Data Shows Borrowers With Less Student Loan Debt More Likely To Default

When you hear about someone defaulting on their student loans, you might assume this borrower took out several tens of thousands of dollars to pay for their education. But a look at the data shows that those borrowers who are most likely to default are often the ones who owe the least.

When you hear about someone defaulting on their student loans, you might assume this borrower took out several tens of thousands of dollars to pay for their education. But a look at the data shows that those borrowers who are most likely to default are often the ones who owe the least.

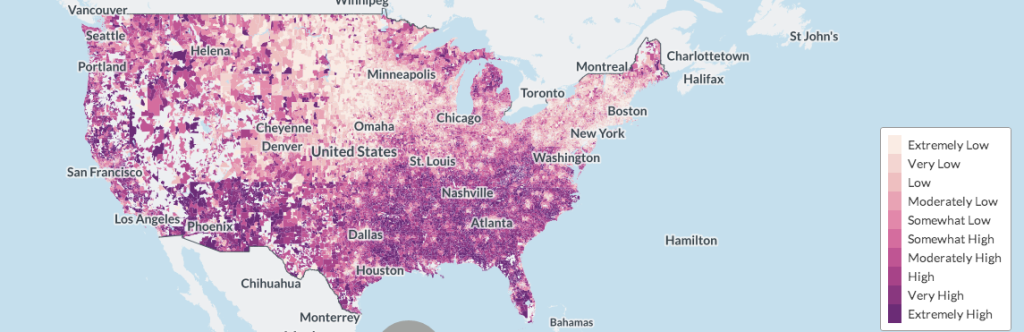

The interactive Mapping Student Debt tool from the Washington Center for Equitable Growth shines a spotlight on the relationship between where a borrower lives and their odds of defaulting.

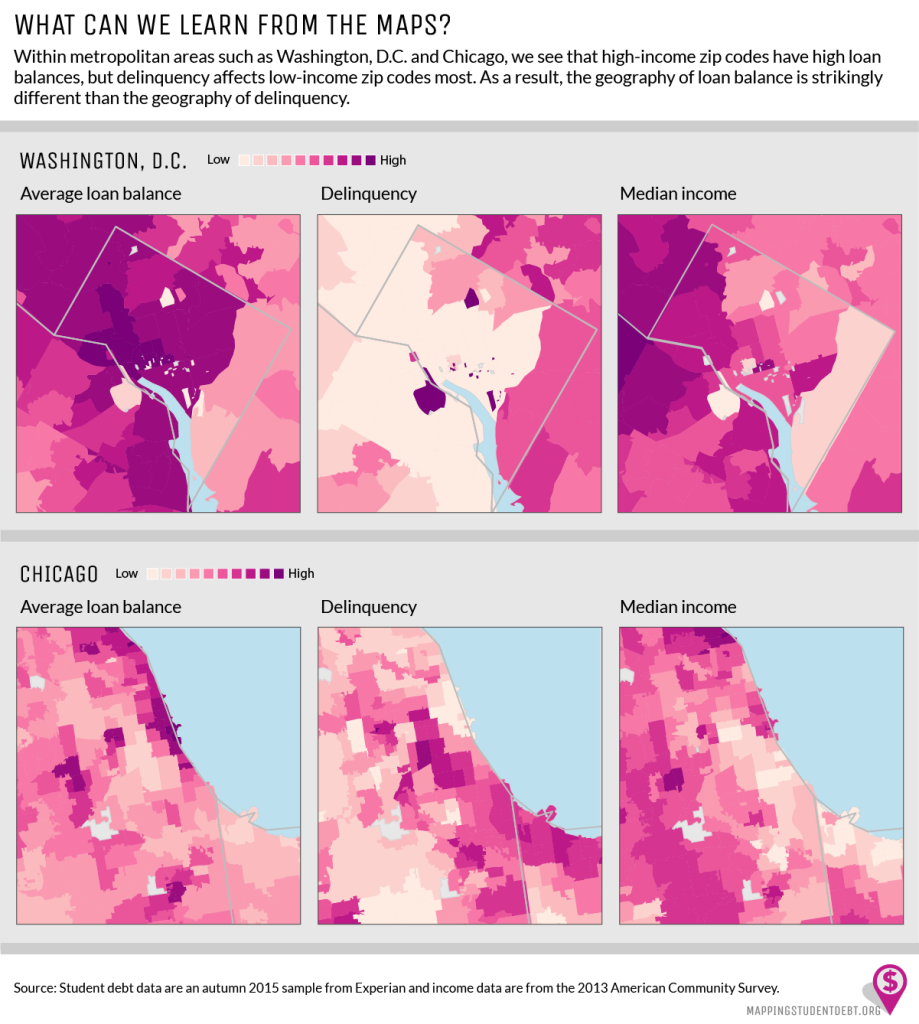

For example, in the Washington, D.C. metro region, ZIP codes with high average loan balances (western and central Washington, D.C.) the delinquency rates are lower. Median income is highest in these parts of the city.

Conversely, in ZIP codes with smaller loan balances – typically eastern D.C., the median income is much lower and delinquencies are much higher. The same pattern could be found in Chicago.

The rate of delinquency was higher in areas of D.C. and Chicago that had lower-income households and lower rates of debt. (courtesy of Higher Ed, Not Debt)

An examination of the data by Marshall Steinbaum and Kayva Vaghul with the Washington Center for Equitable Growth proposes that this finding is a result of the meager prospects members of these lower-income households face in the current labor market.

According to the data analysis, the country as a whole illustrates an inverse relationship between ZIP code income and delinquency rates: as the median income in a ZIP code increases, the delinquency rate decreases, and conversely, when income decreases, delinquency increases.

While the map shows the perceived inequity between low-income and higher-income areas when it comes to the ability to repay loans, it also illustrates that even consumers in higher-income areas feel the burden of heavy debt loads.

“Student debt repayment may also delay expenditures that are associated with the traditional economic lifecycle, such as owning a home or a car or even getting married,” Steinbaum and Vaghul write. “Altogether, this new expense associated with attaining a middle-class income contributes to the erosion of middle-class wealth across generations.”

Suzanne Martindale, attorney with our colleagues at Consumer Union, suggests that the new data implies that it’s not the size of a loan balance that’s the main predictor of debt.

“Rather, it’s more likely that those who are struggling with their loans have come from disadvantaged backgrounds and may not have gotten an education that enables them to earn enough money and thereby repay their loans, even if the balances are relatively small,” she says.

In all, she says the map, and its wealth of data, shows that what we think intuitively about the issue of student debt may not be the real story after all.

“So many commentators claim that the source of the education debt crisis is coming from ‘irresponsible kids’ borrowing tens of thousands of dollars to go to fancy schools,” she says. “But this map shows that’s not the case at all. The people most vulnerable to falling behind on their loans come from low-income backgrounds, and aren’t borrowing as much as their affluent peers.”

If these borrowers are falling behind on modest loan payments, Martindale says we need to change our thinking: why didn’t they get an income boost as a result of getting an education?

One possibility? The type of schools students in lower-income areas attend. For-profit colleges – many with spotty records and high tuition rates – have been known to target disadvantaged communities.

Martindale says this adds to the circumstantial evidence of the harm such schools pose to students.

An introduction to the geography of student debt [Washington Center for Equitable Growth]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.