By now you’re probably used to going to your bank’s website and being upsold on everything from car loans to mortgages to retirement accounts before you can move on to see how your money is doing. But have you ever gone to your bank’s site only to be told you must update your income with the bank before going any further? [More]

capital one

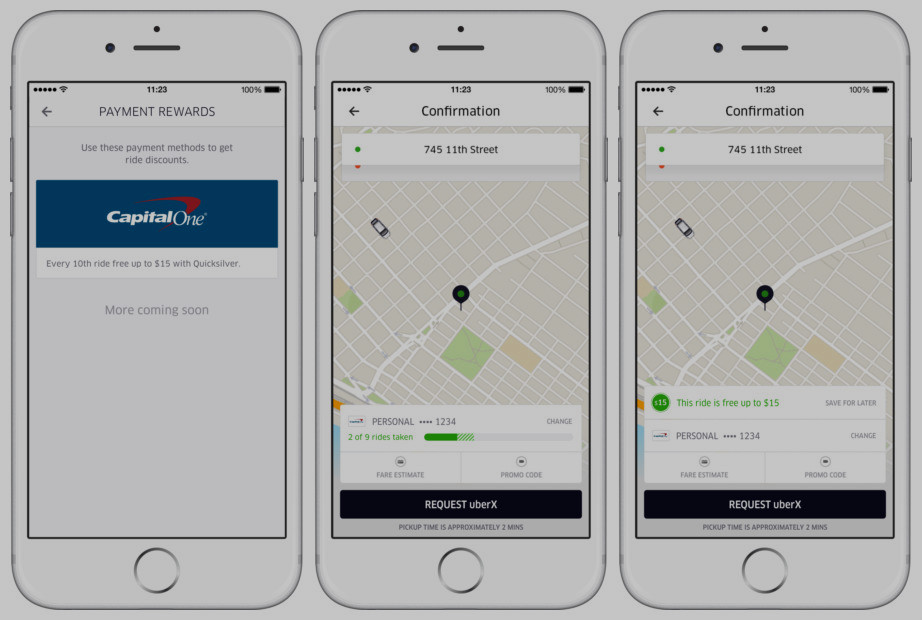

Uber Teams Up With Capital One For Rewards Program

For the most part Uber and credit cards go hand-in-hand: in order to hail a ride you must be willing to pay for your ride via a debit or credit card stored to your account. So it should come with little shock that the company is now partnering with Capital One on a rewards program for riders. [More]

Capital One Will Let Customers Pay Bills, Access Account Info Using Amazon Echo

You can ask Alexa to order you a pizza and get more laundry detergent, and soon, Capital One customers who own an Amazon Echo will be able to access their accounts to pay bills and get other information by speaking to their device. [More]

Someone Transfers $917 To Man’s Bank Account, No One Will Tell Him Where It Came From

Here’s a change of pace: After seemingly countless stories of mysterious debits and charges on consumer’s accounts, here’s a story of a man who found that his checking account suddenly included $917 he knew didn’t belong to him. [More]

3 Things Costco Shoppers Need To Know About Split From American Express

Yesterday, American Express confirmed rumors that it would be ending its exclusive partnership with Costco at the end of March 2016. While that is more than a year away, Costco members and AmEx cardholders already have some important questions. [More]

Costco To Stop Accepting American Express In 2016

It’s been rumored for months that Costco and American Express would eventually end their exclusive relationship, allowing members of the warehouse club to use other cards. Now AmEx has confirmed that the deal will indeed come to an end in early 2016. [More]

Costco May Finally Start Accepting Something Other Than American Express

Costco may be very generous with the free food samples and might have a very forgiving return policy, but when it comes to paying with a credit card at the warehouse club, customers have only one option: American Express. But a new report claims that we could be seeing the end of Costco customers being forced to use their AmEx when buying 872 lbs. of steak and enough toilet paper to keep a small nation clean. [More]

Study: Credit Card Applications Becoming More User Friendly, But Still Lack Valuable Informaton

Credit card companies love to advertise all the perks of being a cardholder — rewards points, cash back, airline miles, etc. — but card issuers have historically hidden the not-as-good stuff in the fine print of card applications. A new study finds that banks are doing a better job of making things more transparent — but not about everything. [More]

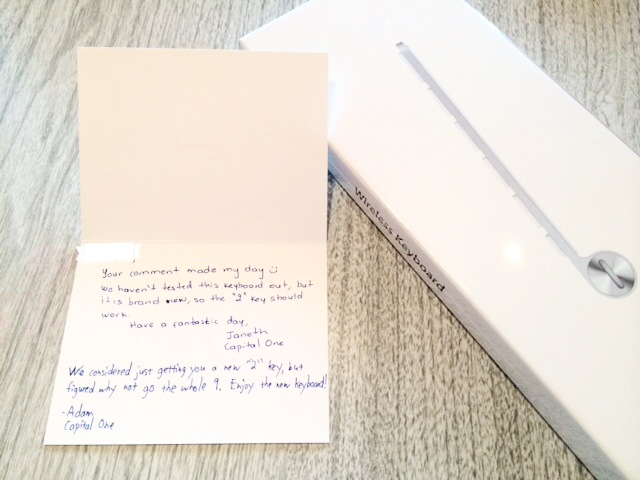

Capital One Sends Customer A New Orange-Juiceless Keyboard So He Can Pay His Bill

We are living in a digital world, which means many things we used to do offline, like paying bills, are now handled online. But what’s a good customer to do when he can’t pay his credit card bill due to a keyboard infiltrated with orange juice? Speak up — and maybe get a free keyboard out of it. [More]

Bank Of America Agrees To Scan For Illegal Payday Lenders In NY

Payday lending is illegal in more than a dozen states, including New York, but some lenders manage to fly under the radar by operating online or hiding their loans as part of another business. In an effort to crackdown on loans that violate state laws, New York has created a database for banks to use to help identify sketchy lenders, and Bank of America — no stranger to the issue of questionable loans — is the first to sign on. [More]

Card Canceled After Target Data Breach Hit With Fraudulent Charge Anyway

The massive holiday season Target data breach is the gift that just keeps on giving consumers more headaches. Replacing a compromised card may not be enough to prevent fraud, it turns out: criminals may still be able to charge purchases to your old account even if you thought it was closed. [More]

Capital One Isn’t Coming To Visit You, Probably

A few weeks ago, Capital One sent customers a contract update that told them that it could drop by their home or workplace whenever they feel like it, and call them up without disclosing their identity. Capital One must not have predicted the response from customers, since now the company really, really want them to know that debt collectors are not going to stop by for a chat. Unless it’s about your snowmobile. [More]

Capital One Contract Update Gives Company Ability To Visit You At Home

Maybe they should change their slogan from “What’s in your wallet?” to “Who’s knocking at your door?” Capital One recently updated its contract for credit card customers, and the new language is giving some cardholders concern that Cap One may just pop in for tea and scones some afternoon. [More]

Capital One Is The Most Complained-About Credit Card Company

Since the Consumer Financial Protection Bureau opened its credit card complaint portal in Sept. 2010, more than 25,000 complaints have been filed with the CFPB. And while the 10 largest credit card issuers account for 93% of all those complaints, one company is responsible for more than 1-in-5 of all complaints filed with the Bureau: Capital One. [More]

Capital One Sends Me Across London To Get My Debit Card To Work

Lucky reader Twila is enjoying a European vacation right now. Only she has one sort of inconvenient problem: her Capital One debit card won’t work in many of the places she’s visiting. Like her hostel. And entire parts of London. [More]

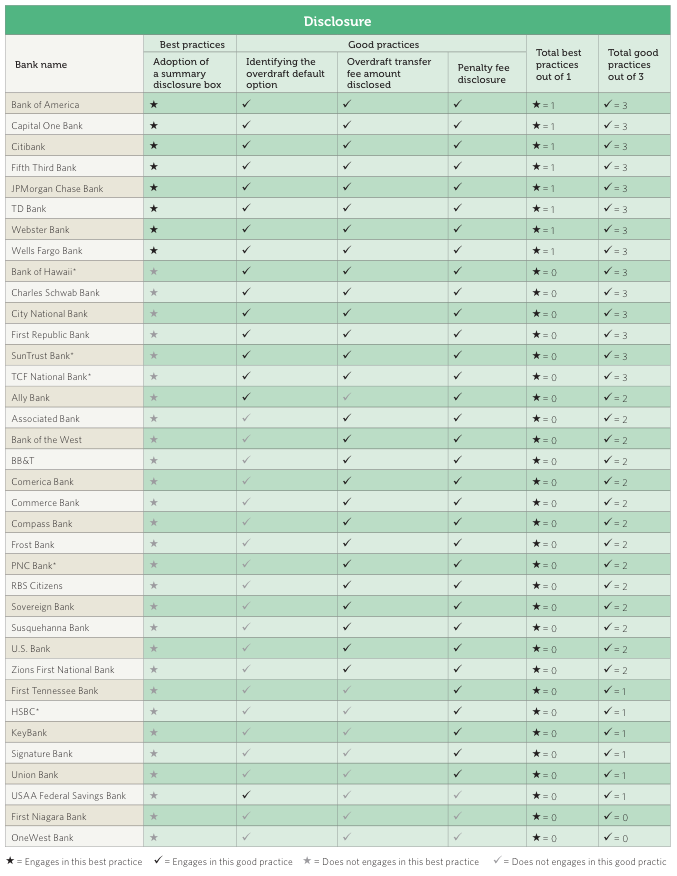

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Worst Company In America Round 1: Bank Of America Vs. Capital One

Your NCAA bracket might already be busted, but how are you doing with your WCIA predictions? Starting off today’s bloodshed is a showdown featuring the tournament’s perennial bridesmaid. [More]