Maybe Emptier Stores Mean Higher Customer Satisfaction? Image courtesy of cookedphotos

Most retailers are having trouble bringing in foot traffic, leading once-steady brands like JCPenney, Sears, and Macy’s to shutter large swaths of stores. Yet, those customers who continue to shop at brick-and-mortar retailers appear to be happier about the experience.

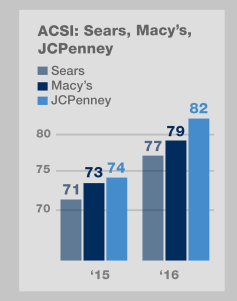

The American Customer Satisfaction Index has released the annual results of its survey for consumer sentiments about the nation’s largest retailers, and despite large-scale closings at Sears, Macy’s, and JCP, scores for each of them are up this year. Sears and Macy’s each improved by six points, and JCP enjoyed an eight-point bump. How could that be?

Scores rose even for retailers that announced drastic cutbacks to their store count and layoffs after the holiday season. Those were mostly department and discount stores. Macy’s rose six points, from 73 to 79, and announced that it would be closing 68 stores shortly after the holidays. Sears rose six points as well, from 71 to 77, but its parent company announced the closure of 150 Sears and Kmart stores at the beginning of the year.

Scores rose even for retailers that announced drastic cutbacks to their store count and layoffs after the holiday season. Those were mostly department and discount stores. Macy’s rose six points, from 73 to 79, and announced that it would be closing 68 stores shortly after the holidays. Sears rose six points as well, from 71 to 77, but its parent company announced the closure of 150 Sears and Kmart stores at the beginning of the year.

During the holiday season in 2016, shoppers shifted a record amount of our shopping online. Maybe, the group that compiles the ratings suggests, shopping is more enjoyable when crowds are smaller. Participants were interviewed between Nov. 15 and Dec. 19, 2016, during the holiday shopping season.

While happier customers generally correlate with better business, it’s also possible that shorter lines and smaller crowds mean faster service and better-stocked shelves, leaving shoppers with more positive feelings about the stores they visit. This could also account for why shoppers give just about all stores higher scores for things like layout and cleanliness: It’s easier to navigate a store and keep it clean when fewer people walk in the door.

“As traditional outlets such as Sears, Macy’s and JCPenney shed properties, shoppers may experience better service in the stores that remain,” ACSI Managing Director David VanAmburg said in a statement. “Although this is obviously not ideal or sustainable in the long run, fewer customers mean shorter lines, faster checkout and more attention from sales staff.”

The Nordstrom drop is an anomaly, and can’t be blamed on the company’s political controversy after dropping Ivanka Trump products. The survey was administered during November and December of 2016, weeks before the First Daughter’s fashion line became an issue. It was around the time that Nordstrom was selling an $85 leather-wrapped rock as a holiday gift, but even a product that silly wouldn’t account for such a large drop.

Target’s score also fell slightly, from 80 to 79. It’s listed among the health and personal care stores with discount competitor Kmart and national pharmacy chains. Perhaps that’s just a reflection of customers who are dissatisfied with the pharmacy changeover.

Last year, Abercrombie & Fitch had the distinction of being the only retailer to score below Walmart. This year, it still brings up the rear among specialty retailers with a score of 76, but that’s four points ahead of Walmart, which, with a 72, has the lowest score of all retailers this year. Abercrombie & Fitch is still finding its way during a massive rebranding effort.

Sometimes, factors beyond retailers’ control affect how shoppers rate them: ACSI credits rising scores across the board for supermarkets to falling food prices more than to anything that the retailers themselves are doing.

If you’re curious about how your favorite retailers did, or want to read the analysis, you can download the report yourself at the ACSI site. The scores for different industries are updated throughout the year.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.