Supermarket Chain Sues Credit Card Companies Over Costly Chip Card Delay Image courtesy of (Ciaran McGuiggan)

Nearly five months ago, new credit card rules went into effect making retailers liable for fraudulent purchases if they haven’t upgraded their checkout technology to accept more secure, but far from perfect, chip-enabled cards. While some retailers have installed the card readers, many haven’t turned them on. But according to a new class-action seeking lawsuit, it’s not their fault.

Florida-based B&R Supermarket filed a lawsuit against credit card issuers Visa, MasterCard, American Express, and banks such as Wells Fargo accusing the companies of breaking antitrust laws by delaying the certification process for EMV systems in order to make small businesses pay for fraud liability as long as possible.

According to the lawsuit [PDF], B&R Supermarket, which owns Milam’s Market and Grove Liquors, followed the new rules to a “T”: bought new card readers, installed them, and trained its staff to use them “well prior to the liability shift.”

But the company claims it’s been hit with $10,000 in liability for fraud, chargebacks, and chargeback fees since the Oct. 1, 2015 shift.

Those costs are a result, the company claims in the suit, of never being “EMV certified” by the card-network consortium that has been managing the rollout, despite having notified the card networks and issuers that B&R Supermarket companies were ready to be certified.

B&R claims that the consortium, which includes Visa, MasterCard, and American Express, have purposefully delayed certifications for small businesses so that don’t have to pay for liability charges.

“The ‘certification’ process is controlled by the very entities that benefit from the Liability Shift and it is the primary means through which defendants’ illegal conduct has been able to flourish,” the complaint states. “The result has been massively increased costs for chargebacks being laid at the feet of the Class members, while the Issuing Banks have been spared those same costs and the Networks have continued profit—just as defendants knew would happen.”

B&R claims that the card issues and networks responsible for the shift knew it would never happen by Oct. 1.

“Defendants knew that the verification process would not be fully operational by Oct. 1, 2015, but implemented the Liability Shift knowing that merchants who purchased and installed equipment would be bearing the cost of the Liability Shift for fraudulent transactions even after they purchased and timely installed approved EMV chip-reading equipment,” the complaint states.

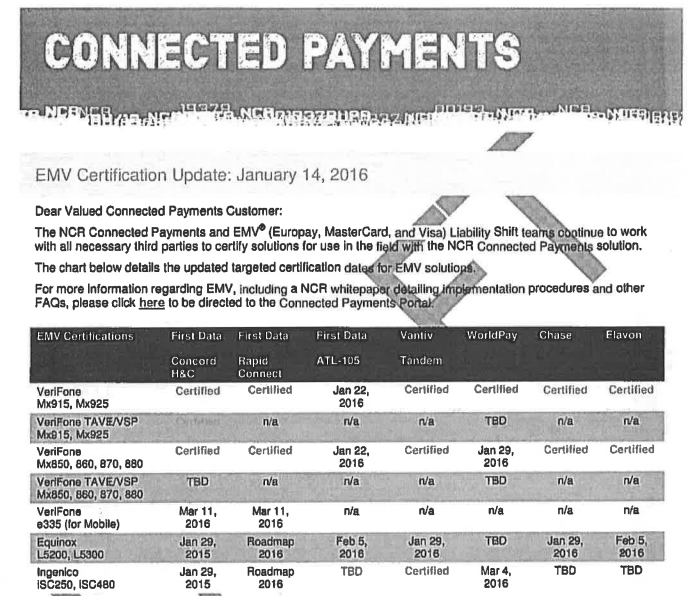

As an exhibit in its lawsuit, B&R included a draft notice from system creator NCR and EMV consortium liability shift teams that shows target dates for certification of the NCR Equinox L5300 card readers — installed at the supermarkets — wasn’t expected until January or February 2016; three to four months after the liability shift took place.

The company says that the $10,000 in costs it’s incurred include stiff charge back fees of $5 for each charge it is found to be liable for. For example, a fraudulent charge of $17.99 means the market has to pay $22.99 to settle the liability.

Prior to the liability shift, the company says it was only charged for four chargebacks.

“Tellingly, nothing Milam’s Market could have done—short of making the business-crippling decision to stop accepting Visa cards—could have prevented this outcome,” the complaint states.

The Florida-based company has asked for class-action certification, alleging that other small businesses have also suffered financially from the slow certification process, noting that costs could run into the billions of dollars overall.

“While very large retailers such as Target, Walmart, and others quickly had their EMV-processing systems ‘certified’—thus sparing them the Liability Shift—the members of the Class are at the mercy of defendants,” the complaint states. “Merchants like Milam’s Market and Grove Liquors have no control over the ‘certification’ process. All they can do is request ‘certification’ and wait for it to occur. And no one can say when that will be.”

In addition to asking for class-action status, B&R is seeking an injunction ordering card issuers and networks to “halt imposition” of the liability shift until proposed class members receive certifications that they are compliant with the chip-enabled system.

A spokesperson for MasterCard tells ArsTechnica says the company is currently reviewing the claims.

“What I can say at this point is what we’ve said since introducing our roadmap in early 2012,” the spokesperson says. “There was never a requirement for any party—issuer or merchant—to move to EMV. Using insights from merchants, issuers, and others, our roadmap and the related liability shift provided incentives to prompt for the most secure ways to pay. We have and continue to work with parties across the industry—merchants, issuers, processors, manufacturers—to assist in this migration.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.