Equifax, the credit bureau that ignored warnings and failed to update its software, leading to a data breach that exposed private information for half the U.S. adult population, stepped into the crosshairs of Last Week Tonight’s John Oliver on Sunday, adding a bit of levity to this otherwise dire ongoing scandal. [More]

2017 equifax breach

IRS Has Second Thoughts About Giving $7.2M Fraud-Prevention Contract To Equifax

What does it take for the Internal Revenue Service to realize that maybe, just maybe, it picked the wrong company to award a $7.25 million fraud-prevention contract? It wasn’t enough that Equifax’s network was so poorly prepared for a hack that a months-long cyber attack compromised the sensitive information of more than 140 million Americans. And then that same company may have served up malware to consumers visiting its publicly available website. Whatever the reason, the IRS has finally begun to realize Equifax might just be absolutely terrible at its job. [More]

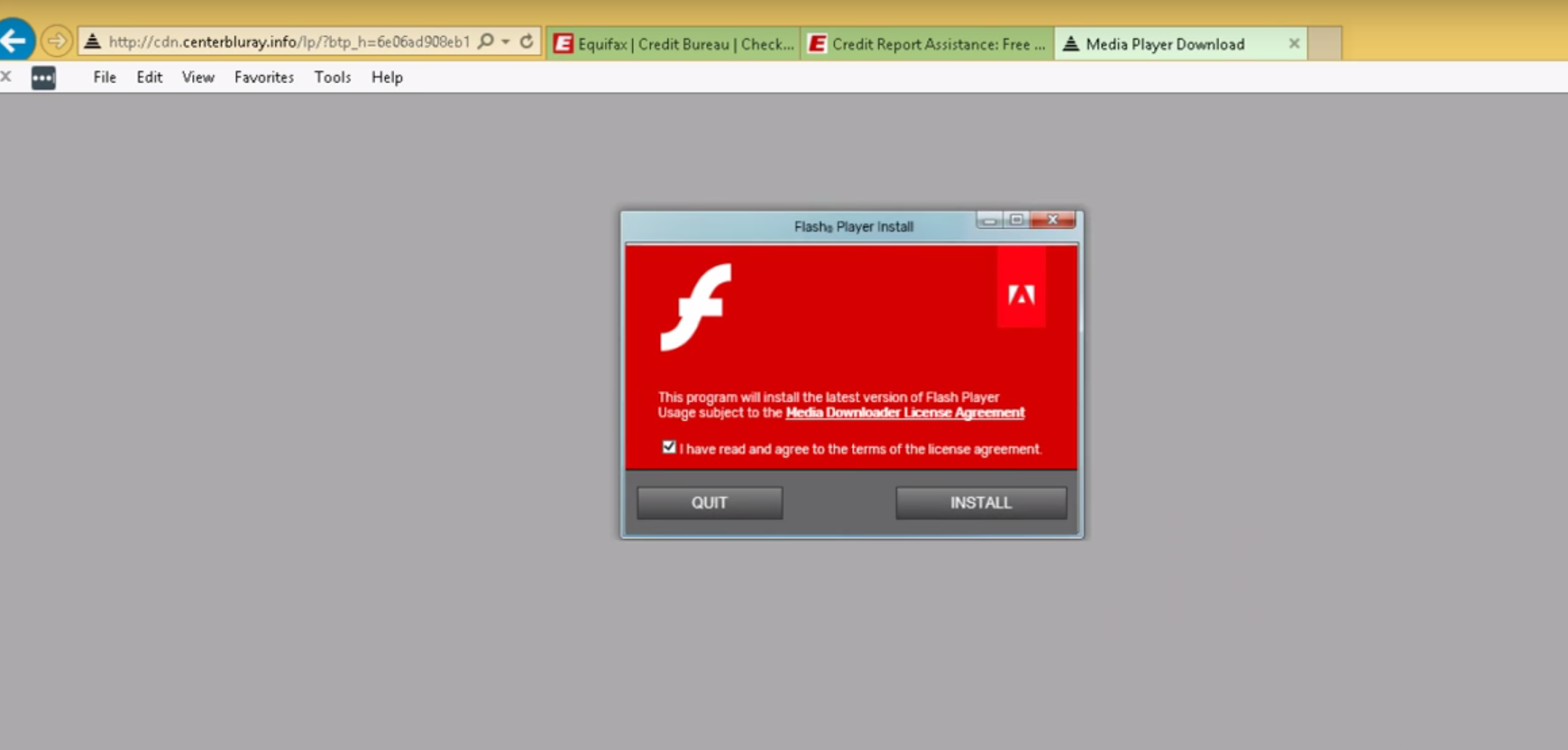

Equifax Website Reportedly Served Up Malware To Some Users

Update: Equifax has taken some pages temporarily offline following the report about malware. [More]

Equifax Security Failings Were Flagged By Wall Street Firm More Than A Year Ago

A company that supplies stock market indexes reportedly warned investors in August 2016 that Equifax, one of the nation’s three major credit bureaus, appeared to be ill-equipped to fight off a sophisticated cyber attack. Apparently Equifax didn’t get that warning; otherwise, hackers may have been prevented from accessing the sensitive financial information for more than 140 million Americans. [More]

Equifax CEO Apologizes For Company’s Incompetence, Promises Vague (Possibly Pointless) Credit ‘Lock’ Service In 2018

The interim CEO for credit bureau Equifax is finally issuing a full-throated mea culpa for the massive data breach that compromised sensitive personal and financial information for about half of the adult U.S. population. In addition to extending the deadline for hack victims to freeze their credit free of charge or sign up for the company’s not terribly enticing anti-ID theft program, Equifax is also promising to offer something new: A way to “lock” your credit file (sort of, maybe, and only partially) for free (possibly). [More]

Equifax CEO Resigns Following Massive Data Breach

Among the items on that list of “Things a CEO Doesn’t Want on Their Resumé” is “Being the one in charge at the time of one of the biggest data breaches in U.S. history.” So perhaps it’s not a shock that Equifax CEO Richard Smith is stepping down only weeks after admitting that his credit bureau failed to secure the personal information of about half the U.S. adult population. [More]

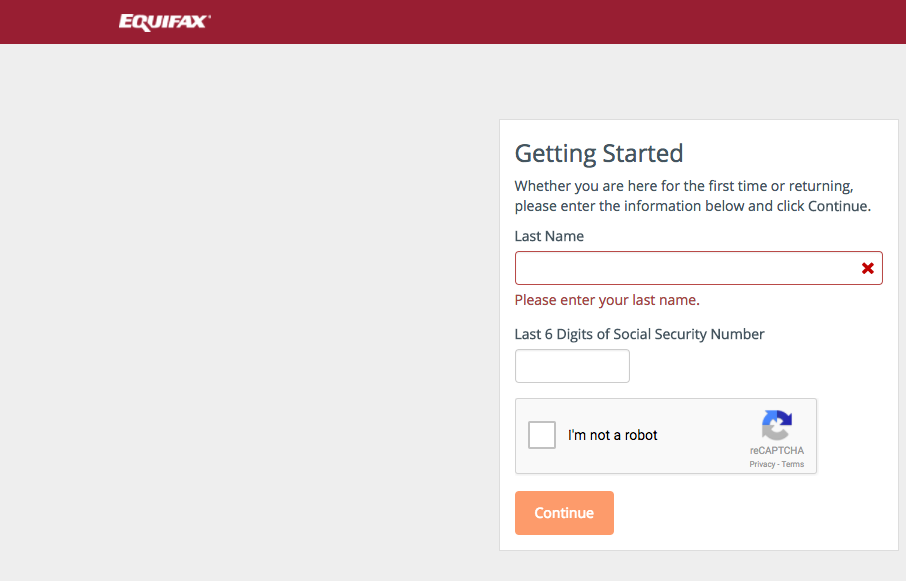

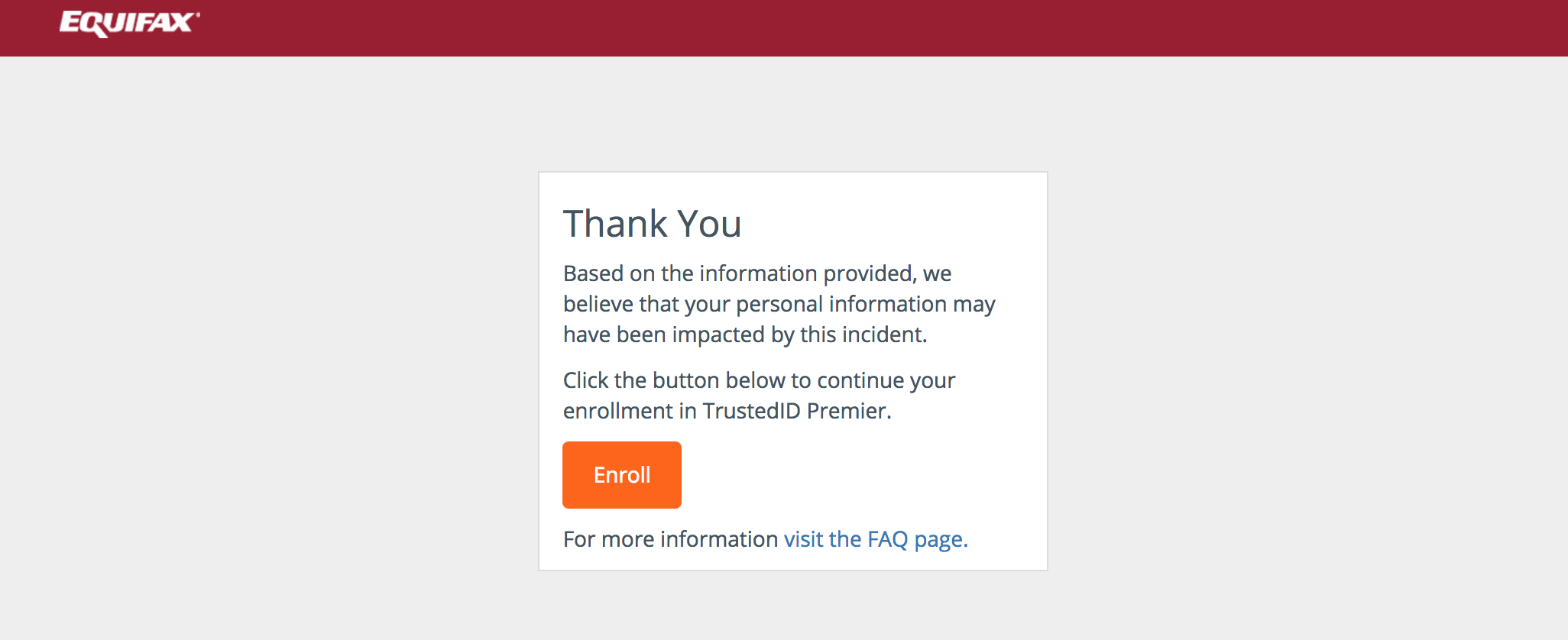

States Call On Equifax To Halt Marketing Of Its Paid Credit Monitoring Service

If you’re one of the 140 million or so people affected by Equifax’s failure to keep its data secure, the credit bureau is offering free access to its TrustedID credit monitoring service (though we don’t recommend you enroll in it). At the same time, the company is continuing to charge everyone else for access to TrustedID, and some consumers affected by the breach are inadvertently paying for a service they can get for free. That’s why dozens of state attorneys general are asking Equifax to stop trying to sell TrustedID for the time-being. [More]

Sen. Elizabeth Warren Introduces Bill That Would Make Credit Freezes Free

In the wake of the the massive Equifax customer data breach, many consumers are wondering: Why, exactly, should we be paying the credit bureaus for credit freezes or monitoring when it was one of them that just lost all our personal data? Two U.S. Senators are wondering that, too, and have now introduced a bill to fix it. [More]

Let’s Not Forget That Equifax Hackers Also Stole 200K Credit Card Numbers

We’re constantly learning new things about the massive Equifax data breach, including its actual cause, that it affected people all over the world, and that the Federal Trade Commission is investigating. Let’s back up, though, and remember something important: Along with the millions of Social Security and driver’s license numbers, 200,000 customer credit card numbers were taken too. [More]

If Someone Calls You From Equifax To Verify Your Account, It’s A Scam

Now that Equifax is part of the mass public consciousness for failing to secure sensitive financial and personal information for about half of the adult U.S. population, soulless scammers are trying to prey on this heightened awareness by blasting out fake calls to people, asking them to verify their account information. [More]

Equifax Drops Controversial Condition From Free Credit Monitoring Service

While the free credit monitoring service being offered by Equifax to the millions victims of its massive data breach leaves a lot to be desired, the company is remedying one of the more controversial aspects of the program — a condition that stripped consumers of their right to file a lawsuit in court. [More]

Don’t Take Equifax Up On Its Credit Monitoring Offer

As anyone able to tear themselves away from hurricane bulletins last week knows, credit reporting bureau Equifax shared the news that the personal information of 143 million Americans was compromised earlier this year. Yet while plenty of companies, including Equifax itself, are happy to give or sell you credit monitoring services after such a massive breach, that doesn’t mean you should take them up on it. [More]