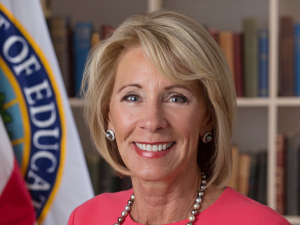

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

Search results for: arbitration

Senate Votes To Make Sure You Can’t Sue Your Bank Or Credit Card Companies

Lawmakers who regularly claim to love the Constitution and espouse their trust of the American consumer have done both a disservice, passing a resolution that makes sure that bank and credit card customers can be blocked from exercising their constitutional rights to a day in court. [More]

Treasury Dept. Says You Shouldn’t Have The Right To Sue Your Bank Or Credit Card Company

Forget the Sixth Amendment, which guarantees the “right to a speedy and public trial” in criminal matters. And who needs that ancient Seventh Amendment and its fancy “right of trial by jury.” The U.S. Treasury Department has concluded that American consumers can not be trusted to thoughtfully exercise these Constitutional rights — at least not when doing so might be an annoyance to the financial services sector. [More]

Betsy DeVos Delays Student Loan ‘Borrower Defense’ Rule Until At Least 2019

Despite the pleas — and legal actions — of lawmakers, consumer advocates, and students, Secretary of Education Betsy DeVos quietly announced Friday that the Department of Education will further delay, by nearly two years, rules intended to prevent students at unscrupulous schools from being left with nothing but debt if their college collapses. [More]

Financial Protection Bureau Finalizes New Rules To Curb Predatory Lending, But Will Congress Let It Happen?

In an effort to rein in short-term, high-cost loans that often take advantage of Americans who need the most help with their finances, the Consumer Financial Protection Bureau has finalized its new rule intended to make these heavily criticized financing operations to be more responsible about the loans they offer. But will bank-backed lawmakers in Congress use their authority to once again try to shut down a pro-consumer regulation? [More]

Sonic Confirms Payment System Attack, Offers Pointless Credit Monitoring

As we learned last week based on information from people in the banking industry, payment cards used at Sonic Drive-In locations have been linked to suspicious transactions. Sonic confirmed today that its payment systems were indeed breached in a malware attack, potentially by crooks seeking payment card numbers. [More]

Monopoly Guy’s Presence Dramatically Improves Senate Hearing

If you were probably watching this morning’s Senate hearing on the Equifax hack, you may have seen something out of the corner of your eye and asked, “Did I just see Rich Uncle Pennybags from Monopoly sitting behind the Equifax CEO?” Yes, yes you did. [More]

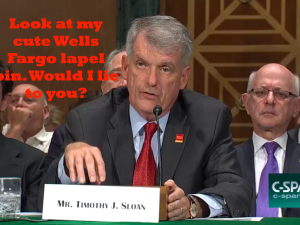

Wells Fargo CEO: We Can Block Customers From Filing Lawsuits Because We Promise To Not Screw Up Again

Imagine a teenager who has been repeatedly caught sneaking out with their friends to get drunk and pilfer garden gnomes from the neighborhood. The teen’s parents ask “Why should we trust you anymore?” and the best answer the adolescent nincompoop can provide is, “Because I started cleaning my room and I’m gonna pass that Geometry quiz, I think.” Now, replace that teen with Wells Fargo, and you’ll basically have the scene from this morning’s Senate Banking Committee hearing. [More]

Supreme Court Allows For Rare Win In Customers’ Lawsuit Against Samsung

The Supreme Court has a long history of ruling against consumers when it involves a company’s attempt to strip its customers of their right to a day in court, but this week the nation’s highest court decided to not hear an appeal in a lawsuit involving Samsung, marking a rare instance in which SCOTUS came down on the consumers’ side in this issue. [More]

Wells Fargo CEO “Deeply Sorry” About That Time His Employees Opened Millions Of Fake Accounts In Customers’ Names

Tuesday morning, Wells Fargo CEO Tim “Apology Machine” Sloan will appear before the Senate Banking Committee to take some public tongue lashings for his bank’s fake account fiasco, which saw Wells employee opening up millions of bogus accounts in customers’ names in order to game the bank’s sales quota system. Sloan’s prepared remarks for this televised tomato-throwing include all manner of statements about how badly the bank behaved and how it’s darn-tootin’ not gonna let that happen again, but also don’t discuss one issue that will certainly be a hot-button topic among some senators in the room. [More]

Chamber Of Commerce Files Lawsuit To Stop American Consumers From Being Able To File Lawsuits

The U.S. Chamber of Commerce may sound like a government agency or a quaint organization of helpful business leaders, but it is, in fact, the single largest lobbying organization in the country, spending nearly $104 million last year alone on lobbying, about $40 million more than any other group. The Chamber also thinks the U.S. Constitution is mistaken, that the Sixth and Seventh Amendments don’t apply to consumers; that the mere fact you are a customer should strip you of your constitutional right to sue banks like Wells Fargo or credit bureaus like Equifax when they open millions of bogus accounts in customers’ names or fail to protect sensitive information for more than 100 million people.

And how does the Chamber of Commerce plan to stop the American people from being able to bring lawsuits? By doing the one thing it doesn’t want you to be able to do. [More]

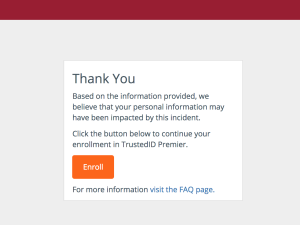

Equifax CEO Apologizes For Company’s Incompetence, Promises Vague (Possibly Pointless) Credit ‘Lock’ Service In 2018

The interim CEO for credit bureau Equifax is finally issuing a full-throated mea culpa for the massive data breach that compromised sensitive personal and financial information for about half of the adult U.S. population. In addition to extending the deadline for hack victims to freeze their credit free of charge or sign up for the company’s not terribly enticing anti-ID theft program, Equifax is also promising to offer something new: A way to “lock” your credit file (sort of, maybe, and only partially) for free (possibly). [More]

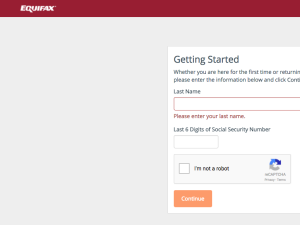

Equifax Says Site Vulnerability Behind Massive Breach; FTC Confirms Investigation

It’s been a week since credit reporting agency Equifax admitted it had lost sensitive personal data for 143 million American consumers — one of the worst data breaches yet. Now, the company says it knows how the intruders got in… and it’s through a bug that was first identified six months ago. [More]

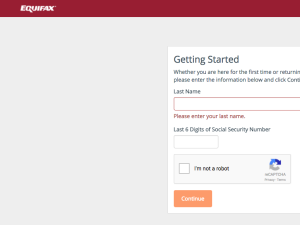

Equifax Drops Controversial Condition From Free Credit Monitoring Service

While the free credit monitoring service being offered by Equifax to the millions victims of its massive data breach leaves a lot to be desired, the company is remedying one of the more controversial aspects of the program — a condition that stripped consumers of their right to file a lawsuit in court. [More]

Don’t Take Equifax Up On Its Credit Monitoring Offer

As anyone able to tear themselves away from hurricane bulletins last week knows, credit reporting bureau Equifax shared the news that the personal information of 143 million Americans was compromised earlier this year. Yet while plenty of companies, including Equifax itself, are happy to give or sell you credit monitoring services after such a massive breach, that doesn’t mean you should take them up on it. [More]

Equifax Already Being Sued Over Massive Breach; Company Criticized For Amateurish Response To Theft

Within hours of Equifax — one of the nation’s three major credit bureaus — confirming that the records of some 143 million people had been compromised in a data breach, the company now faces a lawsuit accusing it of failing to protect its stockpile of sensitive consumer information. Meanwhile, some critics are saying that Equifax’s response to the breach may be causing more harm than good. [More]

More Than 1-In-4 Nursing Home Abuse Cases May Go Unreported To Police

Just as the Trump administration is attempting to prevent nursing home residents or their families from ever being able to sue longterm care facilities for neglect or fraud, a federal audit claims that an alarming percentage of physical and sexual abuse cases at nursing homes may be going unreported to law enforcement. [More]

Federal Appeals Court Is Okay With Uber Taking Away Customers’ Right To Sue

Like companies in just about every industry, the ride-hailing app Uber requires users to agree that they will take any disputes to an arbitrator rather than the legal system. And although you may never have noticed this clause, a federal appeals court has now ruled that customers receive “reasonably conspicuous” notice about the arbitration requirement. [More]