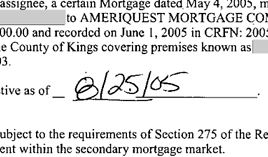

Last summer, GMAC was looking to foreclose on a property here in Brooklyn. Only problem was, it didn’t have documentation proving that it actually owned the mortgage and the original lender, Ameriquest, couldn’t help because it had gone the way of the dodo a few years earlier. So what’s a mortgage servicer to do but fabricate the paperwork? [More]

AMERIQUEST

Get $1000 In Ameriquest Mortgage Settlement

If your home mortgage was serviced by the defunct Ameriquest or its affiliates, you could stand to receive payouts starting at $1,000. Just enter your loan number on the settlement website and it will tell you if you’re eligible. The $325 million settlement came after a multi-state investigation which found shady lending practices that failing to disclose that loans had adjustable rates, failing to disclose the terms of the loan, refinancing homeowners into inappropriate loans, inflating home appraisals, and charging excessive fees. [ameriquestmdlsettlement.com] [More]

Judge Slaps Ameriquest Hard For Selling Mortgage, Then Pretending To Still Own It

Ameriquest originated a mortage, securitized it, and sold it. Then pretended it still owned the mortgage to a U.S. Bankruptcy Court judge. Whoops.

From $2 Million To Foreclosure On An Ameriquest Subprime Mortgage

Frances Joy Taylor had had about $2 million in assets, which she intended to leave to her church, before she met a businessman named Tyrone Dash. Dash took over her affairs and “methodically liquidated or leveraged almost everything she owned: her bank accounts and securities, her insurance policies, her credit cards, her two apartment buildings and, ultimately, her home,” says the Seattle Times. Frances suffers from Alzheimer’s.

$325 Million Amerquest Settlement Payout Might Average $812.15 Per Person

If you got a mortgage through Ameriquest from 1999-2005, you may be eligible for a $325 million settlement Ameriquest reached with 49 states over their shady lending practices, which included failing to disclose that the loans had adjustable rates, failing to disclose the terms of the loan, refinancing homeowners into inappropriate loans, inflating home appraisals, and charging excessive fees such as prepayment penalties and loan origination fees. Ameriquest did not admit wrongdoing.