Sears CEO Tells Employees Things Look Great After Losing $2.2 Billion In 2016 Image courtesy of Nicholas Eckhart

Years ago, Sears Holdings chairman Eddie Lampert came to our attention by publishing a 15-page manifesto about pretty much everything. Since then, Lampert has taken on the job of CEO, despite not having any experience in the retail business and having what at times seems like an active dislike of the retail business. He periodically issues mini-manifestos for employees and for the public about how everything is fine, and published another this morning.

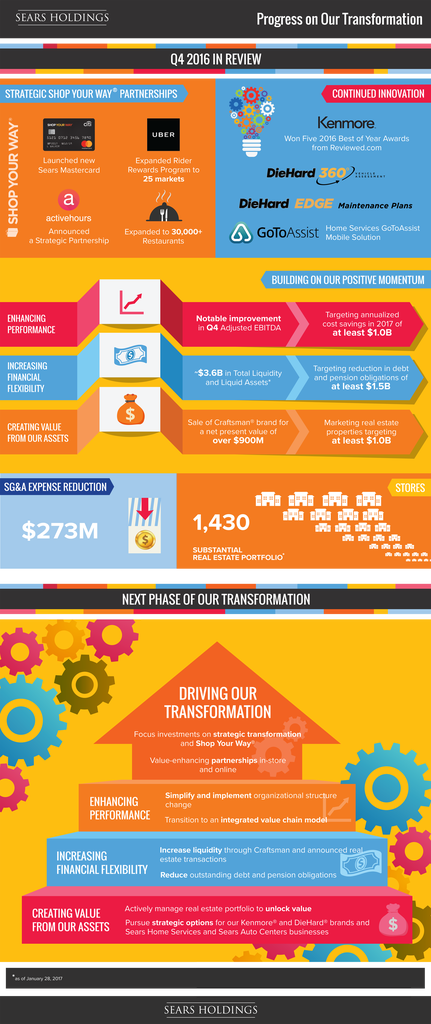

The open letter marked an important occasion. Sears Holdings released its sales and profit information for the last quarter of 2016 and the full year, and they’re not very promising. While Wall Street was apparently delighted to see better results than what experts expected, those experts’ standards were very low. The retailer lost $607 million in the fourth quarter of 2016, and $2.22 billion in fiscal year 2016.

Having followed Sears’ woes for a few years now, it’s hard not to go through Lampert’s open letter to employees line by line and point out the flaws that are obvious to those of us living in the real world. Here, he explains what Sears has going for it and why it can eventually succeed.

“We have very valuable brands among our assets, including some of the most iconic American brands.”

Which it is selling off to anyone who is interested. The problem is that no one is interested in the Kenmore and DieHard brands, and even the estimated value of the Craftsman tool brand plummeted before its sale to Stanley Black & Decker for $900 million.

“We have a large store footprint, dedicated associates and tens of millions of Shop Your Way members actively shopping with us.”

While Shop Your Way is a solid and easy-to-understand rewards scheme, it’s not a program that people feel strong loyalty to. Sears and Kmart shoppers were strongly encouraged to join a few years ago.

“We saw the disruption of retail coming more than a decade ago and built a differentiated online shopping and membership platform – Shop Your Way – to ensure our participation in the next wave of retail.”

What Lampert might really prefer would be for the rewards program to be so successful that Sears Holdings wouldn’t need any retail operations, and to simply collect a share of other retailers’ sales.

Before he had any connection to the company, though, its leaders failed to see e-commerce coming and rid itself of its catalog operations in the ’90s at the exact wrong time.

“All of these assets – whether inherited, acquired or built – are our core strengths.”

The supply of more than a century’s worth of company assets is how Sears Holdings is able to survive long past a point when other companies would have filed for bankruptcy. Those assets include the company brands and real estate that the company has been selling off to fund its continuing (failing) operations.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.