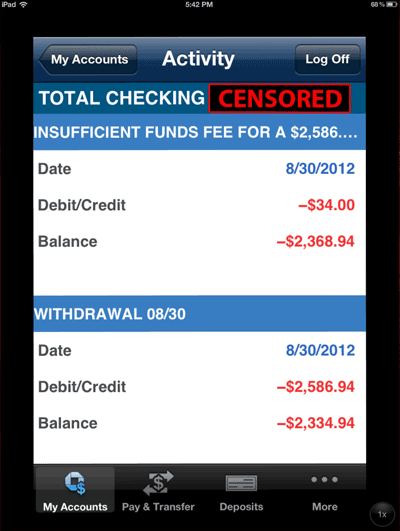

A Chase Bank Teller Makes A Mistake, I Spend The Long Weekend $2,300 Overdrawn

Jason began his holiday weekend with an unpleasant surprise. When he checked his bank account on his iPad, he saw that it was overdrawn. It was overdrawn by a lot. More than two thousand dollars. Jason hadn’t made any huge withdrawals from his account, and neither had any other authorized person. Was he the victim of identity theft? Fraud? ATM skimmers? How could someone take out money that wasn’t there? It turns out that it was quite easy: it just required a one-digit error in the account number. [More]

Do Not Confuse The Chase Bank ATM With Your Weird And Scary 'Checks'

Tom and his wife got married last year (congratulations!) but still have separate checking accounts. Tom never had a problem depositing checks also made out to his wife in his Chase checking account, so he didn’t foresee any problems with depositing their joint $2,000 tax refund check in that same account. But this is The Consumerist, not Satisfied Chase Customers Weekly, so you can guess how that turned out. Now Tom and Mrs. Tom get to wait patiently and hope that the check doesn’t get lost in the mail on its way back to them. [More]

Chase Doubles The Debit But Isn't Sure When They'll Get Around To Fixing It

UPDATE: Chase has issued a statement on accounts that posted debits twice: “Some debit card transactions in the New York tri-state area posted twice. We are working to reverse that and we will reimburse any resulting fees.” [More]

Banks Pull Credit Card Tricks To Lure Consumers Back Into Spending More Money

Now that recession-weary consumers have been shedding debt, banks are doing their best to convince you to get that spending back up. Somewhat tricky moves from various credit card companies could result in a high balance if you’re not careful. [More]

An Important Message From Chase: We Would Like To Sell You Stuff

Doug has a Chase credit card, but doesn’t bank with them. His local Chase branch left him a message asking him to call back by the end of the business day about something that was “important” but “not an emergency.” Fearing a credit card breach, he called them back right away. Turns out what was so “important” was the branch employee trying to sell Doug on opening a checking or savings account at that local branch. [More]

Ditch Your Big Bank, Miss Out On Groupon Refund

Like many other Americans, Casey broke up with his big bank, Chase, and joined a local credit union. The Consumerist commentariat should be very proud of him. Except that since changing banks, he received a refund for a Groupon he had purchased, which Groupon is powerless to give him because the debit card he used to purchase it has been canceled. [More]

Chase Punishes You For Not Earning Enough Money

Since they can’t extract money from our pockets with cascading overdrafts anymore, banks have to get creative. Bradley learned that these indignities add up when the bank deems you insufficiently profitable, and charges a fee on your no-longer-free checking account. Never mind that Bradley is a college student. He doesn’t have a lot of money on hand, and from Chase’s point of view, not nibbling away at his patience and his money now could lead to another 60 years of business from him. Theoretically. [More]

Clergy Perform Exorcism On Chase Bank

A group of clergy gathered together on the steps of JP Morgan Chase on Park Ave in New York City to perform an exorcism on the bank. They said that the bank was possessed by the demons of “selfishness and avarice” because according to the group’s new study, only 6% of New York homeowners seeking a loan mod have gotten it in the past year. The exorcism happens at 0:57. No satanic spirits fly out of the banks, but money does fly out when the clergy closes down their bank accounts. [More]

You're Locked Out Of Chase Online Banking And Can't Get To A Branch? Tough.

Nathaniel writes that Chase Bank refuses to believe that he is who he says he is. He’s locked out of his online banking account, and none of the telephone reps’ “public records” questions prove his identity have anything to do with him. While a trip to a branch would most likely straighten the situation out, he’s physically disabled and such a trip would be difficult. [More]

At Chase, Depositing A $4,000 Check In An ATM Is "Unusual Activity"

Carol tells Consumerist that while in a financial pinch, she took out a title loan for $4,000, depositing it in her Chase bank account using an ATM. Instead of helping the situation, the deposit made her financial mess worse. Chase froze her out of her accounts and made her order a new debit card, but no one at her local branch or in the corporate “Risk Control” department has the power to tell her what the problem is. Her account remained locked after the check cleared. Bank staff also took the opportunity to attempt to sell her student loans and overdraft protection. Not a good time, Chase. [More]

Chase Thinks Boston Non-Smoker Bought $100 Worth Of Smokes In Florida

Now that Chase has reversed their initial decision and issued a refund to the retiree they accused of credit card fraud, maybe they can take a look at a rather similar case, but on a smaller scale. Reader P tells Consumerist that Chase ruled that he is responsible for some uncharacteristic purchases he purportedly made thousands of miles away from where he was at the time. [More]

Chase Returns Retired Teacher's Stolen $6,200

For some reason, Chase bank decided to take a second look at the $6,200 an unidentified person removed from Bronx retiree Ernest Nitzberg’s checking account. It just might have been the outcry after he shared his story with a global audience on the Huffington Post. [More]

Chase Tells 44-Year Customer He Fits Fraud Profile, Stole $6200 From Himself

Over at the Huffington Post, retired teacher Ernest Nitzberg blogged about the experience that made him sever his 44-year banking relationship with Chase. He writes that Chase accuses him of using a debit card that he was never issued to buy $6200 worth of merchandise that he was unlikely to want or need. Makes perfect sense to us, too. [More]

Having A Problem With Chase Bank? Here's Where To Turn

We have a lot of executive customer service contact information for Chase credit cards, but not as much for Chase bank. That’s all about to change, my friends. Here’s someone you can turn to if you have problems with the banking side of Chase. Remember, only pester executive customer service contacts once you’ve exhausted all other options. [More]