While expensive medical emergencies can hit anyone, anywhere in the U.S., a new report finds that one region of the country has a higher level of medical debt than the rest of the states.

The study [PDF], conducted by the Urban Institute, aims to provide a look at just where consumers with medical debts from 2012 to 2015 are likely to reside.

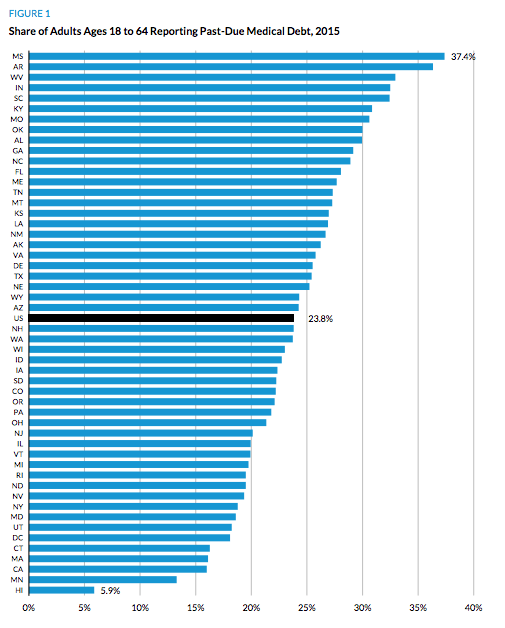

The report, which focuses on non-elderly (under the age of 65) adults, found some improvement in the number of consumers with medical debt. In 2015, 23.8% consumers — or one in four — had past-due medical bills, down from 29.6% in 2012.

Where’s The Debt?

While consumers across the country reported suffering from medical debt, the amount of debt varied by state, with those in the South more likely to hold past-due bills.

According to the report, of the top 10 states with medical debt, eight are located in the South: Mississippi, Arkansas, West Virginia, South Carolina, Kentucky, Oklahoma, Alabama, and Georgia.

The remaining two top 10 states are in the Midwest: Indiana and Missouri.

Conversely, the states found to have the lowest prevalence of past-due debts were spread out geographically. That list includes three Northeast states (Massachusetts, Connecticut, New York); one in the Midwest (Minnesota); four in the West (California, Utah, Nevada, Hawaii); and then there’s D.C. and Maryland, which most people would refer to as Mid-Atlantic, but which are technically in the South census region.

The state with the highest medical debt rate was Mississippi at 37%, while Hawaii had the lowest at 6%.

Cutting The Debt

When examining the rate of past-due bills in states, the researchers found a correlation between the debts and the state uninsured rates, along with the availability of resources such as balance billing laws and consumer awareness.

“Though uninsured people are most likely to report past-due medical debt, many insured adults also reported medical bills that were past due, despite the protection their coverage offers against high medical expenses,” the report states.

For example, 26.6% of consumers with insurance reported having medical debt in 2012, while 39.8% of those without insurance reported the debts.

Despite finding that one-in-four adults faced medical debt, the Urban Institute found that the percentage of consumers with the debt fell by 5.8% between 2012 and 2015.

In 2015, 22.8% of insured consumers said they had medical debt, while 30.5% of those without insurance had the debts.

The report notes that some of these changes could be attributed to the economic recovery and healthy insurance expansion under the Affordable Care Act.

“In particular, expanding access to health insurance coverage has proved an effective strategy for protecting more individuals from medical debt,” the report states.

Additionally, the report notes that state insurance regulations and advocacy awareness have also had an impact on consumers’ medical debt rates.

“Community-based organizations and local agencies can help raise awareness of the consequences and risk factors associated with incurring medical debt, and they can incorporate messages about how health insurance works and why it is important into existing financial education programs,” the report states.

Editor's Note: This article originally appeared on Consumerist.