Walmart App Will Let You Return Online Items In Stores Image courtesy of Mike Mozart

For years, Walmart has been offering ways for customers to shop online and pick up in stores. But Walmart’s new idea to attract online shoppers flips things on their ear by using its retail stores as the places where you return unwanted online purchases.

Walmart announced Monday that it will launch Mobile Express Returns at stores in November, a system that allows customers who make online purchases to use the retailer’s mobile app to speed up the returns process.

Walmart claims that the new option is its way of making the return process “a little enjoyable” for customers, while also appealing to consumers’ desire for convenience.

Using the app, customers select the Walmart transaction and items they would like to return. They then follow the prompts to start the return process.

Customers then have to drive to the store, find the Mobile Express Lane at the customer service desk, scan a QR code displayed on the app, and hand the item to the waiting associate.

Returns are then credited to the customers’ payment account.

To begin with the system will only be available for customers making online purchases, but Walmart notes that it will work for in-store purchases starting in 2018.

“By leveraging our physical stores and the Walmart app, we’re changing the returns game in ways that only Walmart can do,” Daniel Eckert, senior vice president, Walmart Services and Digital Acceleration, said in a statement.

Playing Catchup Again

While the new return system will no doubt be convenient for many customers, Walmart isn’t exactly the first company to try to streamline online returns.

Just last month, rival Amazon announced that it would allow the return of some items to local Kohl’s stores, removing the sometimes longer wait time for online returns.

Through that program, customers can simply take their unpacked Amazon orders to Kohl’s and have the return completed instantly. The Kohl’s employee will then package the item and ship it back to Amazon.

Growing Online Sales

Still, Walmart’s push for a simplified returns process for online products comes as the company continues to push new e-commerce initiatives in order to compete with Amazon.

Over the past year alone the company has purchased a handful of online retailers including ModCloth, Moosejaw, and Bonobos.

Related: 6 Things We Learned About Walmart’s Love-Hate Relationship With Online Sales

It has also installed giant vending machine-like Pickup Towers at stores, added online grocery pickup to hundreds of locations, and dispatched employees to make online deliveries.

The retailer also tried — and then ditched — a subscription service called ShippingPass in favor of offering free two-day shipping on millions of products with a lower minimum purchase price and began offering discounts on products ordered online but picked up in-store.

These online-focused initiatives are apparently paying off. The retailer announced during its annual meeting today that its online sales have increased 60% in the second quarter of the year. And that growth is expected to continue, as Walmart estimates it will increase online sales by 40% over the next year, as the company continues to integrate its online tools to stores, including 1,000 additional online grocery pickup locations.

“We’re combining the accessibility of our stores with e-commerce to provide new and exciting ways for customers to shop.” Walmart CEO Doug McMillion said in a statement.

The company notes in its annual report [PDF] that it will continue focusing on its existing stores and making them more appealing to customers.

“Historically, new stores have been the key contributor to Walmart’s growth,” the report notes. “Going forward, more growth will come from comp sales at existing stores. By leveraging technology, executing more frequent remodels and providing more sophisticated training to our associates, we’ll deliver a better experience to customers.”

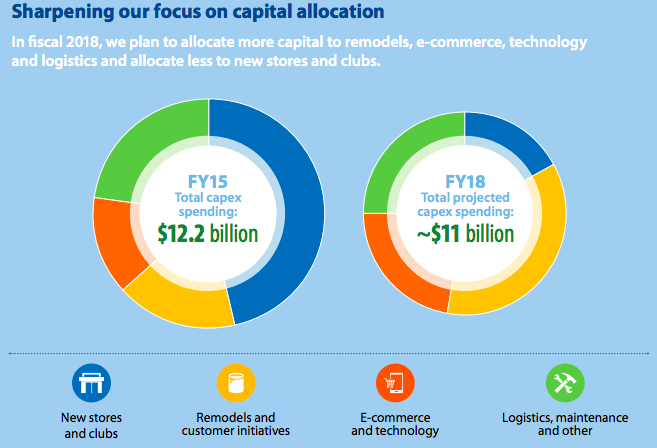

To that end, the company says it will cut its capital spending by about $1 billion, significantly slow its new stores and instead spend more on remodels and e-commerce technology.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.