Percentage Of Rich Kids Needing Student Loans Has Doubled Since 1992

The percentage of students from affluent families that leave college with student loan debt more than doubled in the past 20 years.

At one time, prospective college students from affluent families could count on having their tuition paid for by their parents or college savings accounts. But times have changed and now even students from the highest income brackets are borrowing to finance their high education dreams.

A new Pew Research Center analysis [PDF] of National Postsecondary Student Aid found that the share of college graduates from high-income families who took out student loans to pay tuition has more than doubled in the last two decades.

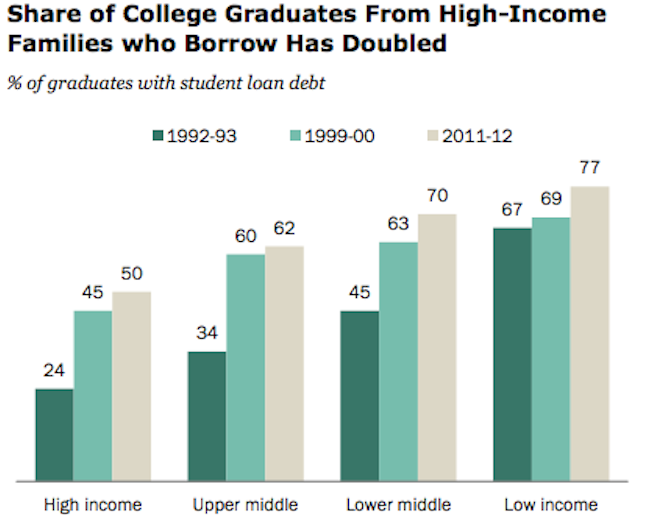

Nearly 50% of 2012 high-income graduates – those with a parental income of $125,700 or more – left college with student loans. The figure represents a staggering increase from just 20 years ago when just 24% of students in the same income level graduated with loans.

The report only examined loans taken out by students, not those taken by parents.

An increase in borrowing was also fairly significant for students in the upper-middle class with 34% borrowing in the 1992-93 school year and 62% borrowing for the 2011-12 school year.

While borrowing may have increased for more affluent students, those in lower-middle and low-income families continue to borrow the most, Pew found.

Nearly 70% of students in the lower-middle class graduated with student loan debt in 2012, while 77% of students in the low-income class graduated with debt.

While those numbers represent a staggering amount of debt, it has been a more modest increase over the past 20 years. In 1993, 45% of low-middle income student graduated with debt, while 67% of low-income students left college with student loans.

So what exactly has caused such a monumental increase in the number of well-off students borrowing for college? Pew reports there could be several factors including the fact that the Great Recession deteriorated a large amount of household wealth and recent policy changes that have expanded the eligibility for federal loan program borrowers.

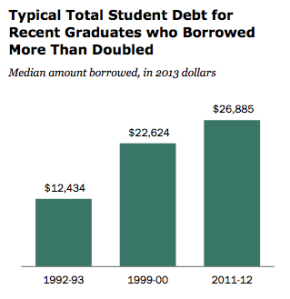

With student loan debt well over $1 trillion dollars, it’s no surprise that the average amount of debt students leave college with had doubled since 1993.

With more students of every income class borrowing to pay for college, it should come as no surprise that the amount of debt students graduate with is at an all-time high.

The study found that among graduates of the class of 2012, the typical borrower owed about $26,900 in student deb. That amount is roughly double the what was owed by the typical borrower in the class of 1993 – $12,400.

The Pew report’s author, Richard Fry, says the new analysis sheds additional light on a correlation between income levels and student loan borrowers with low credit scores.

“At least among those completing a bachelor’s degree, however, student borrowers are not increasingly from less affluent circumstances,” he reports in the study. “The decline in the credit quality of student borrowers may not be due to a change in the economic profile of student borrowers.”

The Changing Profile Of Student Borrowers [Pew Research Center]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.