Why Dish’s Sling TV Is A Factor In Pending Comcast/Time Warner Cable Merger

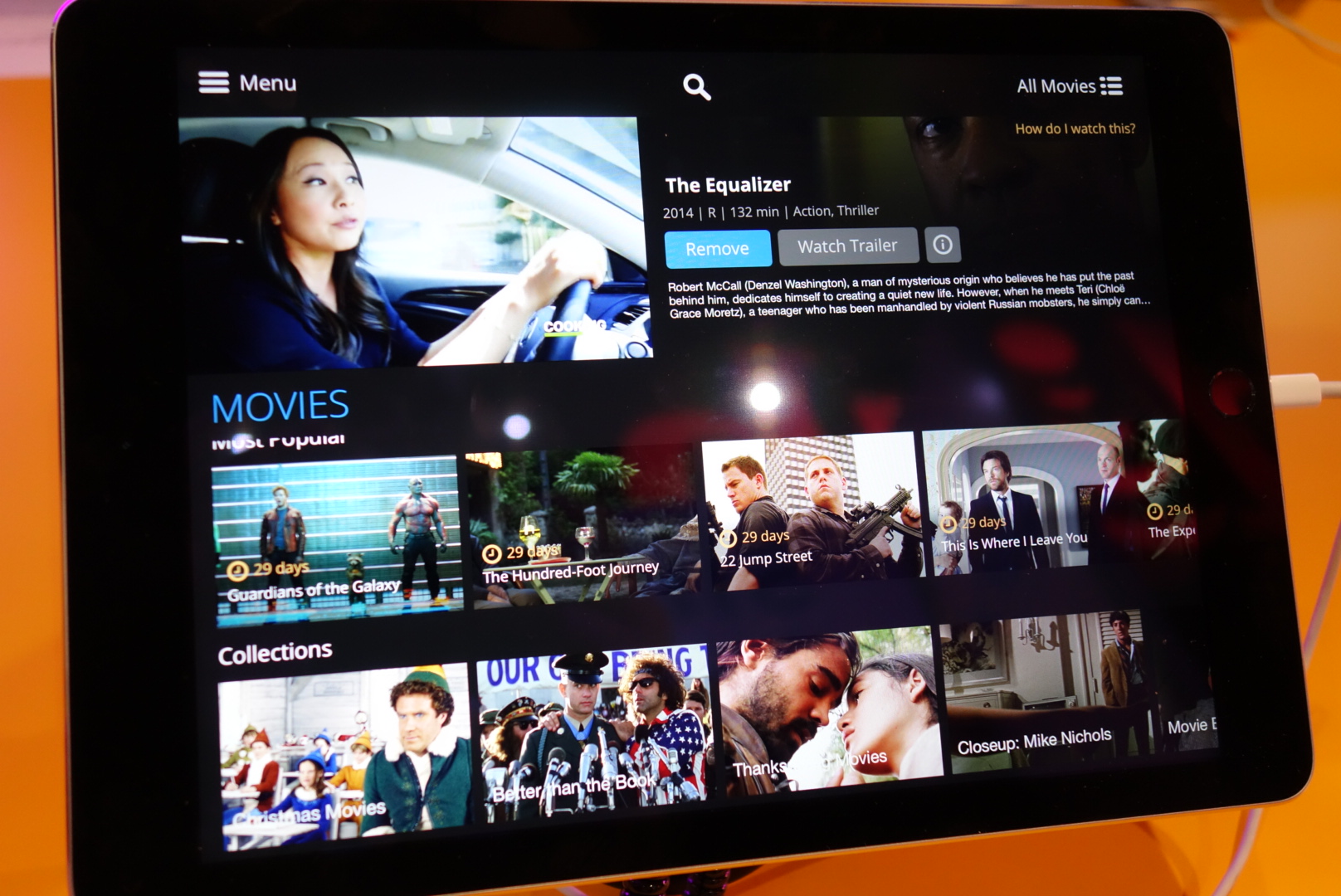

Later this month, Dish will finally launch its much-awaited Sling TV streaming service that gives subscribers live online access to a dozen cable channels. And even though Sling has yet to go live, it’s already being factored into the pending mega-merger between Comcast and Time Warner Cable.

Later this month, Dish will finally launch its much-awaited Sling TV streaming service that gives subscribers live online access to a dozen cable channels. And even though Sling has yet to go live, it’s already being factored into the pending mega-merger between Comcast and Time Warner Cable.

Yesterday, the FCC sent Dish a request for information [PDF] as part of its deliberations on the Comcast/TWC deal.

It seeks info from Dish on its programming agreements and documentation of negotiations with A+E Networks, CBS, Comcast, ABC, E.W. Scripps Company, and Turner as they relate to Sling TV.

It’s worth noting that most of these companies are not on Sling. While ABC’s parent company Disney made a deal that includes the Disney Channel, ABC Family, and two ESPN channels, the ABC broadcast network itself is absent from Sling. Disney also owns part of A+E Networks, but none of that company’s cable offerings are currently part of the new streaming service.

No channels from Comcast-owned NBC are available on the service, nor are any from CBS. And though Sling does have HGTV, Food Network, Travel Channel and Cooking Channel from Scripps Networks Interactive, the SNI operation is no longer part of the E.W. Scripps Company which owns many local network affiliate stations around the country.

Dish has been a vocal opponent of the Comcast/TWC merger, arguing that an even-larger Comcast does not benefit the public interest and would harm competition in both the TV and broadband spheres.

The FCC has already heard from Dish, most recently in a 266-page filing that details the satellite company’s opposition to the deal, so why the sudden interest in Sling?

Because Sling, even though it’s currently quite spare, represents a direct challenge to the traditional cable industry model — No contract, no cable box, available on multiple devices, transportable from location to location. At the same time, it relies on the cable industry — as the way in which most consumers get their home broadband — to deliver its product.

So it may not be able to bring Sling to consumers if Comcast, Verizon, AT&T, TWC, et al, do what they did to Netflix, allowing data to bottleneck to the point where subscribers were getting a sub-standard product, or nothing at all. That is, until Netflix paid up for a better connection to these service providers’ networks.

But while Netflix gives consumers something to watch other than cable TV, it doesn’t actually compete directly with cable, in that you can’t watch live broadcasts of House Hunters or SportsCenter on Netflix. Thus, there may be even more of a motive for cable-owned ISPs to do what they can to make the Sling experience as unappealing as possible. And with a combined Comcast/TWC controlling nearly half of the market for high-speed (25Mbps or more) residential broadband in the U.S., it could easily crush Sling if it chose to.

Additionally, Dish/Sling and the cable companies are competing for carriage contracts with the broadcasters. If Comcast acquires TWC and another 10 million customers, it will have even more ability to leverage that audience and keep networks from making deals with Sling, or with the planned Sony live-TV streaming service.

As Re/code’s Amy Schatz points out, the FCC has made similar requests for information from Google, Amazon, Hulu, HBO, Netflix and others. The Commission has also requested data on peering agreements like the ones Netflix recently made to ensure that its streams get to users with minimal interruption.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.