Harry’s got a problem: the Bank of America card he’s had for years is paid off, but now it’s been set to explode in Harry’s wallet if he ever uses it again because the variable APR will jump to 29.99 percent. What’s worse, his other card has been canceled. Now Harry doesn’t know if he should start using the BofA card or back away quietly from it. [More]

aprs

Study Shows People Take Out Loans At 400% Even When They Do Know Better

Why would you ever take out a loan at 400% interest? Because you’re absolutely desperate, or because you have no idea what 400% interest actually means. Well, many people do it every two weeks. It’s called a payday loan, and Slate has an article discussing the findings of a recent study on these “storefront loan sharks”.

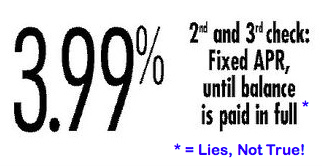

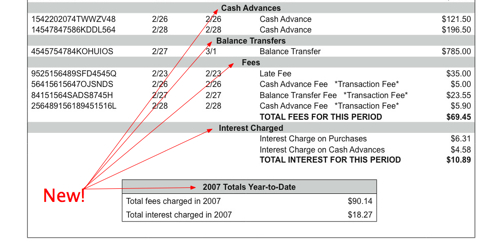

Chase Promises To Honor Promotional APR Until Balance Is Paid Off Or They Change Their Mind—Whichever Comes First

Chase doesn’t want to honor an old promotion promising to lock in a customer’s APR until their balance is paid off, so they’re just ignoring the original terms and jacking up interest rates. The bank wants to hike a promised 3.99% rate to either 7.99%, or 5% of the total balance plus a $10 monthly service charge, terms that are dull enough to put you to sleep until you receive the next month’s bill. Inside, Credit Slips walks us through how this is legal, along with tips for recapturing the stolen promotional rate.

Over Your Credit Limit? Get Ready For Higher Interest Rates!

Next time you brush past your credit limit you may get hit with more than a hefty over-the-limit fee. The Red Tape Chronicles reports that credit card companies are starting to slap exuberant spenders with penalty interest rates. Compounding the danger to consumers, creditors are simultaneously rushing to slash credit limits.

6 Reasons To Keep More Than One Credit Card

Keeping a second credit card won’t lead to financial ruin, and may prove useful in several situations. Bankrate offers six reasons to stash away a spare card.

Nobody Knows The True Cost Of Credit

Credit card companies make it impossible for consumers or markets to know the true cost of credit, according to Georgetown Law professor Adam Levitin. The professor makes his point with a pop quiz:

… what’s the interest rate on the credit cards you’re carrying? How about the default rate? Do you know what constitutes an event of default? What will trigger a penalty fee or surcharge? How much are those fees? If you’re like most Americans, you probably cannot answer many or all of these questions.

Liveblogging The Senate Permanent Subcommittee On Investigations Hearing On Arbitrary Credit Card Rate Increases

Today at 9:30 a.m., Senator Carl Levin (D-MI) will continue his investigation into the unfair and deceptive practices of the credit card industry. Today’s topic: arbitrary rate increases for cardholders in good standing. The hearing picks up where Senator Levin left off in March, when he questioned the use of excessive fees, interest charges, and the abuse of grace periods.

Discover Randomly Raises 400,000 Members' APR "To Remain Competitive"

Discover card holders, check your bills. You may be one of 400,000 lucky members getting their interest rates significantly increased for no apparent reason.

We received a “Love Note” separately from our statement from Discover stating that our APR will be rising from 12.74% to 19.99% . While I do carry a small balance on the card sometimes, it has never been one that I use much because I have cards that are below 8% APR and still offer rewards. Now, my credit isn’t bad (744 FICO – just checked after getting off the phone with Discover). I have no past dues, never pay late, etc. I also noticed that the statement said “this decision to change your terms was NOT based upon information in your credit file”.

Credit Card Companies Cheer New Regulation?

The Federal Reserve Board wants credit card companies to clean up their act, and the credit card companies couldn’t be happier. The Fed’s proposed regulation would give customers 45 days notice before a change to their card’s terms, require fees and interest to be shown separately on each bill, and would transform default APR into the more menacing-sounding penalty APR. None of this is objectionable to the credit card companies:

“We strongly agree that improved disclosures empower consumers to make better choices in our competitive marketplace,” said Edward Yingling, head of the American Bankers Association, a lobbying group that represents the biggest credit-card issuers.

We tell you why creditors are grinning, after the jump…