Hi Meghann, nice work on Consumerist. You all do a great job, and I enjoy the blog, read it a lot, and learn a lot from it. I thought I would run a situation/question by you and see if you all have any answers or know where to find them.

apr

Ask The Consumerists: Get A Lower Rate Without Hurting My Credit?

Rent-A-Center More Like Ripoff Center

JLP over at AllFinancialMatters checked into renting furniture to own with Rent-A-Center. For a sofa and loveseat with a retail price of $1,048, a renter would pay $26.99 per week for 104 weeks, adding up to a whopping $2,806.96!

What To Look For In A Credit Counseling Service

Credit counseling is not for everyone, but may be for you if you are struggling with debt. Credit counselors work by negotiating a reduced payment plan with creditors. In exchange for receiving timely payments, creditors may return a small portion of the amount received to the counseling service. Only consider a counselor if you can reign in your spending and pay off your debt in less than five years.

Should You Pay Off Your Credit Cards With Home Equity?

Ah, one of the questions for the ages. Shall you or shall you not pay off your credit cards with home equity? Let’s say you ran up a credit card on a bunch of crap you didn’t need and are now being charged 15%. You’ve seen the error of your ways, and now are interested in paying off your debt. How should you go about it? Should you use Home Equity? Blueprint For Financial Prosperity suggests that, while you may be saving big money by cutting your interest rate, you should think the decision over carefully.

10 Ways To Avoid Credit Card Pitfalls

•Be aware that the card issuer has a great deal of leeway. They reserve the right to change the terms of your card, including the APR (annual percentage rate), at any time, for any reason–with as little as 15 days notice. So check your monthly statement carefully.

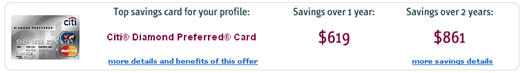

Save On Your Credit Cards With Savings Agent

If you’re looking for a quick way to compare credit cards, Savings Agent can help. If you need a quick reference before you call your credit company to ask for a lower APR, or you really want to switch credit cards, Savings Agent is a free tool that compares dozens of cards to find you the one with the lowest cost. If you don’t have any debt, Savings Agent can recommend cards with the best rewards programs. The site doesn’t ask for any personal information, and it’s easy to use. It’s a good first step toward negotiating your new interest rate. —MEGHANN MARCO

Attention: You Lowered Your APR Just By Asking, Again.

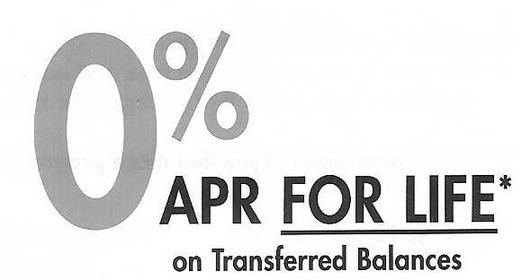

- I’d been thinking seriously about getting a new card and transferring the balance…. I was fairly certain that I could find a card that would allow me to transfer my balance and pay 0% for at least a year (Instead of paying 500+ bucks in interest over the next 6 months with my current card).

Chase Raises Reader’s APR To 148.14%

Chase credit card raised Lee’s effective APR to 148.14%

EXCLUSIVE: CHASE Screws Struggling Card Members Harder

Chase yesterday decided to put the screws harder to its most struggling credit card customers, an insider tells us.

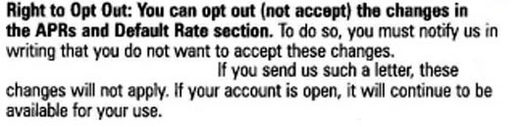

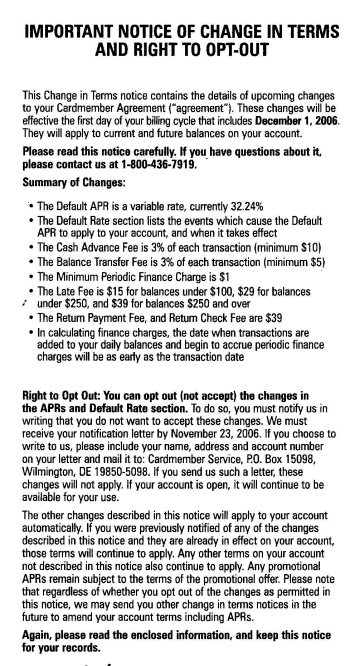

Beat Chase’s New 32.4% Default APR

If you’re a Chase credit card holder and you received a “Change of Terms” notice in your recently mail, congratulations.

Reduce Credit Card APR: It Never Hurts To Ask

Acambras got her Citibank APR dropped from 13.99% to 2.99% just by asking.

Convert Interest Rates To Actual Interest

It ain’t alchemy but it can turn lead into gold.

Letters to the Editor: All That Glitters Is Not Gold

Some would envy Eilidh, being showered with golden jewelry by a male admirer.