Should Your Job Be A Factor In How Much You Pay For Auto Insurance? Image courtesy of Benoit Cars

While many consumer advocates believe that drivers’ auto insurance rates should be based on factors that only relate directly to their activity on the road, many states allow insurers to use a wide variety of considerations — including education, marital status, homeownership, and occupation — to help set those rates? With one state looking to halt the use of occupation data, we wanted to know what our readers think.

The Wall Street Journal reports that the New York Department of Financial Services has asked four major insurers — Allstate, GEICO, Liberty Mutual, and Progressive — to explain why they believe the state should not bar auto insurance companies from using job-related information as a factor in determining a driver’s insurance rates.

Supporters of the use of this data contend that people with certain occupations do indeed present a lower risk for claims, even if it’s because a well-paid doctor may choose to go out of pocket for a repair rather than turn to their insurer.

Critics believe that the use of factors that don’t directly relate to driving is not scientifically proven, and often results in lower-income Americans paying higher premiums than they should if rates were based primarily on driving records.

“As long as state governments require drivers to buy insurance, they should require insurance companies to price their product based on how we drive, not who we are,” J. Robert Hunter, former Commissioner of Insurance for Texas and the current Director of Insurance for the Consumer Federation of America, tells the Journal.

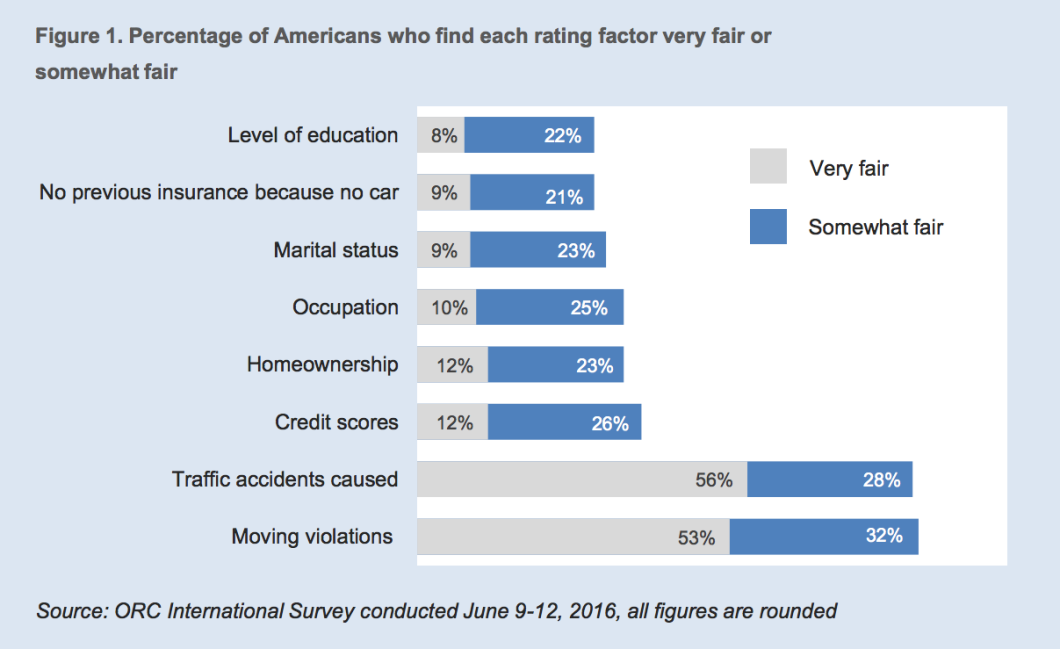

Earlier this year, the CFA undertook a nationally representative survey on consumers’ feelings about non-driving factors that are used to set insurance rates.

As you can see from the chart below, only around 10% of respondents thought it was “very fair” to use occupation, while another 25% thought it was “somewhat fair,” leaving 65% of respondents who believed this practice to be at least “somewhat unfair.”

So we wanted to see if our readers felt similarly:

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.