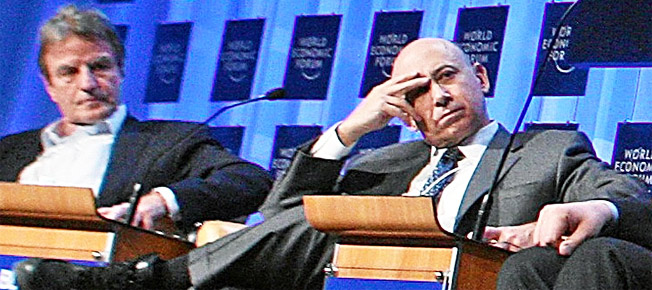

New York Attorney General Andrew Cuomo has opened an investigation of eight major banks, to find out whether they gave misleading data to rating agencies to pump up the ranking of mortgage-backed securities. The companies in the crosshairs are Citigroup, Goldman Sachs, Morgan Stanley, Credit Suisse, Deutsche Bank, UBS, Crédit Agricole and Merrill Lynch (aka Bank of America). [More]

cdos

10 Things You Don't Know About The Goldman Sachs Case

The media spin cycle is churning out its typically tepid hogwash about the SEC’s suit against Goldman Sachs. The Big Picture skewers 10 myths about the case and gets to the heart of the matter: Goldman is screwed. Here’s why: [More]

Here's The Math Formula That Ruined Our Economy

Now if your kids ask you why they have to learn math, you can tell them, “Because if you don’t, you could ruin the global economy, you little beast.” Wired has just published an article that traces the entire clusterfrak back to a formula published in 2000 by a mathemetician working for JPMorgan Chase. Bankers loved its simplicity but completely misused it—despite warnings from academics that it was flawed—to turn pretty much every security into a triple-A, no-risk fabrication.

What Are "Collateralized Debt Obligations?" Watch These Champagne Glasses.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..