We’ve already seen that unconscious patients can end up with huge medical bills when an ambulance takes them to a hospital that doesn’t accept their insurance. But even if you’re conscious enough to point the driver toward the right hospital, you could still be stuck owing hundreds, even thousands, of dollars because that ambulance ride isn’t covered by your insurance.

As a sheriff’s deputy in his Rocky Mountain community, Don* regularly serves others with bills or summons from hospitals, doctor’s offices, or law firms related to medical services. But when Don’s wife needed an emergency lift to the hospital, even he didn’t expect that the short ambulance trip would result in thousands of dollars in bills.

Don, whose wife has since passed away, says that he’s come to learn more than he ever dreamed he would about medical transports and the resulting bills.

“I just could not believe the flood of bills that we’d get,” he recalls. “After the first experience with the ambulance, I didn’t do that anymore. I’d carry her and put her in the car.”

Don’s story is no outlier. Nearly 600 individuals from around the country have submitted their stories of surprise ambulance bills to our colleagues at Consumers Union.

A Matter Of (Bad) Luck

Just as we saw with surprise hospital charges, the unexpected ambulance invoices are often the result of a common practice known as “balance-billing.” That’s when an out-of-network healthcare service provider — surgeons, anesthesiologists, technical specialists, among others — will bill patients for the amount that remains after the insurance company only pays part of the invoice.

Surprise bills are particularly troublesome for emergency room visits, where patients don’t have the time or ability to check that every person they see is part of their insurance network. And the same holds true for ambulance rides to the ER.

When someone calls 911 for an ambulance, the operator will frequently dispatch a municipal EMS provider. Time is of the essence in an emergency (as indicated by the very use of the word “emergency”), so patients and loved ones aren’t often in any position to ask or care whether the ambulance is operated by the in-network hospital or a by an out-of-network third party.

“When you call 911 you might get lucky and get a service that has a connection to your insurer,” Jack Hoadley, a health policy analyst at Georgetown University tells Consumerist. “If you’re unlucky, you don’t.”

Lois, from a small town in Texas, tells Consumers Union that her husband required a medical transport to a hospital.

“Insurance covered less than half the cost of ambulance travel, leaving $1,600 above the deductible,” she recalls. “The insurance paid at what they considered reasonable and customary.”

Pat Jolley, Clinical Director of Research and Reporting for the Patient Advocate Foundation, tells Consumerist that Don and Lois’s situations are typical when it comes to ambulance billing.

“I think a lot of the bigger bills we see are for emergency situations where someone has a heart attack and you call an ambulance and it’s not in-network,” she says. “When the claim is submitted to insurance they’ll pay whatever the in-network rate would be, then the remainder is the patient’s responsibility.”

That’s just how things work, she says. “There’s a dollar limit that insurance will pay.”

No Transport Needed

When Connecticut resident Lisa decided to embark on a road trip to visit her sister in Ohio, she assumed she would incur a few costs: hotel, food, souvenirs, and other travel-related expenses. What she didn’t expect was to receive a $200 ambulance bill for a ride she never took.

While driving on I-80 in Pennsylvania, Lisa ran into a bit of snow. After traveling further down the road, the weather passed, and she thought she was in the clear. She was wrong.

“In the future, I’ll know that if nothing’s wrong don’t even get in.”

“Something went wrong,” she tells Consumerist. “I pulled to the right at about 70 miles per hour and the car just pulled real hard, flipping over, end-over-end, and side-over-side before it stopped upside-down.”

While Lisa says she didn’t need medical care, people who witnessed the accident did what any other good Samaritans would do when spotting a car go off the road like that: they called 911.

“Believe it or not, I had no injuries,” Lisa tells us. “Two guys pulled over, asked if I was alright, and one had called an ambulance.”

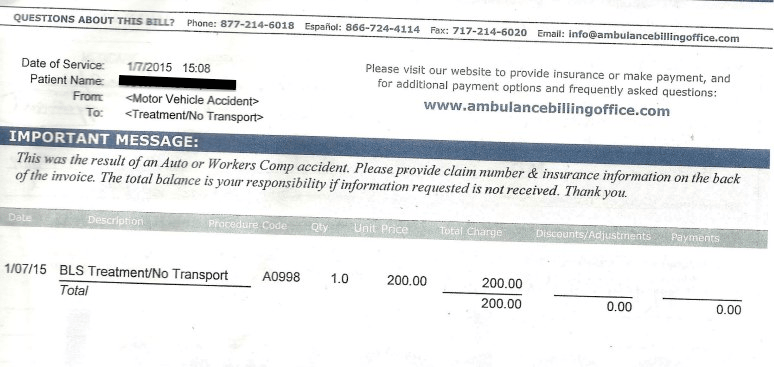

When the ambulance arrived, Lisa says they checked her out, called a local hospital, and allowed her to skip a trip to the hospital.

The rest of Lisa’s trip went by as planned, but when she returned home she found something waiting for her in the mailbox: a bill from the ambulance company, along with a note informing her insurance wouldn’t cover the costs.

Lisa immediately made a call to her auto insurance, which told her they wouldn’t cover the cost, but perhaps her health insurance would.

“Medicare said they would cover the cost only if I had gone to the hospital,” Lisa tells Consumerist. “My secondary insurance stated the same thing. They said that’s just the way it is, that’s their rule. They have guidelines that they follow and that’s one of them, ‘Too bad so sad.'”

So despite having three types of insurance — auto, Medicare, and private insurance — Lisa ended up paying the bill out-of-pocket, after successfully negotiating with the company to lower it to $200.

“It was cheap compared to some ambulance bills, but I was in there for only three minutes,” she says. “In the future, I’ll know that if nothing’s wrong don’t even get in.”

But Jolley tells Consumerist that even if Lisa had declined all treatment from the ambulance crew, she would probably still have been billed for something.

“Even if they go on standby at the site and determine that you don’t need transport you can receive a bill,” she cautions. “Unfortunately, they can do that.”

Jolley says that the only real options for Lisa and others in her situation would be to try to negotiate with the ambulance company, or file an appeal with the insurance company.

From Hospital A To Hospital B

Todd*, of California, is no stranger to the ins and outs of health insurance. His wife, who has a history of coronary artery disease, has spent her fair share of time in the hospital, at clinics, and unfortunately, inside an ambulance.

A few years ago, his wife began experiencing chest pain, so the couple decided to visit urgent care.

“When someone goes in with that history, they get excited and the doctors said we needed to go to the hospital,” he tells Consumerist.

Because the couple was already at a health facility, coupled with his wife’s health history, they weren’t allowed to simply drive themselves to the hospital. Instead, the clinic ordered a transfer via a private ambulance specializing in cardiac care.

“She didn’t need it,” contends Todd. “She was not having a cardiac event, but we had to. They are so afraid that if they release you too soon something is going to happen.”

The couple, who had “terrific” insurance, was nevertheless surprised to receive a $1,100 bill.

“They never spoke to us about pricing — of course no one in health care talks about pricing — and they said nothing about insurance coverage,” Todd says. “So we didn’t think to worry about whether it was an out-of-network transport.”

But because this specialty provider was not a contractor with the hospital, they billed Todd and his wife directly for the balance not covered by their insurance.

The hefty bill came as quite a shock to Todd and his wife, especially since their insurer had covered previous high-priced ambulances, including trips with city EMS and that time they needed an air ambulance transport with a $38,000 price tag.

“They said there was nothing they could do about it,” Todd explains. “After about two years of back and forth with the insurance company, they said they would send it to collections, so we paid it.”

What makes Todd’s story even more interesting is the fact that he used to work in ambulance billing, often encouraging the companies he worked for to balance bill.

“It’s the way to actually get some good revenue, because insurance companies and medicare doesn’t pay what it costs to run an ambulance company,” Todd tells Consumerist. “But I never informed them not to advise the patient.”

From both his personal and professional experience, Todd now advises others to always ask questions if they want to protect themselves from costly ambulance bills.

“We fought them on this and we said that it wasn’t right that we be charged for an ambulance when this wasn’t really an emergency.”

“They need to know whether or not a service is going to be covered by insurance,” Todd says. “And if it’s not, then what the cost will be.”

Todd’s experience isn’t just a one-off, either.

Across the country in South Carolina, Vicki’s husband experienced chest pain and required an ambulance transport from one hospital to another.

“We tried to get into see his primary care physician, but they told him to go to the ER,” Vicki recalls. “He drove himself there and I went there a bit later.”

After keeping tabs on his vitals for several hours, the physicians decided he needed to be monitored overnight. The only catch? The hospital he was currently at couldn’t accommodate him. Instead he’d have to go to another facility.

“He would have to go by ambulance because of all the sensors attached to him,” Vicki wrote. “We fought them on this and we said that it wasn’t right that we be charged for an ambulance when this wasn’t really an emergency.”

In the end, the couple relented and they were transported to the other facility, where they never found out the reason for her husband’s pain.

“Insurance did not pay for the ambulance bill and it has been very hard for us to pay it off,” she says of the resulting $850 transport bill.

Jolley tells Consumerist that both Todd and Vicki’s stories are in line with typical ambulance transport policies.

In these situations, it often comes down to a hospital’s liability or potential liability. Most facilities have policies in line not to allow a patient to drive themselves to another hospital.

Chuck Bell, a project director with Consumers Union, tells Consumerist that if the transfer isn’t deemed too time sensitive, a patient may have the opportunity to call their insurance provider to find out if a transport is covered.

“I have heard of situations like these; there’s not much you can do,” Bell says. “You could try to discuss the bill with the hospital after the fact and ask for a reduction, because you had no choice in the matter.”

An $1,100 Ride Home

When you think of an ambulance, it usually involves taking a patient to a hospital, or transporting critically ill patients between facilities, but ambulances are sometimes used to bring a patient home — even though some insurance policies won’t cover such return trips.

James, from Washington, had to deal with an unexpected ambulance bill after his 93-year-old mother fell and was transported to the ER. More accurately, he was hit with the bill for the transportation away from the hospital.

His mother’s insurance covered the ride to the ER, where she was treated for a broken nose, but not admitted. But then the hospital decided, without checking with any family members, that his mother should also get a return ambulance ride.

“The ER authorized the ambulance to transport her back to the home,” James says of the unusual circumstance. “The ER apparently wanted her out and did not take the time to call us to arrange transportation.”

By authorizing the return ambulance trip, which wasn’t covered by her insurance, the family got stuck with the $1,100 bill for a 6.7 mile ride. That’s more than $164 per mile, which could have been avoided if someone had just made a phone call — or even flagged a taxi.

Jolley tells Consumerist that an ambulance ride home is more unusual, unless there was a medically necessary reason, like a person needing to be transported flat.

“That would be considered elective,” she says, noting that in some cases insurance won’t cover elective transports.

Had James been notified about the transport, but unable to pickup his mother, Jolley suggests the family could have looked into a senior van transport that may have charged less.

Still, she says there are usually discharge planners at hospitals that help patients arrange transport home.

It Comes Down To Contracts And Money

As with other health services, how much you’ll pay out-of-pocket for an ambulance trip is dependent on your insurance network. Coverage agreements between insurance companies and ambulance services vary dramatically from provider to provider depending on where you live.

An analyst for a large insurance provider tells Consumerist that one reason consumers see high costs when it comes to ambulance bills is because of exclusive contracts some communities have with providers.

“This means that the prices are regulated, but it also means that there is a monopoly,” he explains. “In some places, that applies to private contracts as well.”

Unlike freelance ER doctors who could, in theory, offer their services to any hospital, ambulance services often fall under one of two major categories. Private ambulance companies generally focus on handling non-emergency transport — carrying patients between hospitals, nursing homes, and other care facilities — while municipal and EMS services respond to 911 calls and other emergency situations.

Priceonomics reported in 2013 on a case in Texas, where Austin-Travis County EMS is the exclusive provider of 911 ground response and transport in the county. Because the county EMS is publicly funded and barred from entering into contracts with insurance companies, this effectively means all ambulance services in Travis County are out-of-network.

Paying For Just-In-Case

According to a 2012 report by the U.S. Government Accountability Office, an ambulance ride can range from $224 to $2,204 per transport for Medicare beneficiaries.

Our insurance expert explains that some of the variability in ambulance costs is due to the fact that its an on-demand business that always has to be ready.

“They are on-call whether there is a need or not,” he says.

According to the Kaiser Health Network, some insurance companies believe ambulance providers choose not to contract with insurers because they wouldn’t be able to recoup as much for their services as they can when they bill patients as out-of-network providers.

Some ambulance service providers counter that argument, contending that the reimbursement rates are too low to make joining networks cost-effective.

In-Network Doesn’t Mean Out-Of-Trouble

Even if your insurance considers an ambulance service in-network, you still might be stuck with a hefty bill. That’s because, as Kaiser Network points out, some reimbursements only cover half of the charges.

In those cases, the provider can still balance-bill a patient, depending on where they live. Some states have laws that protect consumers from balance-billing, while others have tried and failed to enact such protections, Jack Hoadley, the health policy analyst at Georgetown University, tells Consumerist.

Fighting Back

No one expects you to research ambulance providers while you’re putting your severed hand in a cooler, but healthcare advocates urge consumers to investigate their coverage now, so they have some idea of what to expect if they do call 911.

“Given the high cost of healthcare and the amount of hassle that might happen when fighting insurance, it’s definitely worth checking out,” Bell, the project director with Consumers Union, tells Consumerist. “Just as you’d want to know if the hospital in your area is in-network, why not find out what ambulances are in-network?”

Bell acknowledges that there is the possibility that you might not have a choice of ambulance providers in your area.

“Still, having that information is better than not having it,” he explains.

In less-dire situations where the need for an ambulance might be debatable, a phone call might help you avoid or minimize a surprise ambulance bill.

“In the event that it might not be a true emergency — if you don’t feel like your life is in jeopardy — then the insurance company might have a nurse advice line you can call,” Jolley says. “If you talk to them and they say ‘Call 911’ or an ambulance, then they will have documentation that they advised that, so that could assist in getting the claim paid later.”

Down, But Not Out

If you’ve already received an unwanted surprise ambulance bill in the mailbox, it doesn’t mean you’re necessarily on the hook for that balance listed.

Jolley reminds consumers that they have the right to appeal how much of a claim was paid by insurance.

If an appeal doesn’t work, patients can alway try to negotiate with the ambulance company, Jolley tells Consumerist.

“Consumers need to remember that ambulance companies have charities and financial assistance programs to help with out-of-pocket costs, but you have to ask.”

Speak Up

Beyond doing the research to learn what your insurance company will and won’t cover when you have an emergency, you can also add your voice to Consumers Union’s campaign to end surprise medical bills.

CU also has an online insurance complaint tool that points consumers where they need to go to file an insurance-related complaint in each state.

*Per their request, we have not used Don and Todd’s actual names.

Editor's Note: This article originally appeared on Consumerist.