Americans have always viewed a college education as an investment in a student’s future, but there’s another sort of investment going on behind-the-scenes, and it’s nearly risk free. With access to a revolving door of prospective students and a continuous supply of federal aid, some colleges are turning hopes and dreams into big returns for Goldman Sachs and other investors.

Today, prospective college students — from recent high-school graduates to those returning to school after years in the workforce — often seek out opportunities that will allow them to continue working while obtaining their degree. Some for-profit colleges market themselves as the answer: work during the day and take classes online or at local campuses when you can.

But at the intersection of convenience, accessibility, and education, there lies a low-risk, high-reward opportunity for the savvy businessperson. The question is: Are for-profit educational institutions looking out for the students, or the investors?

PROFITABLE INVESTMENT

PROFITABLE INVESTMENT

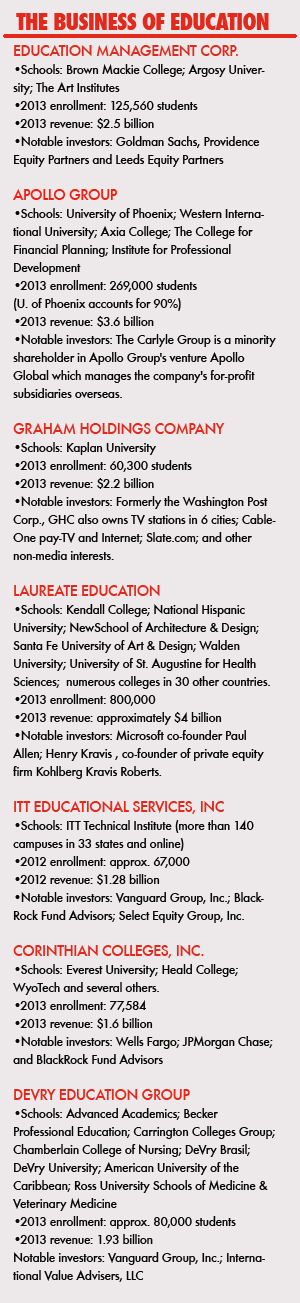

While you may not know it from the amateurish quality of the for-profit college ads that litter daytime and late-night TV, many of these schools are owned by multibillion-dollar conglomerates offering big returns to their high-profile backers .

“For-profit schools are quite profitable, especially the larger schools like Phoenix or Corinthian,” Suzanne Martindale, a staff attorney for Consumers Union*, tells Consumerist. “To make money, all they need to do is enroll students — they get to keep the financial aid, including loans, which students are on the hook for later.”

One successful for-profit education investor is finance giant Goldman Sachs. Following the collapse of the U.S. housing market, the firm saw a new investment opportunity in the form of a 43% stake in Education Management Corporation, the company behind schools like Brown Mackie College, Argosy University and The Art Institutes.

When Goldman Sachs was announced as one of EDMC’s new partners in 2011, the Huffington Post reported that the move allowed Goldman to secure itself a means of tapping into the boom in for-profit higher education.

At the time, enrollment at for-profit colleges was expanding as consumers sought to alleviate the impact of a declining economy by returning to college. The federal government supplied prospective students with billions of dollars in aid, money that for-profit colleges and their investors were happy to take.

In 2013, EDMC reported enrollment of 125,560 students and revenue of more than $2.5 billion.

Of course, Goldman Sachs isn’t the only well-known backer of for-profit education. Until Oct. 2013, the Washington Post Company – the corporation that owned The Washington Post newspaper at the time – was behind Kaplan University, which runs 10 campuses in four states and also offers online courses.

Amazon CEO Jeff Bezos bought the newspaper portion of the Washington Post Company late last year and the business that remained became Graham Holdings Company.

With 70,000 total students and $2.2 billion in revenue in 2013, Kaplan University is a cash cow for Graham Holdings.

Large corporations don’t hold a monopoly on investing in for-profit education; wealthy individuals often put their money into this industry. One such investor is Microsoft co-founder Paul Allen. The billionaire is just one of many investors in Laureate Education Inc., which owns 75 schools in 30 countries. The corporations’ colleges boast 800,000 students worldwide and revenue of $4 billion in 2013.

Another investor in Laureate is Henry Kravis, the co-founder of successful private equity firm Kohlberg Kravis Roberts & Co., which has investments in Playtex, Toys “R” Us, Safeway and other companies. Bloomberg Businessweek reports that Kravis took a $487.5 million stake in Laureate, an investment that has increased in value to $710.8 million after just three years.

WITH EDUCATION LOANS, RISK FLOWS TO THE BORROWER

“Shareholders who invest in these businesses can make money, since the faucet of federal taxpayer money is all but guaranteed to stay open,” Martindale says. “This creates an environment that is good for business in the short-term, but devastating to students and families – not to mention our economy – in the long-term.”

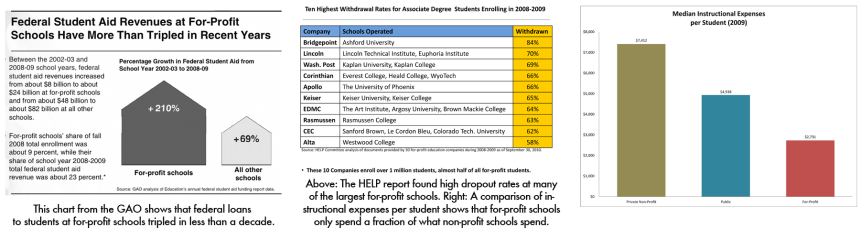

At the forefront of the profitability recipe is the aid the federal government provides students at for-profit institutions. Between 2003 and 2008, the amount of federal aid distributed to these schools tripled from $8 billion to $24 billion according to a Government Accountability Office report (See charts below).

Colleges essentially receive a guarantee of revenue — in the form of federal student loans and grants for tuition — before a student begins taking classes. And because the burden of repaying student loans fall to the student, whether or not they actually graduate with a degree, investors and corporations are left with little or no consequences.

In 2008, the for-profit industry accounted for 23% of all federal student aid distributed, and the average for-profit school received 66% of its funds from federal student aid. An investigation by the Senate Committee on Health, Education, Labor, and Pensions (HELP) found that $32 billion in federal student aid goes to for-profit schools, but those institutions only use about 17% of those fund on actual instruction.

The consequences of education gone wrong can be devastating for students. On average, 54% of students who began at a for-profit institution during the 2008-2009 school year withdrew by summer 2010, the HELP investigation found. But the bad news doesn’t end there for students.

Nearly 22.7% of students who attend for-profit colleges will default on their federal and private student loans, and unlike other forms of credit, education loans are notoriously difficult, if not impossible, to discharge through bankruptcy. This means former students are at risk for extreme forms of debt collection, such as garnishment of wages.

(Click image to see full-size charts)

So, while students risk their livelihood by taking out costly loans in order to further their education, investors have been looking at a growth industry with favorable conditions for lenders.

FRIENDS IN HIGH PLACES

The risks for-profit colleges currently face come in the form of high-profile lawsuits, investigations by federal agencies and proposed regulations regarding the employability of their graduates. However, those risk are made tolerable by the industry’s thick pocketbooks.

David Halperin, the author of the book Stealing America’s Future: How For-Profit Colleges Scam Taxpayers and Ruin Students’ Lives, says the industry provides a wealth of donations to the political arena each year.

“They are looking for people who have influence with members of congress both Democrats and Republicans,” Halperin says. “They are leaning on them to not push too hard.”

Proposed legislation, such as the Dept. of Education’s gainful employment rule, which would require for-profit colleges to show they actually prepare students for careers or lose their access to federal aid, could have meaningful impact on the way for-profit colleges conduct their business, and the industry knows it.

In fact, EDMC’s own annual report shows the company is aware that regulations could pose significant changes to the industry’s profitability:

“Existing and future laws and regulations may impede our growth. These regulations and laws may cover consumer protection, taxation, privacy, data protection, pricing, content, copyrights, distribution, mobile communications, electronic device certification, electronic waste, electronic contracts and other communications and Internet services. Legislation and regulation in the United States as well as international laws and regulations could result in compliance costs which may reduce our revenue and income and/or result in reputational damage, as well as governmental action should our compliance measures not be deemed satisfactory.”

EDMC joined other for-profit colleges to form the Coalition for Educational Success to lobby for changes to the Department of Education’s 2011 gainful employment rule. CES spent a total of $1.8 million in 2011 in a successful attempt to make changes to the proposed legislation, OpenSecrets.org reports.

A newly proposed second attempt at a gainful employment rule will likely face stiff opposition from the for-profit industry, Halperin says.

“There are two approaches the industry can take: let’s work with the government and try to create a business model to help students or let’s go for broke and try to gut the rule and try to fight tooth and nail against lawsuits and we can go back to where we were before,” Halperin tells Consumerist. “And I think that’s the strategy that for-profit colleges have chosen.”

*Consumers Union is the advocacy arm of Consumerist’s parent company, Consumer Reports.