Your Cable Company Will Probably Give You Free HBO For A Few Months, But Good Luck Getting The “New Customer” Rate Image courtesy of Kenneth Rogers

For years, we here at Consumerist HQ have heard anecdotal claims that negotiating for a better rate from your cable provider is no longer as simple as it used to be. The discounts weren’t as deep, people would say, the offers were on the weak side, and in the wake of bad PR, companies have seemed more willing to call customers’ bluff and let them cancel service painlessly. Of course, anecdotes do not equal data, so we wanted to know: is this actually a thing?

We asked, and you, our readers, answered — over 3,300 of you all told. (Thank you!) And the news, it turns out, is a lot rosier than we thought. Across the board, the majority of customers appear to stand a pretty good chance of gaining at least some benefit from calling and asking… unless they’re with Charter.

About Our Methodology

Image courtesy of Karen ChappellFirst things first: This was not a properly scientific or nationally representative survey. Still, we gleaned a lot of information — enough that it’s definitely still useful for starting the conversation.

Of the more than 3,300 responses received, in excess of 2,800 met three conditions: The survey was complete; the respondent lived in the U.S.; and they had attempted to negotiate with their cable, satellite, or telecom provider at some point.

Comcast subscribers accounted for about a third of all those responses, which is not too surprising, since Comcast is the nation’s largest cable/broadband provider. The merged DirecTV and AT&T have more customers total, but the large majority of those subscribers are satellite and not broadband.

The merger of Charter and Time Warner Cable is creating a broadband provider that’s close in size to Comcast, but the survey involves attempts to negotiate cable/internet bills before the two companies merged.

To reflect the complicated situation with newly consolidated providers, we have kept the survey respondents’ data separate, but analyze the results for recently merged companies under combined headers below.

We asked respondents two important questions about their attempted negotiations to gauge how — or if — things have changed over time.

First — when did you negotiate? The available time frames were: more than two years ago; more than one year ago but less than two years ago; or within the last 12 months. Consistently, across all providers, the majority of customers who responded had negotiated within the last year. Still, about a third of our responses came in from folks reporting outcomes from more than 12 months ago.

We also asked “What was the outcome of negotiation?” and provided a variety of outcomes. When crunching the data, we took all those answers and broke them down into two broad categories of “positive” and “negative.”

Positive outcomes included: receiving a discount or lowered rate on existing services (e.g. “We’ll drop your internet price by $10”); receiving additional services without extra charges (e.g. “Here’s some free HBO for a few months”); or receiving a “new customer” introductory rate. That’s the promotional rate cable companies advertise to attract new customers and can sometimes be as little as half the eventual rate.

Negative outcomes included those where the caller received no benefits, and either (A) stuck with the status quo, or (B) cancelled part or all of their service.

Respondents were able to select multiple outcomes, and so we were generous with our assessment count. Every response that included any positive outcome went into the “positive” column, even if it also included a negative outcome. After all, those customers still got something, even if it wasn’t terribly satisfying.

One last caveat, before the juicy bits: it’s worth noting that Consumerist readers are, by and large, a smart and savvy group. (You’re also all very good-looking.) Your interest in, and familiarity with, consumer issues could mean that our regular readers may be more likely to successfully negotiate a deal than customers who don’t regularly concern themselves with consumer issues.

And Now, The Results

Image courtesy of Great BeyondWith all that out of the way: What did we see?

We were able to identify a couple of key trends. One is that customers’ overall ability to negotiate appears to be pretty stable over time — our findings were very much in line with regular, more scientific surveys from our colleagues down the hall at Consumer Reports. Customers are having about as much luck in recent months as in any of the previous years this decade.

But that comes with an asterisk — your likelihood of success varies pretty widely by provider, and that brings us to the other trend: it seems like you’re most likely to have success with satellite providers who, probably not coincidentally, are the ones facing the most competition, as they are generally available in every market while even the largest cable companies have limited footprints.

So… Let’s break it down by provider.

Comcast

Comcast, according to the responses, has stayed pretty stable over time. Overall, about two-thirds of the customers who negotiated — in any time frame — were able to see some kind of positive outcome. The other third, not so much.

Comcast, according to the responses, has stayed pretty stable over time. Overall, about two-thirds of the customers who negotiated — in any time frame — were able to see some kind of positive outcome. The other third, not so much.

Far and away the most common positive outcome for Comcast customers involved receiving a discount or lowered rate on existing services; just over 40% of respondents who negotiated with Comcast in any time frame reported getting that.

Trailing in a distant second — at roughly 20% — were folks reporting the “extra stuff without new charges” option. Receiving a new customer rate was, in comparison, very uncommon, ranking dead last for outcomes overall (including both positive and negative).

Of the third who didn’t get anything out of negotiating, roughly half cancelled one or more services (cut the cord); the remainder maintained their service as it was.

Bottom Line: While the success rate with Comcast shows that a discount or other freebie is not guaranteed, the overall trend seems to indicate that it couldn’t hurt to ask.

Charter & Time Warner Cable

Charter is notable among the companies we broke out data for in one strong and unpleasant way: it’s is the only one where respondents had a greater chance of striking out than of seeing success. More than 50% of Charter negotiators received nothing at all for their trouble; only 46% saw any kind of success whatsoever.

Of those who did have success with Charter, a discount on existing services was once again the most common outcome. Barely a handful of Charter customers reported receiving new customer introductory rates or getting additional services.

It’s difficult to say whether the Charter responses are representative of a historical trend, as the large majority of Charter customers we heard from were folks who had tried negotiating a deal within the last year; our sample of customers who negotiated more than two years ago was very small. So while you can definitely look at whether it is or isn’t working now (it’s not), it’s best to not infer a definite trend.

While Time Warner Cable respondents reported higher rates of success than their new corporate kin, the percentage (45%) of TWC subscribers who said they received some kind of discount on existing services was about the same as Charter. The remaining successful TWC negotiations showed significantly smaller populations getting extra free stuff or that sought-after introductory rate.

Bottom Line: So while there may not be very much for customers to miss about the much-loathed TWC as it starts to fade from view, there’s the possibility that your likelihood of snagging a better deal might get left by the wayside along with other promised improvements from TWC.

Bright House Footnote: An often overlooked piece of the Charter/TWC merger was Charter’s simultaneous acquisition of Bright House Networks. Given that company’s small size, it’s not surprising we received very few responses from Bright House subscribers. With that tiny sample size in mind, the success rate for these Bright House customers who negotiated was around 70% — also significantly higher than for Charter.

Let’s hope that Charter adopts its new partners’ flexible negotiation policies, but not TWC’s horrendous customer service.

AT&T and DirecTV

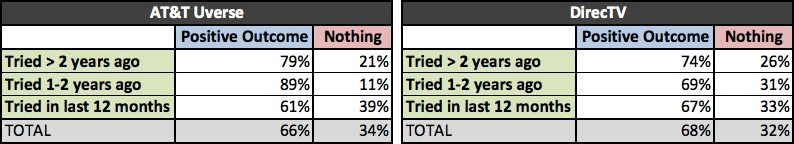

The merger of AT&T and DirecTV was approved just over a year ago, but combining the operations of a massive satellite service and a terrestrial cable company is going to take some time. Yet for all the differences between AT&T and DirecTV, subscribers to each service seemed to have very similar experiences, reporting nearly identical success rates (66% and 68%, respectively), with roughly two-thirds of respondents saying they received something for their efforts.

An identical percentage (44%) of negotiators with both companies reported receiving a discounted rate on services. Likewise, an almost identical percentage — 21% for DirecTV and 22% for AT&T — received additional services without extra charges.

Bottom Line: Once again, though, only a very few very lucky consumers managed to snag a new customer rate. For AT&T and DirecTV combined, fewer than 5% of negotiators reported that they received that outcome. More DirecTV customers than AT&T customers managed to swing it, but it’s a serious long shot either way.

Verizon FiOS

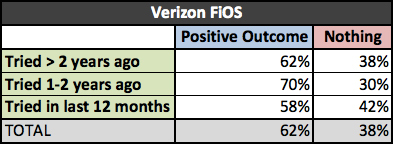

FiOS is the only all-fiberoptic service here, but in terms of the odds of successfully negotiating a better deal appear to be about the same as old-fashioned coax cable and satellite.

FiOS is the only all-fiberoptic service here, but in terms of the odds of successfully negotiating a better deal appear to be about the same as old-fashioned coax cable and satellite.

Generally, FiOS customers reported around a 60% chance of success on average. Once again, our pool of responses from more than two years ago was too small to label this figure a solid historical trend, but in the last year or two that average has still held true.

Once again, the most common outcome (37%) for FiOS customers was to receive some kind of discount or lowered rate on existing services. However, almost equivalent numbers of subscribers reported receiving no benefits (and keeping their service) as reported receiving some new freebie or upgrade.

Bottom Line: Managing to get a new customer rate was, once again, very rare for Verizon subscribers — although percentage-wise, not quite as bad as for other companies. Fewer than 1-in-10 of our Verizon respondents say they managed to negotiate for an introductory rate.

Dish Network

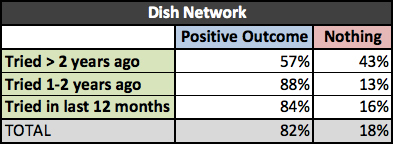

Dish Network subscribers who try to negotiate appear to have the easiest time of it.

Dish Network subscribers who try to negotiate appear to have the easiest time of it.

Overall, more than 80% of Dish subscribers say they received some kind of benefit when they called up the satellite company — far and away the highest percentage from any of the companies, large or small, whose subscribers we heard from.

Dish also had a huge skew, as compared to other providers, when it came to what outcome customers received. Slightly more than 60% of Dish subscribers said they were able to negotiate a lower rate on existing services. Compare that to the 40% average for all respondents.

As typical with other providers, though, other outcomes were unlikely: Only approximately 18% of Dish negotiators received some extra goodie for free, while very, very few managed to receive a new customer introductory rate.

Parting Thoughts: The Future Of Cord-Cutting

Image courtesy of Ingrid TaylarUnless our readers are truly unrepresentative of the typical American consumer, it looks like things do often work out for customers who ask.

The overall aggregate, including all of the “other” responses from companies we didn’t break down here, fell about the same way as all of the companies dissected up above did.

About two-thirds of all the consumers who tried to negotiate got at least one positive outcome, and about a third got nothing. No one reported having their cable company jack up the price just because the customer tried to negotiate a better deal, so if your bill is too dang high, you certainly don’t have anything to lose from calling up customer service to what can be done.

Perhaps more interesting, though, were the results of some of the demographic questions we asked at the end. Maybe, over time, cable companies will get more interested in negotiating, rather than less — because for them, it seems, the writing’s on the wall.

At the end of the survey, we asked a question about consumers’ cord-cutting status: Are they happy with their service? Are they considering cutting the cord? Did they already? Inquiring minds want to know!

And boy, did we find out. About 17% of our poll-takers said they already cut the cord; another 27% said they were not considering cutting any service in the near future.

But a whopping 51% of our total respondents — across all providers, all outcomes, all everything — identified themselves as current subscribers, “but considering cord-cutting in the near future.”

It’s not just the youngun’s or those crazy snake-people millennials disconnecting, either. Of those who were contemplating the cut, 39% identified as ages 50-64, another 21% identified as ages 40-49, and 19% identified as 65+.

In short: More than 75% of those who told us they were considering cord-cutting in the near future were at least 40 years old — supposedly the golden demographic of consumers who will keep sticking with pay-TV.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.