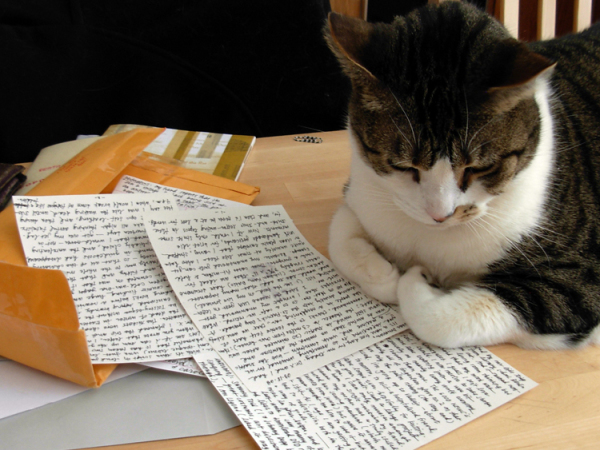

that doesn't seem right

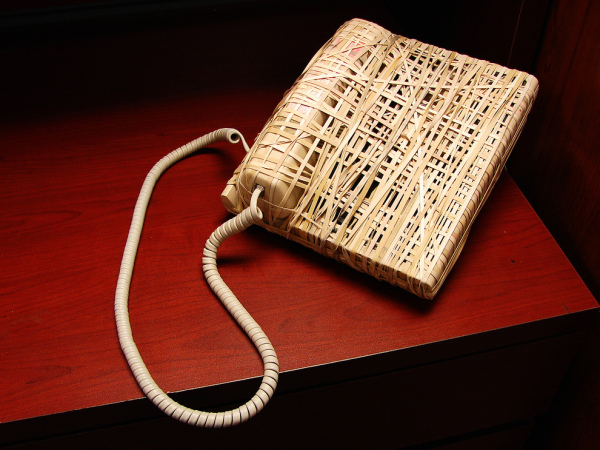

Can A Cashier Make Me Read My 3-Digit Credit Card Code In Front Of Other Shoppers?

the bad kind of surprise

Insurance Loopholes & Master Pricing: How Surprise Medical Bills Knock Consumers Down

here's the beef